Aug 28, 2025

eNews

Readying your defenses against synthetic fraud

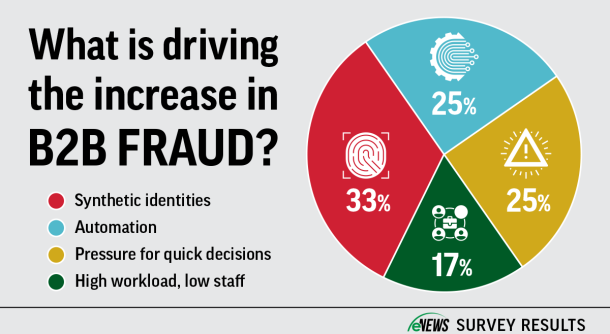

As technology continuously reshapes the business-to-business credit field, the risk landscape transforms as fraudsters manipulate newer technology to attack businesses. With artificial intelligence becoming more advanced, credit managers are raising their defenses against synthetic fraud as it takes on new forms each day.