Jul 31, 2025

Blog

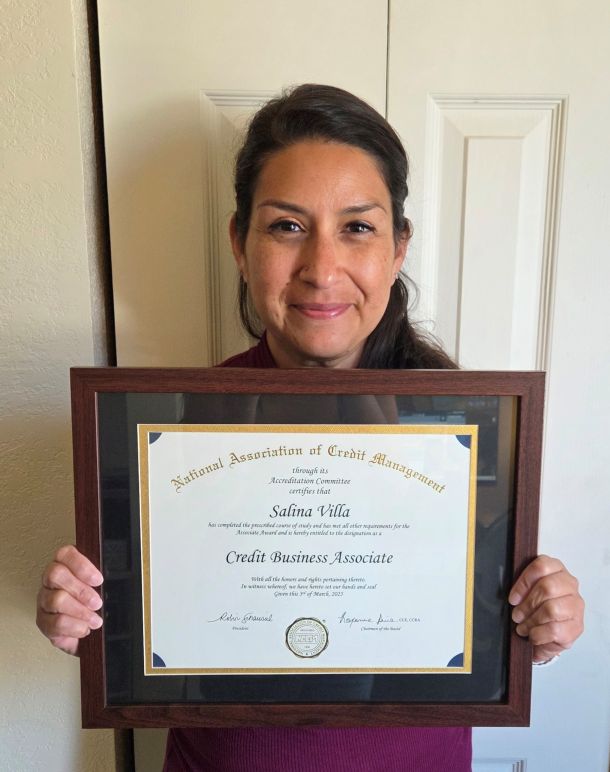

Professional certifications: The building blocks of success

NACM and FCIB’s six Professional Certification Programs are the essential building blocks of a thriving credit career. Each designation builds on the last, equipping credit professionals with the skills and knowledge needed to navigate the business-to-business (B2B) credit landscape with confidence.