Feb 20, 2025

enews

Navigating M&A challenges for credit pros

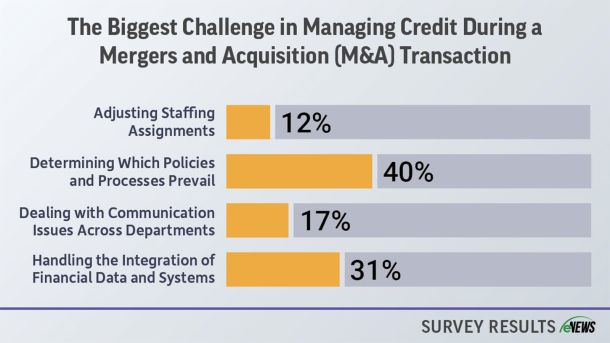

Mergers and acquisitions (M&As) can be transformative for businesses, often leading to greater efficiencies, market expansion and cost savings. However, for credit professionals, these transactions can introduce a range of complexities and risks.