eNews, Technology

Top 5 misconceptions of artificial intelligence

AI is a rapidly evolving technology that has the potential to greatly benefit various industries and professionals. However, this article aims to clarify several common misconceptions about the use of AI in B2B credit and related industries.

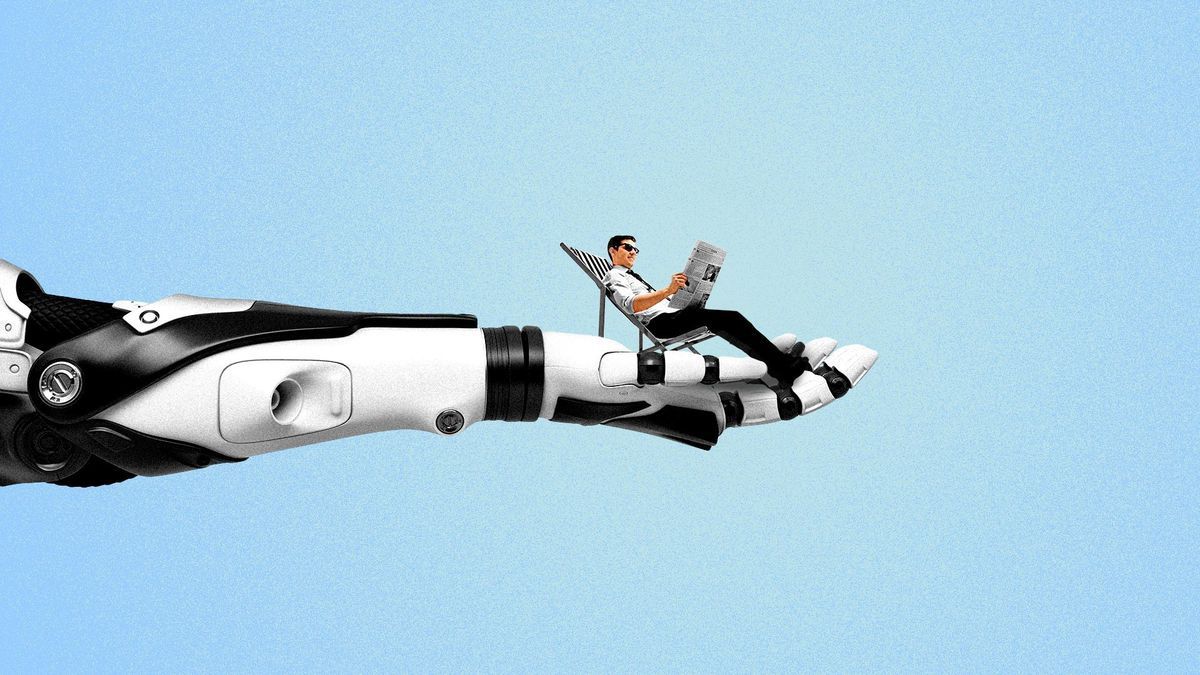

#1 “AI will replace my job.”

This misconception stems from the widespread fear that AI will replace human jobs, rendering many roles obsolete and leading to significant unemployment. However, this is not the case, as history has shown that innovation such as the move from desktop solutions to client servers or the introduction of Business Process Automation has created new jobs rather than eliminating them. AI is not here to replace jobs, but rather to assist professionals by providing them with data at their fingertips and reducing the time spent on mundane tasks. AI allows them to focus on building relationships with customers and prospects instead of spending hours scouring through financials and current affairs. Check out Collatio® to see how Scry AI does this.

#2 “AI will replace my customer support team.”

While AI technology, such as ChatGPT, can handle many customer inquiries, it can only replace part of the customer support team. Instead, the team becomes the teacher and keeper of these systems, helping to train the AI and jumping into conversations when a human touch is required. The role of customer support personnel will evolve to become liaisons between customers and product teams, helping create new products and structures, but this is not likely to become obsolete.

#3 “AI can single-handedly help me avoid market risk.”

AI is not a magic bullet for avoiding market risk in an investment management-world. Humans distinctly remember what we read in the newspaper or an article from yesterday into today. However, we tend to miss out on the secondary and tertiary related articles while making daily decisions. “Recency bias” has led credit analysts and investment managers to make incomplete or wrong decisions. While AI can help direct attention to relevant articles and summarize information, it cannot make decisions independently. AI can assist in understanding relationships between industries, regulatory bodies, and companies, but more is needed to replace the expertise and intuition of a human analyst. Check out Sentio® to see how Scry AI does this.

#4 “AI can solve my cashflow problems.”

While support engineers can train the AI in situational conversation, AI cannot emulate human emotions, empathy, and fillers like “ums” and “ahs.” It may be true in movies but not in real life. The so-called “mom and pop shops,” mid-size borrowers rely a lot on their relationships with the credit managers. Therefore, credit managers and analysts are still necessary and cannot be replaced by AI when managing cash flow decisions and building relationships with borrowers.

#5 “Blame AI for its decisions.”

While AI systems can make decisions, the credit analyst and manager are ultimately responsible. AI outcomes are only sometimes tractable, and policies around AI-generated systems are still in flux. Therefore, it is not possible to hide behind the non-existing “iron curtain” of AI. A human in the mix must make and take responsibility for decisions.

In conclusion, AI has the potential to benefit various industries and professionals greatly. Still, it is essential to understand the limitations and misconceptions surrounding the technology to make it work for one’s business. AI is not here to replace jobs or make decisions on its own but rather to assist and enhance the work of human professionals.

There are many other misconceptions, and you can find them in this must-read Amazon Best Seller: “The Fourth Industrial Revolution & 100 Years of AI (1950-2050)”: A new book from Dr. Alok Aggarwal, CEO of Scry AI Inc, which provides more information on AI and its potential uses and applications. Scry AI Inc. was founded in 2014 and builds innovative AI-based enterprise applications that enable clients to rethink and automate their data-driven and manually intensive business operations. Scry’s families of enterprise apps include Collatio® (for ingesting, extracting, and reconciling unstructured and structured data), Anomalia® (for detecting anomalies and potential fraud), Concentio® (for ingesting and harmonizing IoT data), and Vigilo ® (for predicting operating and marketing risks). Further details can be found @ HERE.