Business Practices, eNews

The AI rulebook: Smarter use starts with smarter policies

Artificial intelligence (AI) has transformed how the world operates, integrating itself into nearly every facet of business. For credit departments, AI is being used to enhance email communication, draft demand letters, review contracts and even predict collection trends. As AI continues to evolve and expand across industries, many organizations are developing formal policies and procedures to guide its use.

Why it matters: Despite its rapid advancement, AI presents significant challenges, particularly regarding accuracy and reliability of information and data privacy and security. Implementing clear, refined policies and procedures within the credit department can help mitigate these concerns and ensure AI is applied ethically and effectively.

What’s with AI?

Over the past few years, AI has quickly become an integral part of everyday life, automating routine tasks and enhancing productivity. Generative AI tools like Microsoft Copilot and OpenAI’s ChatGPT can retrieve and analyze existing information to create new content for us to use and engage with. However, concerns about risk continue to make some organizations cautious about full-scale AI adoption.

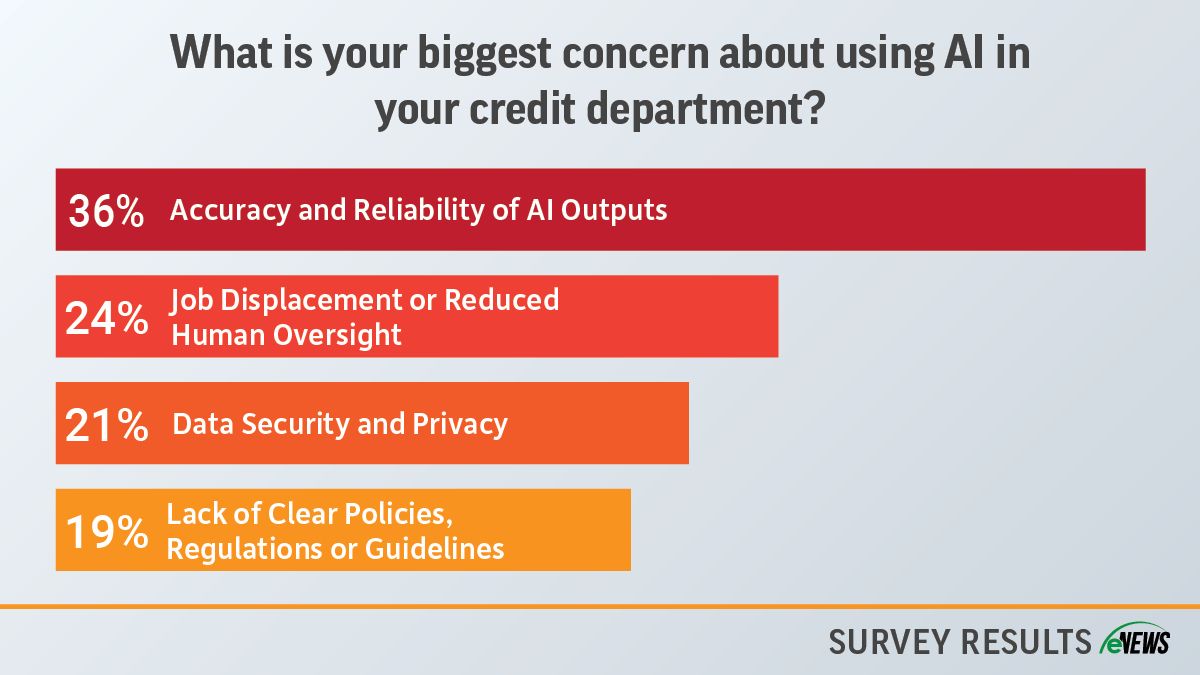

According to a recent eNews poll, 36% of credit professionals cited accuracy and reliability as their top concern when using AI in the credit department, while 24% worry that AI will contribute to job displacement or reduced human oversight. “AI is great for standardized evaluations, but we deal with a lot of unique situations and there are nuances that AI alone might overlook,” said Tammy Ten Bruin, regional credit manager at Keller Supply Company (Seattle, WA). “If we were to use AI, we’d use it to pull and organize information. But ultimately, a human would need to review the data and make the final decision.”

Other key concerns include data privacy and security (21%) and a lack of clear policies or guidelines (19%). “We handle a lot of confidential customer data, so my concern is how that data would be protected and managed,” said Kristirose White, corporate credit manager at Farwest Steel Corporation (Eugene, OR). “As a more traditional company, we’re more cautious about implementing AI in our department, especially from a third-party. Still, it is something that I do want to look into to alleviate a little bit more of the decision making so that it’s no longer manual.”

Using third-party AI tools without proper vetting can risk unauthorized data sharing, security breaches and regulatory violations. Additionally, flawed or biased data can result in inaccurate or discriminatory outputs. To avoid these issues, strong AI policies and human oversight can ensure compliance with data protection regulations, protecting both their business and their customers.

Building your AI policies and procedures

Before drafting an AI policy, companies should ask themselves a few fundamental questions:

- What AI tools are we using?

- How is AI integrated into our services?

- Are the tools secure, private and aligned with our internal policies?

Answering these questions can help you begin crafting AI policies tailored to your specific operational needs.

Engage with your legal team early in the process. Legal counsel will assist in drafting sound AI policies and procedures, ensuring compliance and minimizing risk. “My job is to provide counsel as to how they can responsibly use and categorize data with AI,” Kathleen McGee, partner at Lowenstein Sandler LLP (New York, NY), said during the Credit Congress session, AI in the Credit Department: Drafting and Implementing Responsible AI Policies and Procedures. “I help them reimagine a comprehensive AI policy that works in the short- and long-term future. I also advise adding contract provisions that protect against confidentiality breaches, as well as audit rights and accountability clauses for vendors that generate AI-based outputs.”

Policies should be communicated clearly and consistently across the organization. “Take a top-down approach to ensure that all departments understand why they can or cannot use AI, and make sure that guidance flows consistently across every part of the organization,” McGee said.

As AI systems advance, it’s critical to benchmark outputs against original expectations. For example, if you’re using AI to assess creditworthiness, ensure it’s using the correct data inputs and producing consistent, explainable outcomes. AI tools should also be tested regularly to ensure they’re performing as expected.

AI policies and procedures should be reviewed and updated on an annual basis to account for regulatory changes. For instance, policies must reflect any new federal or state requirements, especially regarding how vendors use AI. “Whether or not AI is being policed by government, privacy law and data security law—as well as your vendor and client contracts—will maintain its restrictions and regulations,” McGee said.“If you’re using a system or application powered by AI, verify and understand how and when you should be using the AI and what its capabilities are.”

The bottom line: AI is a powerful tool that can improve efficiency and accuracy, but it only works well when it’s guided by clear rules and oversight.Clear policies and procedures, especially regarding privacy, data security and intellectual property, are essential to help credit professionals use AI as ethically and responsibly as possible.