Business Practices, eNews

Navigating M&A challenges for credit pros

Mergers and acquisitions (M&As) can be transformative for businesses, often leading to greater efficiencies, market expansion and cost savings. However, for credit professionals, these transactions can introduce a range of complexities and risks.

Mergers and acquisitions (M&As) can be transformative for businesses, often leading to greater efficiencies, market expansion and cost savings. However, for credit professionals, these transactions can introduce a range of complexities and risks.

Why it matters: Navigating the integration of diverse financial systems companies after a merger or acquisition is challenging. Credit professionals must strive to understand the impact of them on credit management.

In this article, we will explore the challenges credit professionals face during M&A transactions and offer strategies for effective credit risk assessment.

Determining which policies prevail

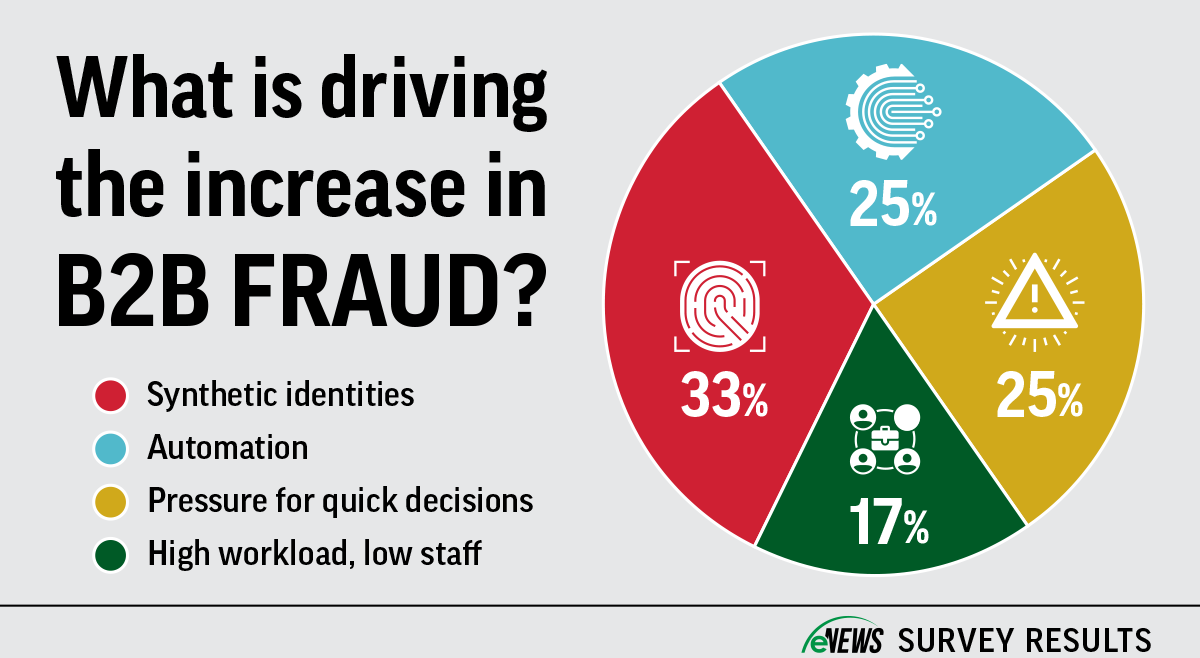

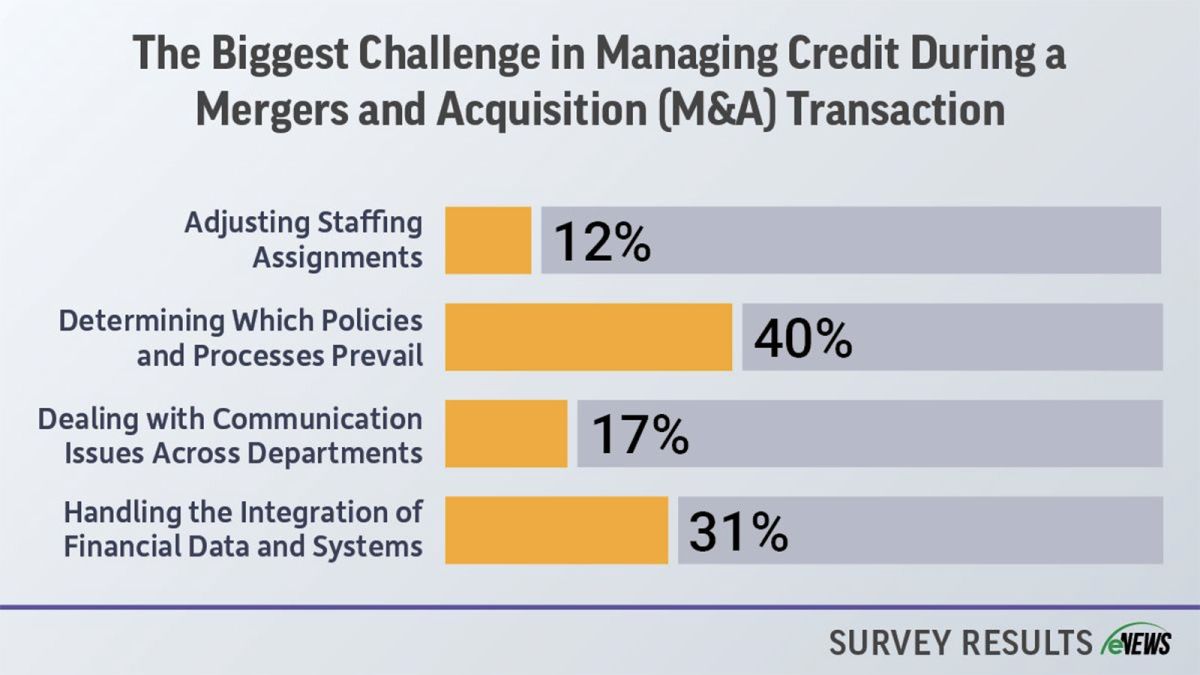

According to a recent eNews poll, most credit professionals surveyed said that the biggest challenge in managing credit during an M&A transaction is determining which policies and processes prevail (41%). Once this decision is made, the next challenge becomes getting people on board with the decision. This was the case for Michelle Kelly, CCE, CCRA, CICP, senior credit manager at Mansfield Oil Company of Gainesville, Inc. (Gainesville, GA), who acquired a family-owned company with significantly different credit practices, making policy alignment challenging.

“Aligning policies is more challenging when acquiring a company, as employees may resist change,” Kelly said. “To ease concerns, I kept an open-door policy and engaged with credit, sales and operations teams. By guiding them through tough approvals and explaining our approach, I built trust and emphasized our shared goals. To fit our risk tolerance, we had to underwrite existing customers, update data to match our systems, and train the team.”

Integrating financial data and systems

The second biggest challenge of M&A transactions is integrating financial data and systems, according to 30% of surveyed credit professionals. For instance, one company’s credit department might be more automated or use a different system to store and share financial data, making it difficult to merge systems or at least work together. “You’re going to find common accounts and look at how the accounts of the company are structured, as well as their payment behavior and what terms they have, among other things,” said Marcello Distefano, director of finance at Dal-Tile LLC (Dallas, TX). “So, there’s this back-and-forth until both companies can agree upon a finalized data structure or data set and once that happens, the actual data absorption and inclusion into the financials begin. You also have to take into account the risk assessment portion of doing your due diligence on the financials and having well-defined procedures and protocols that you can agree upon.”

Managing communication

Managing communication is a challenge for 17% of surveyed credit professionals, whether it’s within teams, across departments or with customers. Given the numerous changes and the merging of two organizations, ensuring that everyone is aligned and informed can be difficult. “Communication is always a challenge in M&As, especially with key stakeholders and new roles,” said Kelly. “Which is why I established clear communication channels and used Teams to have personal conversations. Fostering a collaborative environment was important as everyone was comfortable sharing concerns. By addressing issues with empathy and reassurance, I built strong relationships and ensured smoother communication, leading to a successful transition.”

