Business Practices, eNews, Technology

From PDF to portal: Modern invoicing methods

Over the past 25 years, businesses have increasingly moved from paper-based invoicing to digital and automated invoicing systems. The shift suggests that the invoicing process will eventually be completely paperless.

Why it matters: Choosing the right invoicing method is vital for maintaining steady cash flow and transparent client relationships, impacting your company’s financial health.

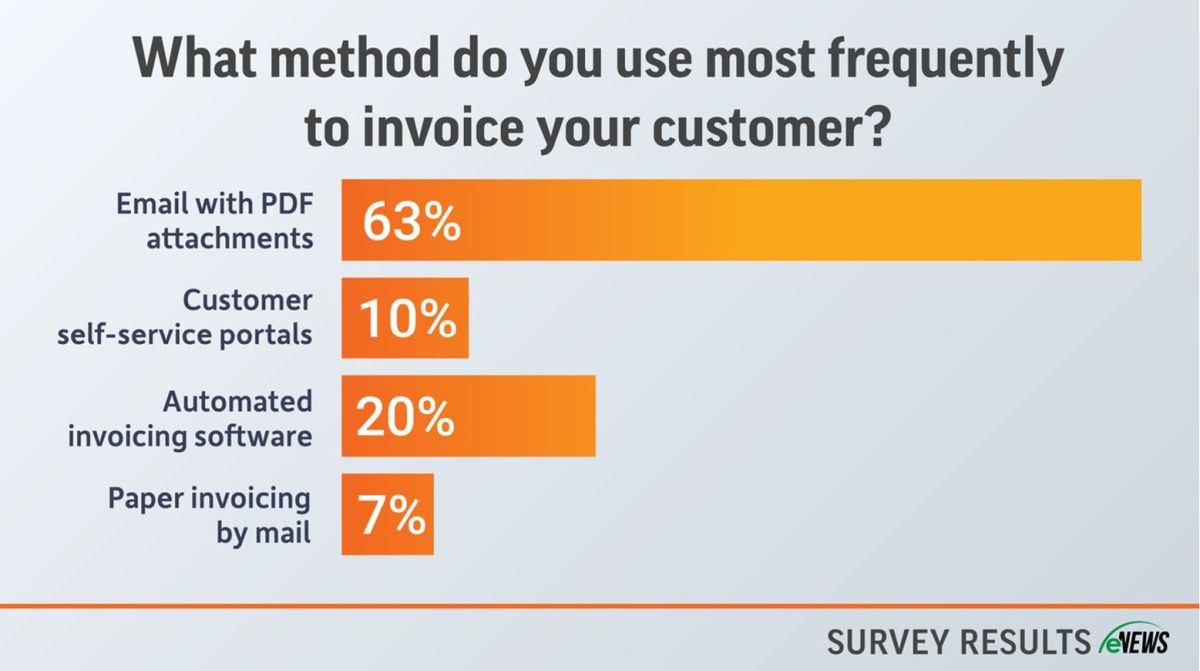

By the numbers: A recent eNews poll revealed that most credit professionals (63%) use email with PDF attachments as their invoicing method.

- In comparison, 20% said they most frequently use automated invoicing software, while 10% rely on customer self-service portals.

- Only 7% still send paper invoices to customers.

However, your invoicing style will likely change depending on your customer’s needs and preferences. “Proper invoicing minimizes disputes, which means fewer delays in payment,” said Nancy Behrenshauser, credit manager at J&L Building Materials Inc. (Frazer, PA).

E-invoicing

E-invoicing allows for faster invoice processing and payments. In turn, credit professionals have more time to focus on high-value credit tasks. It enhances accuracy by enabling real-time tracking of validation, approvals and payments, reducing errors and overpayments. It also provides businesses with better reporting and analytics tools.

“Having our ERP system email PDF copies of invoices every night saves us a great deal of manual processing time,” said George Demakis, corporate credit and accounts manager at Scafco Corporation (Spokane, WA). “We’ve also programmed our system for the few customers who require specialized invoicing (individual PDFs for each invoice rather than multiple ones in one PDF and a signature on the bill of lading to show that the material has been delivered).”

Not only that, but e-invoicing also can help businesses meet compliance concerns for both domestic and international transactions. This is most useful when working with international customers where mailing is not always an option. The European (EU) Commission published its draft directive, VAT (Value-Added Tax) in the Digital Age (ViDA), on Dec. 8, 2022. The directive makes e-invoicing mandatory in the B2B sector and introduces an electronic reporting system for cross-border transactions beginning on Jan. 1, 2028.

According to an EU Commission report, e-invoicing will help reduce VAT fraud by up to €11 billion a year and bring down administrative and compliance costs for EU traders by over €4.1 billion per year over the next ten years.

Like most digital invoicing methods, e-invoicing is cost-efficient because it reduces the need to print invoices, which saves energy and paper. In the end, it helps reduce a business’s carbon footprint and operational expenses.

The effectiveness of e-invoicing depends on having up-to-date customer contact information. “Oftentimes, the email address that we are sending it to is no longer valid or that person is no longer employed by our customer and the invoices never get to the appropriate party for payment,” Demakis said.

