May 29, 2025

eNews

Using economic forecasts to predict risk

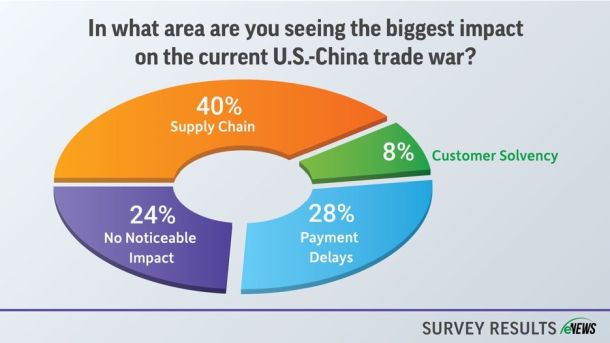

Under any circumstance, it is difficult to predict where the economy will be in the coming weeks, months or years. With ongoing trade wars between the United States and major trade allies and fluctuating tariffs that are subject to change at a moment’s notice, it can be even harder.