Business Practices, eNews, Technology

Leveraging the internet to verify your customer

Over the past decade, technology has transformed how credit professionals conduct business. Automation and artificial intelligence (AI) have streamlined tedious, manual processes, allowing credit professionals to focus more on strategic, value-added tasks. However, technological advances have also led to an increase in fraudulent activity within business-to-business (B2B) credit.

According to a Trustpair report, 90% of U.S. companies experienced cyber fraud in 2024, up from 79% in 2023. While many executives believe their organizations are effective at identifying sophisticated fraudsters, an equal number reported experiencing successful attacks, indicating that their confidence may not be justified.

Why it matters: Leveraging internet tools to properly identify your customer can strengthen your credit investigation process and minimize risk of fraud. Let’s look at the top online tools and strategies credit professionals are using to identify their customers and prevent fraudulent activity.

Web searches

Credit professionals can use search engines such as Google, Bing or Yahoo!, to verify customer information like name, owner and address. In your search, you can find public websites of the company, which will give you more insight into their business. “We visit public websites, including the Secretary of State (SOS) and public county assessor websites if the customer indicates the building is owned,” said NACM Commercial Services member, Misty Menashe, CBA, credit and collections supervisor at LaCrosse Footwear, Inc. (Portland, OR).

Credit professionals can verify the legitimacy of a company’s physical address with Google Earth, a geobrowser that uses satellite imagery, aerial photography and geographic data to provide a 3D representation of the Earth. With it, users can explore the globe and view places from various angles, confirming company and shipping addresses. “It’s amazing some of the addresses we see,” said Terri Eggebeen, manager, credit and collections at Fechheimer Brothers Company (Cincinnati, OH). “We always use Google Earth to verify the company and see the surrounding area my product will be in.”

Google Maps can be used to verify a customer’s address along with its website, phone number, operational status and internet tags linked to that address. “Additionally, we use a ZIP Code Lookup tool to verify the address for all provided addresses, which indicates whether the address is deliverable and whether it is business or residential,” said NACM Southwest member, Jessica Holt, director of credit and collections at Soligent Distribution (Dallas, TX). “Email domains are also checked for their age and rated from low to high in terms of trustworthiness.”

Lookup services

Attackers rely on end-user oversight to persuade recipients that their malicious emails and any accompanying requests are legitimate. Cybercriminals often trick users into visiting fake websites by using a look-alike domain, or domain name that is designed to closely resemble a legitimate website’s domain, but with subtle variations like misspellings, extra characters or different top-level domains.

To verify a domain address of a business, you can use online tools such as, Zoho Toolkit, Name.com and Whois.com. Domain health checkers such as EasyDMARC or MxToolbox can help check registration details, security and overall health.

Credit professionals can use third-party service providers to verify domain addresses. “If an email domain is flagged as new or has a high-risk rating, I visit the company’s website for further verification,” said Holt. “This method has helped me identify fraud in several public companies.”

Social media

Companies use social media for various purposes, such as building brand awareness, engaging with customers, promoting products or services and gathering insights, all of which help boost sales and strengthen their online presence.

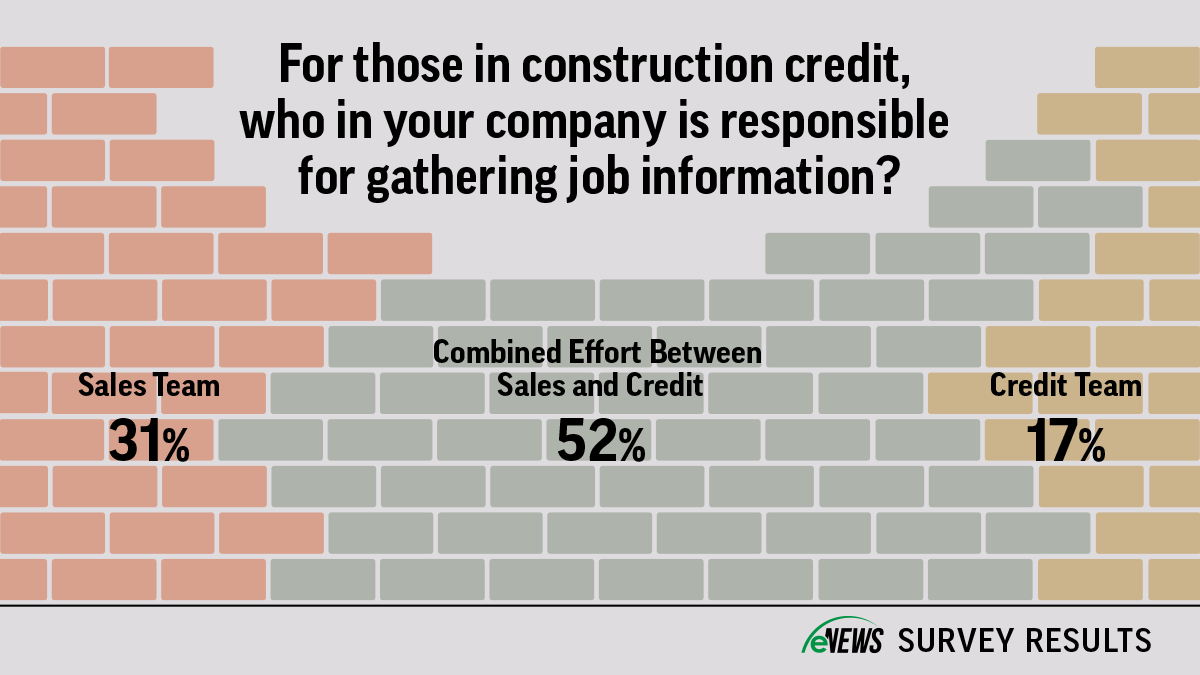

Social media can enrich research efforts and add depth to your understanding of customers, helping you make more informed decisions. In 2024, an eNews poll revealed that 81% of credit professionals use social media to research customers.

From the casual banter of X (formerly Twitter) to the polished professionalism of LinkedIn, understanding the nuances of each platform is essential for effectively navigating the sea of information they offer. “I use as many social media outlets as I can to investigate customers, starting with LinkedIn and even Yelp, which will tell a lot about a company’s integrity,” Eggebeen said.

Advice for credit professionals

If you sense something is wrong, trust your gut and reevaluate the customer’s information. “We check if websites use https and always look for any signs that the credit application is suspicious,” said NACM Intermountain member, Andrea Harding, director of credit at Sierra Forest Products (West Chicago, IL). “If something feels off, such as an order shipping to a state we haven’t shipped to before, we double-check.”

Pay attention to similar or contradicting names in a credit application. Having an extra set of eyes when reviewing a credit application will help you catch discrepancies. “If similarly named accounts or persons appear on the application, slow down and have a co-worker review it too,” Menashe said.

When researching customers, look beyond the first returned search engine results. This will help you get the most accurate information about a customer and prevent missing important information.

Sometimes all you need is physical proof of a customer’s identity. If you aren’t sure, call them or ask for additional documentation. “We often ask for hard copy purchase orders and make calls to the customer’s purchasing department to confirm orders,” Harding said. “If a customer bypasses the vendor onboarding process, it’s a red flag. Fraudsters typically avoid these procedures.”

Stay updated on fraud trends and communicate your findings with other credit professionals. “Our credit team regularly shares best practices, especially after identifying fraudulent applications,” Harding said. “It’s important for credit professionals to continuously learn, share knowledge and stay one step ahead of fraudsters.”

The bottom line: Fraudsters are finding smarter ways to deceive companies. By staying alert and using online tools to verify customers in your credit investigations, you can minimize the risk of fraud.