eNews, Leadership

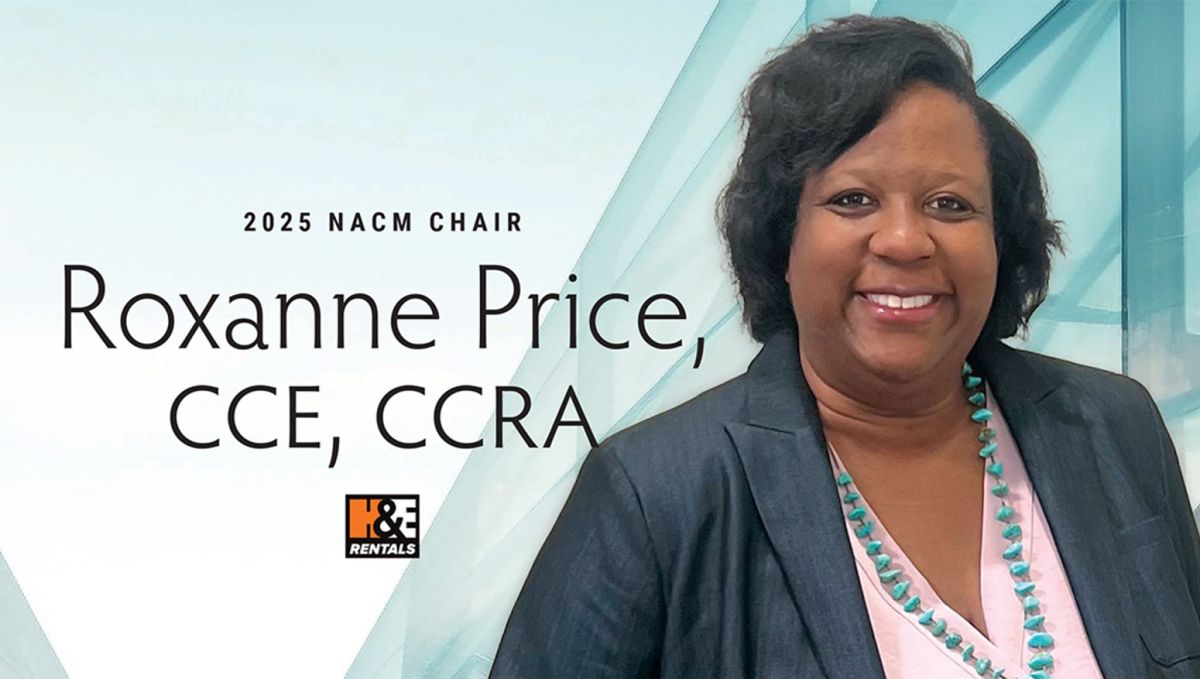

Leading with vision: Roxanne Price takes the helm as NACM Chair

Armed with the knowledge and experience gained through nearly two decades in the B2B credit industry, Roxanne Price, CCE, CCRA, corporate credit manager at H&E Rentals (Baton Rouge, LA), is prepared to lead NACM into the future with respect to the industry’s age-old principles.

Throughout her career, Price has watched as the credit management profession evolve with the introduction of new technology, smarter practices and better working habits. This, alongside her rich experience in multiple areas of the credit industry, has prepared her to take on this role and be a voice for credit managers across the country. Leading up to her term, Price sat down with NACM to talk about how her credit career started, how the industry has changed and how she hopes to mentor younger credit managers during her time as Chair.

What inspired you to pursue a career in credit?

I attended Louisiana State University (LSU) and I received a degree in business management and marketing. I was ready to head into the workforce and run the world with my degree, but of course, it just didn’t quite work out that way. I wasn’t able to get into marketing because of the economy at the time. I had an opportunity to be an assistant credit manager, and being a fairly new college grad, I saw management in my title and I said this is something I definitely want to pursue.

During your time in credit, how have you seen the industry evolve?

You have to be ready for change. But recognize that sometimes change can be difficult if you really don’t know what’s on the other side. I’ve seen the credit management role grow from just working with a spreadsheet, dialing for dollars and calling on accounts to get the money in the door as quickly as possible into something bigger. Today, credit managers are expected to know more and do more. In short, we’ve moved from basic collection tasks to becoming strategic partners, influencing decisions that extend well beyond the credit department.

What advice do you have for those new to the credit industry?

Start by fully understanding your company’s expectations, climate and culture. Striking the right balance is key—being too strict can strain client relationships, but being too lenient can increase risk. If you’re uncertain about a decision, don’t hesitate or assume you should already have all the answers. Seek guidance, ask questions, and learn from others’ experiences.

My son, Parrish Price, a recent college graduate, currently works as a Settlement Specialist at Envela Corp. and is now following in my footsteps by entering the world of credit management and accounts receivable. He’s had years of hands-on training—whether he realized it or not! During our commutes to school and the office, Parrish often heard about my day and learned the importance of providing excellent customer support, building strong relationships, addressing urgent matters, and resolving issues quickly. He’s also come to understand the value of continuing education through NACM, which builds essential skills and knowledge that prepare you for career advancement.

What goals do you have for NACM in 2025, and how do you plan to accomplish those goals?

Serving on NACM’s Southwest Board for several years gave me a firsthand look at the dedication and work it takes to lead at the national level. I wanted to take an active role in shaping NACM’s future by attracting and empowering the next generation of leaders.

As we look to 2025, my primary goal is to position NACM as the go-to resource for the next wave of credit professionals. We’re focused on innovating how we attract, engage and retain emerging leaders through more accessible, relevant and forward-thinking programs. This includes expanding NACM’s workshops, classes and professional development offerings to meet the needs of new credit managers.

Check out the January issue of Business Credit magazine for the full story!