Business Practices, eNews, Leadership

Tackle budgets with confidence: How credit managers can advocate for their department’s needs

As budgeting season kicks into high gear for many companies, credit managers are finding themselves ready to advocate for their department’s needs. Whether working solely on department budgets, helping to shape company-wide spending plans or anticipating risk, the process can be daunting.

Why it matters: Effective budgeting allows credit professionals to advocate for their department and align their work with their company’s overarching financial goals for the year ahead.

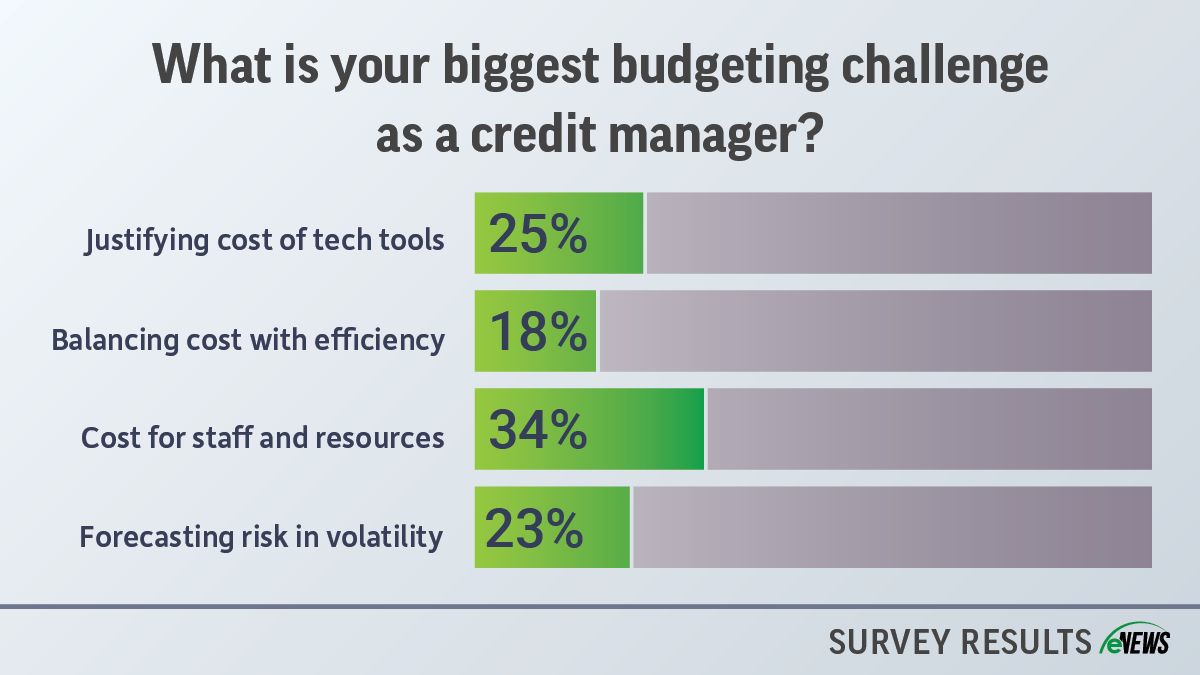

By the numbers: An eNews poll found that 34% of credit managers find that the biggest challenge with budgeting is considering the cost of staff and resources, while 25% found justifying the cost for tech tools was the hardest. Another 23% found that forecasting risk in volatility was the most challenging.

Every credit manager has a unique relationship with their company’s budget, leading to diverse perspectives. “The budgeting process varies a bit from company to company and may depend on the size of the organization,” said Matt McVay, accounts receivable manager at Evolus (Newport Beach, CA). “I have worked for smaller businesses where I was much more involved in those discussions. My current role is much more segmented by department, so accounting creates and manages the budgets and passes that info to me.”

No matter how involved you are in the budgeting process, it’s important to compare how your spending might change year-over-year. For example, an increase in professional development costs or customer visit expenses.

“I need to submit those changes as a budget adjustment for the next year so that I’m not locked into last year’s travel expenses,” said JoAnn Malz, CCE, ICCE, NACM Chair and director of credit, collections and billing at The Imagine Group LLC (Shakopee, MN). “The same goes for if I add a new position that wasn’t in the budget before.”

Working on the budget means explaining and justifying potential increases in costs, which can be intimidating for credit managers new to budgeting. “The ability to track the specific financial return on a project or being able to accurately forecast the potential return of a project is a crucial element in obtaining approval for budget increases,” said Steven Prensner, CBA. “Likewise, being able to accurately forecast the labor budget or other expenses needed for the project.”

When it comes to budgeting, credit managers can also help with determining and assessing bad debt reserves for the coming year. Credit managers have a knowledge and understanding of their company’s finances as well as the overall economic climate that is indispensable when determining bad debt reserves.

“Some businesses may be using historic trends to forecast bad debt reserves for the following year, but I think it’s important that the credit managers have a voice in that because we get the CMI and we know what’s going on in the economy,” Malz said. “We know what’s going on very specifically within our own portfolios. We know if there’s a particular industry that’s hurting right now that we may need to think about when we’re budgeting for reserves.”

Getting more involved with the budget can help you better your understanding of not just your department but also your company’s mission as a whole. “The more information you have to work with, the more specific you can be in setting up your KPI’s for your team,” McVay said. “Being involved with the budget allows you to see what the organization prioritizes and helps align your work and goals with the overall organizational goals.”

For those who have only recently taken on a role where they will have to work on the budget, Roxanne Price, CCE, CCRA, NACM Chair-elect and corporate credit manager at H&E Equipment Services, Inc. (Baton Rouge, LA), recommends working with your team and consider what the budget looked like before you joined the team.

“Clarify with their accounting department to understand historically what they have budget for within that department and then that should be your baseline and should give you an understanding of where they were prior to you joining the organization,” Price said. “If you need to add to it, I recommend running through it again with your accounting department or your CFO.”

The bottom line: It can be intimidating to approach the yearly budget, even when you have a team of others to lean on. As credit managers, it is important to remember that your understanding of your customers, industry and the economy is valuable when it comes time to work on the budget.