Apr 10, 2025

eNews

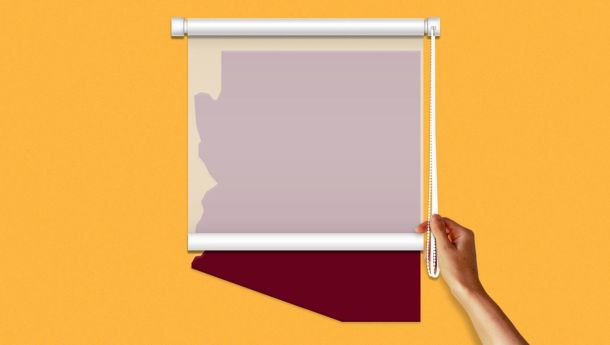

Politics Shifting Behind Trade War

President Trump’s trade war is officially on. However, in an extraordinary reversal just hours after they were set to go into effect, the President delayed the implementation of extremely harsh reciprocal tariffs on over 60 countries. That leaves in place the April 4th 10% across-the-board tariffs but gives the world time to breathe and react.