“Because sales and credit don’t always share a harmonious relationship, I needed to make sure they all knew our team was dedicated to helping the sales team be successful,” said Brett Hanft, CBA, credit manager at American International Forest Products (Portland, OR). “I would encourage all credit and finance professionals to be proactive with your communication—take the initiative to introduce yourself to others. Being professional, polite and friendly tremendously helps ease the uncertainty of change for all the new members of your integrated team.”

Adjusting staffing assignments

Adjusting staffing assignments comes in last as a challenge in an M&A transaction for 12% of credit professionals. It involves developing a comprehensive plan to integrate the workforce of both companies, analyzing staffing needs and making decisions on workforce adjustments like redeployment, attrition management and potential layoffs. “Most companies, not all, are looking for some cost reduction synergies when they have an M&A,” said Barry Hickman, senior director of credit at Dal-Tile LLC (Dallas, TX). “They don’t want to separate credit departments unless it’s a highly differentiated business model. So, they’re trying to figure out how to support both businesses combined. Is it a large distribution? Are there a lot of small accounts? Do I have enough staff?”

Communicating clearly and frequently with employees, addressing concerns and providing updates on the integration process are integral to successfully adjusting staff assignments. “There’s always a level of uncertainty in M&As,” Kelly said. “For instance, a staff member of an acquired company may wonder, will I retain my role, or will they centralize it to their location? In this case, you’d have to communicate the changes and reassure them. Perhaps you’re retaining them for their knowledge or the added value they bring to the company, and it’s something you can communicate to them.”

Integrating company cultures

Another struggle for credit managers during M&As can be integrating different company cultures. For instance, one company might have a stricter work environment, or one may be hybrid while the other is entirely in office. Or maybe the acquiring company tries to overrule the acquired company’s work culture. “Sometimes, the tendency for the acquirer is to take control of everything and underestimate the amount of work, the amount of transactions and what the company brings in and realize later that it’s best to leave things as they are and let them stand on their own,” Hickman said.

It is important to navigate and respect these cultural differences and ensure both companies adjust. “Having everyone come to the table with an open mind to understand and learn from each other has been key as we work to integrate the best practices from both companies,” Hanft said. “In our recent M&A, both teams have been conscientious and dedicated to accepting change, learning from new team members and working together to help grow our consolidated business.”

The bottom line: Mergers and acquisitions offer growth but demand careful navigation of policies, systems and cultures. Credit professionals must remain vigilant and adaptive to ensure smooth transitions and mitigate risks.