Nov 20, 2025

eNews

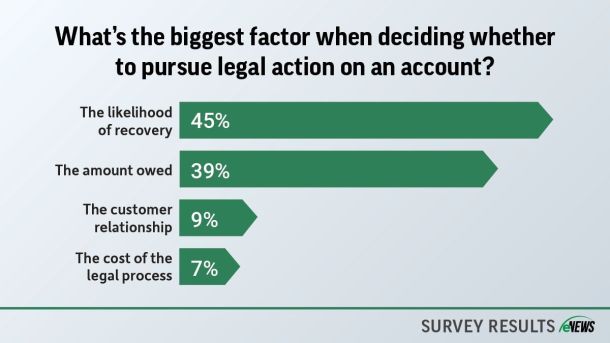

To sue or not to sue?

Those in credit management know the feeling of dread that comes from a slow-paying customer, or the anxiety sparked by a customer who doesn’t pay at all. Troublesome payment habits can weigh on credit professionals, but they also prompt an important question: when is it time to pursue legal action?