Automated invoicing software

Third-party invoicing software can automatically generate invoices based on sales orders, send them to customers via email, track invoice status and send payment reminders when due dates approach.

Larger corporations may require you to send invoices via Electronic Data Interchange (EDI), which automates the process of sharing and processing documents, such as invoices, purchase orders and shipping forms, across organizational boundaries. “Many of our larger retailers require EDI, which makes up 50% of our customer base,” said Wendy Bain, credit manager at Baden Sports, Inc. (Kent, WA).

Automated invoice processing can help save money on administrative tasks such as data entry and paper-based processes. It also minimizes late fees incurred from vendor agreements, which can improve vendor relationships. “I and many of my customers prefer automated invoicing because it allows them to enter invoices into their books or accounting software as they go,” said Eric Bode, credit analyst at Talbert Building Supply, Inc. (Roxboro, NC). “This approach streamlines both our invoicing and accounts receivable processes, helping us get paid more quickly.”

With increased transparency, credit professionals can easily monitor expenses and also understand where the money is spent and when. Its ability to generate a quick return on investment (ROI) leads to big savings over time. Automated invoicing software is customizable and easily integrates with other business systems like accounting and credit risk management (CRM).

However, some software may not offer the level of flexibility needed for specific business needs. It also requires training of credit staff for proper use. For small businesses, the initial setup and subscription costs of automated invoicing software can be significant. B2B automated invoicing software typically ranges from $10 to $49 per month, though some products offer free plans.

Customer self-service portals

Similar to third-party invoicing software, customer self-service portals allow customers to view and manage their invoices, payment details and subscriptions all in one place. The key difference is that the latter is a website where customers can access information and perform tasks independently, without needing to contact a service agent.

Customer self-service portals improve the customer experience, accelerate payment processing and reduce administrative workload for businesses. They also offer enhanced security for customers. “Not only is there no emailing or mailing involved, but entities can grant access to those who need to handle the invoices—it’s a win-win scenario,” said Philip McCraw, CCE, lead credit specialist at Southwest Power Pool, Inc. (Little Rock, AR).

Potential drawbacks of customer self-service portals are that they can be difficult to navigate and understand. Additionally, the portals struggle to integrate with existing CRM or ERP systems.

Paper invoicing

Paper invoicing involves printed physical documents delivered by mail or courier. It includes manual steps like invoice generation, distribution, payment processing and reconciliation. Paper invoicing proves useful for sending invoices to customers that still abide by traditional methods or who request paper for specific religious reasons. For example, in the Amish faith, using electricity or digital technology is prohibited. “We have Amish customers who would print every invoice and mail it to us via USPS once a month,” Bode said.

Paper invoicing doesn’t have to be strictly done over mail, it can be faxed, too. For instance, Karen Featherston, CBA, credit manager at Timber Products Co LP (Springfield, OR), faxes invoices to some customers of the Mennonite religion, who prefer not to receive electronic invoices.

One of the biggest drawbacks of paper invoices is that it is often time-consuming. Once the invoice is received, the credit professional must manually enter the data from the paper into a computer, which takes up valuable time and can lead to costly errors. In addition, the lengthy processing time, frequent mishandling and multiple approvals lead to payment delays, disrupting the company’s cash flow.

Paper invoices are also expensive to process. According to an IndustryWeek report, the cost of processing a paper invoice can range from $12 to $30 with an average cost close to $15. Larger companies with more complex accounts payable processes may incur costs as high as $40 per invoice.

Invoicing best practices

- Know your customer: Learn about your customers’ invoicing preferences. Communicating with them about the pros and cons of each invoicing method will help you choose the best option. Furthermore, it will streamline payments and strengthen your relationship.

- Invoice often: “I always encourage new customers to opt for weekly invoices,” Bode said. “By sending frequent invoices, customers can keep a closer tally of what’s outstanding and stay on top of their payments.”

- Ensure regulatory compliance: To prevent security breaches in customer self-service portals, credit professionals must adhere to Payment Card Industry Data Security Standard (PCI DSS) compliance (PCI). Payment portals must also comply with regulatory frameworks, such as anti-money laundering (AML) laws, know-your-customer (KYC) regulations and tax laws.

- Be responsive to errors: Stay alert to invoicing errors and fix disputes promptly. “We have a dedicated person, with numerous spreadsheet tools linked to our ERP system and designed by our IT team, who reviews all orders before they are invoiced,” Demakis said. A sales order review process can help catch errors before the sales are invoiced. “Our sales team has tools connected to our ERP that alert them if something on a sales order is out of line with requirements,” said Demakis. “This allows them to correct the issue before approving the sales order for invoicing.”

- If all else fails, call the customer: If you notice a customer is past due or can’t get a hold of them by email, the best option is to call them directly. “I continually stress to my team that if the first email contact attempt goes unanswered, pick up the phone and call,” said Demakis.

The bottom line: The shift towards digital and automated invoicing methods is increasing due to their efficiency, cost-effectiveness and ability to streamline payments, although the choice of method should be tailored to individual customer needs and preferences.