Nov 14, 2024

eNews

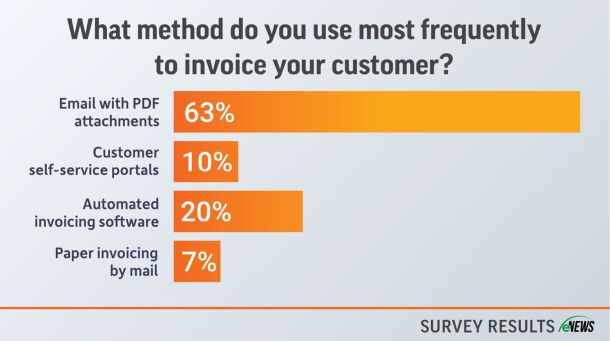

From PDF to portal: Modern invoicing methods

Over the past 25 years, businesses have increasingly moved from paper-based invoicing to digital and automated invoicing systems. The shift suggests that the invoicing process will eventually be completely paperless.