Feb 13, 2025

eNews

Credit investigations: your first step to success

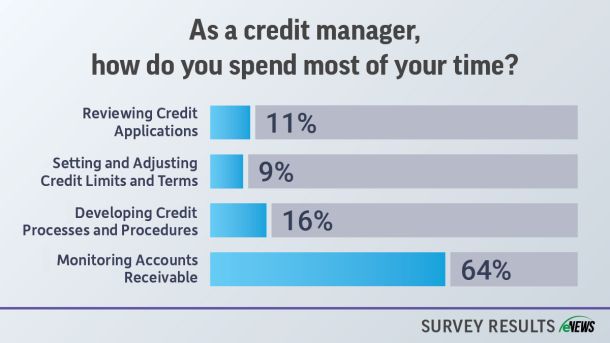

When it comes to mitigating risk and protecting a business from potential losses, the success of any credit department hinges on the credit investigation. That first look into a customer to assess creditworthiness, and determine the appropriate terms of sale, is a crucial stage in your relationship with that customer.