eNews

Lean in credit: Eliminate waste, enhance workflow, add value

A new customer is ready to place a big order, but they’re stuck waiting for credit approval. Behind the scenes, the credit team is buried in manual data entry, chasing trade references and waiting for a manager’s review. Time is lost, energy wasted and costs pile up—all without adding real value to the customer. Believe it or not, many credit departments operate this way without realizing how inefficient the process has become.

Why it matters: By applying Lean methodology, credit professionals can identify and eliminate waste to improve efficiency and focus on what truly matters: protecting the business while supporting growth.

What is Lean methodology?

Lean methodology, alternatively referred to as Lean manufacturing or Lean thinking, originated from the Toyota Production System (TPS) post-World War II and was further developed in the 1990s. It focuses on continuous improvement and efficiency by reducing waste and maximizing customer value. Over time, it has been widely adopted across diverse industries and sectors globally.

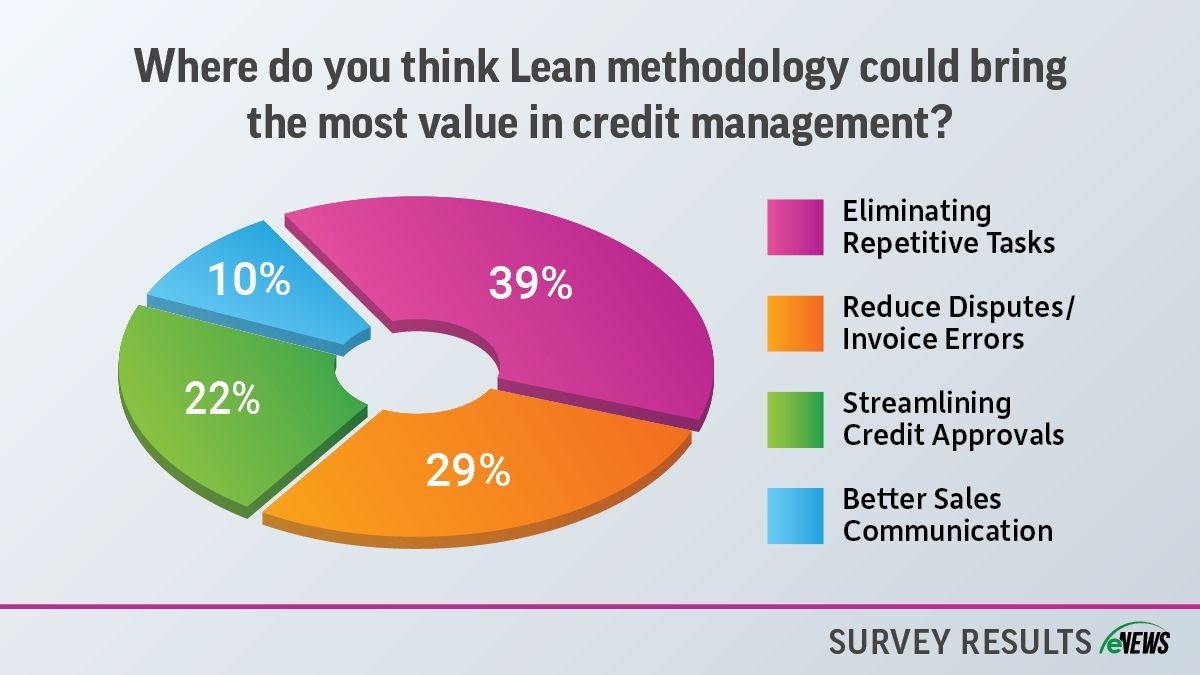

A recent eNews poll revealed 39% of credit professionals surveyed said that Lean methodology could bring the most value by eliminating repetitive tasks. Another 29% reported that it helps reduce disputes and invoice errors, while 22% said it streamlines credit approvals. “It helps me streamline credit approvals as long as I am thorough and sensitive to the needs of the customer who depends on me to finish the process so they can have the material they need,” said Charity Huter, AR representative at Empire Pipe & Supply (Birmingham, AL). The remaining 10% noted improved communication with the sales department.

How does it work?

Lean methodology begins by identifying what matters most to both external and internal customers of a process. For instance, in the credit application process, the customer is waiting for approval, the sales representative is hoping for a sale and the customer service representative is waiting for information or updates. By clarifying their priorities, credit managers can more effectively meet stakeholder needs and identify unnecessary steps in their processes.

After identifying these values, credit managers can create a Lean thinking map or value stream map (VSM), a visual tool used to analyze and improve the flow of materials and information needed to deliver a product or service to a customer. The map serves to identify waste, bottlenecks and areas for improvement in a process. According to Lean methodology, there are eight types of waste, often remembered by the acronym: DOWNTIME. Here’s how they manifest in credit management:

- Defects: Incorrect invoices, misapplied payments or erroneous credit limits

- Overproduction: Unnecessary reports, duplicate approvals or excessive documentation

- Waiting: Slow approvals, delayed customer responses or system processing time

- Non-utilized talent: Underusing staff skills or poor task delegation

- Transportation: Unnecessary document transfers

- Inventory: Backlog of unprocessed applications

- Motion: Searching for data across multiple systems

- Extra processing: Redundant data entry or duplicate approvals

Push vs pull system

In manufacturing, companies tend to use the push system, in which they produce more products than they need, forcing them to forecast future demand. This results in overproduction, creating large inventories that sit for weeks, months or even years.

Lean methodology encourages the use of the pull system, in which production is based on customer demand. This allows companies to reduce waste, catch errors and lower production costs, ultimately leading to higher customer satisfaction. In credit management, this can be applied to almost any process. “Think about your weekly, monthly or quarterly reports,” said Angela Thurman, founder and CEO of Thurman Co. (Houston, TX), during the NACM webinar, Lean Thinking in Credit: Streamline, Simplify, Succeed. “Are they all really necessary? Is anyone looking at them? What are they doing with this information? If no one’s looking at them or using that information, it may not be necessary and can be cut from your day.”

Lean tools to use in credit management

Lean methodology offers practical tools that credit professionals can begin applying right away to reduce inefficiencies and improve performance. Here are a few to consider:

- Visual management: Tools like dashboards and Kanban boards (a visual project management tool) can help track credit approvals and collections, making work status visible and actionable.

- Standard work: Document the best-known way to complete common tasks—such as credit reviews or collection calls—to ensure consistency and reduce training time.

- 5S for credit desks: Apply the Lean 5S system—Sort, Set in Order, Shine, Standardize and Sustain—to organize your workspace and digital tools for better efficiency.

Just because the process is mapped out doesn’t mean the work is over. Lean methodology encourages the continuous improvement of processes through regular evaluation. “I suggest celebrating daily successes to help nurture the team and have them begin to observe where they can make improvements,” Thurman said. “Involving teams outside the department can bring forth new ideas and perspectives on how to improve processes and find solutions.”

For example, even after streamlining a collections workflow, a team found that certain accounts were falling through the cracks. By reviewing the process monthly, they discovered that follow-up reminders weren’t being sent on time. As a result, they implemented automated notifications for customers, which significantly reduced Days Sales Outstanding (DSO) and increased overall cash flow.

The bottom line: Credit departments face unique challenges that Lean methodology can directly address. By removing inefficiencies, credit professionals can free up time for higher-value tasks and support their customers and their businesses.