Business Practices, eNews, Leadership

Tame today’s workloads with time management skills

Time management can be tricky when your day-to-day work feels unpredictable. Credit managers know how easy it is to get so wrapped up in a single task that their entire to-do list slips their mind. Whether you carefully schedule out every second of your workday or keep a tentative list of tasks that need completion, it can be hard to organize your time as a credit manager because there is so much to do.

Why it matters: Credit professionals have all sorts of responsibilities, from conducting credit investigations to adjusting credit lines. At times, however, it can be a bit daunting to face that ever-growing mountain of tasks as you start each day of work.

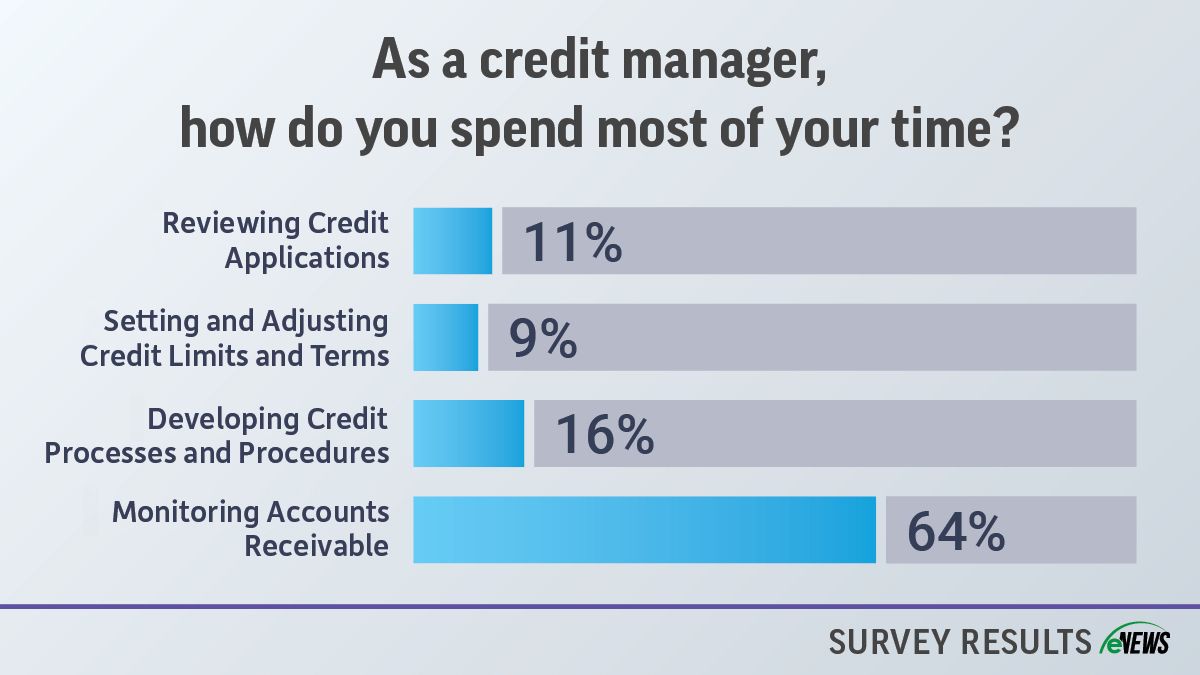

By the numbers: Each credit manager has different priorities when it comes to time management, with the tasks taking up most of their time depending on their rank, industry and company. According to an eNews poll, 64% of credit managers spend most of their time monitoring their accounts receivable and 11% spend most of their time reviewing credit applications. Another 16% spend most of their time establishing credit procedures and 9% adjusting credit limits and terms.

No two days are the same for credit managers, with seasonal buying habits, shifts in the economy and new technology constantly disrupting any established status quo in the credit world. “There are a lot of different priorities depending upon what’s going on at that moment,” said Doug Proske, CBA, CCRA, credit manager at Echo, Inc. (Lake Zurich, IL). “We’re always looking at streamlining processes so we work smarter instead of harder. Our days take on their own shape, but we do everything we can to control our work habits and leverage the tools we have.”

Time management can be difficult, especially when your day-to-day work can seem unforeseeable. Here are a few tips on how to hone your time management skills and improve your workday in the process.

At the start of each day, consider all the tasks that need to be done and create a to-do list. Ordering the list based on what needs to be done urgently and what can wait will help you create a solid plan of attack for your day that doesn’t forgo any important tasks.

“As a credit manager, every day is different, you never know what it’s going to throw at you,” said Lorielle Champagne, CCE, credit manager at ROMCO, Inc. (Carrollton, TX). “I manage my day by having an idea of what needs to get done and then prioritizing certain tasks to make sure that the musts are the first things tackled.”

For Champagne, communication with customers, both new and established, looms high on that list of to-dos. “If someone has reached out, whether it be an internal or external customer asking for information of any kind, if it’s an invoice copy or they need to call to reconcile their account, then that would be priority,” Champagne said.

Strong time management relies on a strong team dynamic. It is critical that credit managers understand what tasks to assign to other team members and when. “It really comes down to being able to send out tasks to your teammates,” said Ryan Farmer, CBA, director of cash/collections/credit management for Vestis Uniforms and Workplace Supplies (Lexington, KY). “It helps having people on your team that you trust, from your credit analysts to your credit associates.”

Allocating tasks to different members of your team can be a great professional development tool for people at all experience levels. “A lot of metrics reporting can’t be done systemically and that is what I push my senior analysts to do,” Proske said. “It’s a great tool to grow them so they understand what I’m looking at, why I’m looking at it and how I’m getting that data. It helps streamline processes, leveraging tools and techniques to maximize our efficiency and it also means seniors get to learn a new facet of the business.”

When thinking about time management, it is important to factor in time to handle any emergencies that might pop up any day. “Maybe we just received bad news about a big customer and we have to get in front of that, or a customer is upset they hit their credit limit and we need to get on the phone,” Farmer said. “Being able to accommodate those fires and still do what you need to do is an important aspect of time management.”

The bottom line: Effective time management comes down to having a strong understanding of what needs to be done and when. With automation changing how the work of a credit manager is done, it is crucial that time management techniques evolve alongside credit practices.