eNews, Government

Why elections matter to credit managers

With Donald Trump’s victory in the 2024 U.S. presidential election, credit managers are facing a new political landscape that will directly influence the economy and credit risk management.

Why it matters: Presidential transitions often bring significant changes to tax policies, global trade negotiations and the regulatory environment. For credit professionals, understanding how Trump’s policies—especially in trade, tariffs and fiscal management—will play out is essential for anticipating potential risks and opportunities in the coming years.

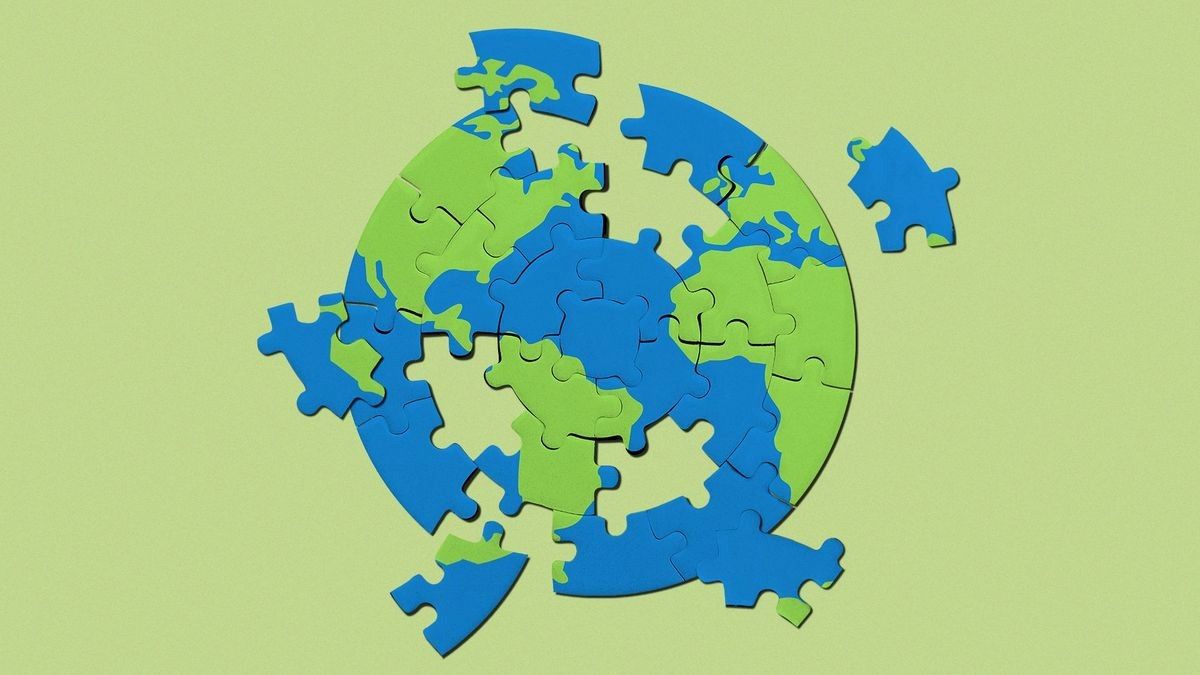

2024 has been the year of elections. Voters in 64 countries and the European Union—about half the population of the world—have hit the polls this year. More than 50 elections worldwide, affecting half of the planet’s population—from the U.S. to Taiwan, Russia, India and beyond—are undergoing periods of transition of power that send ripples across the global economy.

David Culotta, head of risk underwriting for Coface North America, said that political outlook has a direct influence on economic and financial stability, making it a crucial aspect of a country’s risk assessment.

“More specifically, transitions of power can directly impact tax policy, global trade negotiations, areas of government investment and the regulatory and legal framework, among other factors,” Culotta said. “Such changes can lead to meaningful shifts in foreign direct investment, business confidence, global trade dynamics and FX rates—all of which could potentially impact payment trends.”

By the numbers: According to NBC News Exit Polls, 31% of U.S. voters felt the economy was a key issue as they cast their votes. Additionally, 45% of voters said their current financial situation is worse than it was four years ago, despite waning inflation and the low unemployment rate.

Kamala Harris and Donald Trump presented differing economic plans throughout their campaigns, with the latter promising to levy trade tariffs on China and other trading partners. While tariffs have a place in American policy, economists worry that tariffs could strain relationships with trade allies and create a fiscal deficit.

In the final months of Biden’s administration, before Trump takes power in January, the economic impact of the election and subsequent transition of power will be felt. Global and domestic markets have already reacted to the election. The stock market hit a record high, with the S&P500 rising 2% and the Russell 2000, an index of smaller stocks, rose 4%, according to Axios. The yield rate on the U.S. 10-year bond jumped from 0.19 to 4.48%, reflecting the anticipation for a strong economy under Trump.

Despite being a key issue for voters on Election Day, neither candidate’s financial plans were expected to have enormous implications for the economy, according to Jay Tenney, managing director at Trade Risk Group (Irving, TX). “The consensus is that there might be some effect on the fringes,” Tenney said. “But really, if you look at the policies of each one, you’re going to end up with a massively increasing deficit regardless.”

While presidents have their own economic plans, Tenney adds, the Chairman of the Federal Reserve remains the most important person when it comes to the nation’s economy.

At this moment, it is hard to say what the economic implications of Trump’s second term will be, especially because there is no guarantee when, or if, he will implement the economic policies he touted during his campaign. Along with Trump’s victory, republicans gained control of the Senate and could maintain control of the House of Representatives, meaning Trump’s economic policies may come to fruition without much resistance.

“We are expecting a stronger dollar, higher inflation and higher treasury yields,” said Chris McKee, Ph.D., CEO of The PRS Group. “The currency issue could be a problem for exporters selling into emerging markets since the local currency could be challenged. This would impact the job of a credit manager.”

Following Trump’s victory, international leaders swiftly extended their congratulations, signaling potential diplomatic engagements on the horizon. “From France to India, leaders from outside the U.S. were quick to congratulate Trump and it would not be surprising if official visits are being planned, complete with trade delegations,” McKee added.

The bottom line: The election has already impacted the national and global economy, and it remains to be seen exactly how different our economy will be under a second Trump term.