eNews, Technology

Automation in action: Build, buy or blend?

As the B2B automation market expands, credit managers have access to a broad range of solutions and service providers to meet their challenges and diverse needs. While the abundance of options may seem daunting, it opens the door to finding a solution that can either complement an existing system or stand on its own.

Why it matters: To meet department needs, credit professionals have to choose between purchasing automation software, building their own in-house legacy system or using a mixed approach.

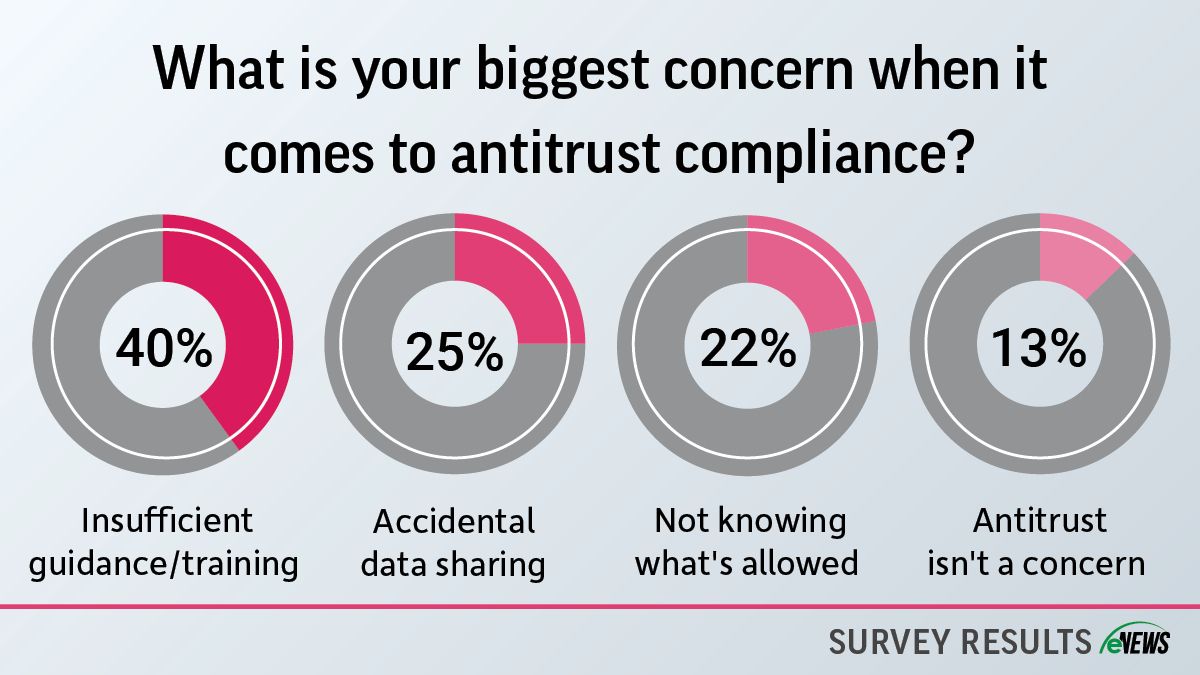

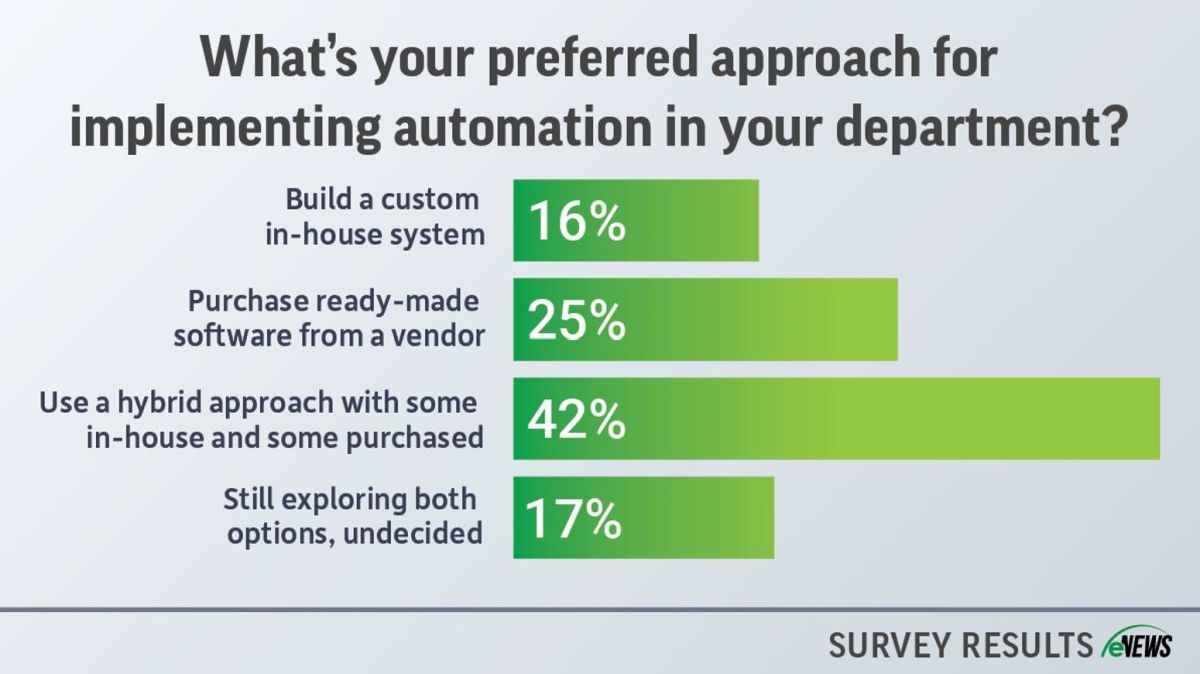

By the numbers: According to an eNews poll, 25% of credit professionals surveyed prefer ready-made software from a vendor, while 16% prefer a custom in-house automation system.

- The majority (42%) prefer a hybrid approach, combining both in-house and purchased automation software.

- The remaining 17% are still exploring their options.

Buying automation

Buying automation involves purchasing an existing product or software from a third-party vendor. When you buy automation software, you’ll be able to use it right away, addressing the specific problem.

Pros:

- Speed: It is faster to carry out since the software is already made.

- Cost: It has lower upfront costs compared to building software from scratch.

- Support: Vendors often provide support, updates and maintenance.

Cons:

- Customization: You have limited ability to customize the software to meet your exact needs and it works best if your data isn’t as sensitive.

- Dependency: You must rely on your vendor for updates and support.

- Integration: You may face challenges integrating it with existing systems.

Purchasing automation software means you may have to customize it often to fit your specific department needs. “We purchased automation software to improve efficiency, help us organize our workload and respond to clients more quickly,” said Chris Mortenson, credit and collections manager at Kirby Corporation (Houston, TX). “After careful consideration, we selected a vendor and spent about six months customizing their software to fit our needs.”

Building automation

Homegrown automation or software can be hard to integrate with modern technology later on. Building involves developing a product internally, either by using an in-house team or hiring contractors. If you choose to build the product, you can control privacy, security and how the product is used.

Pros:

- Customization: You can tailor the software to meet your specific needs and requirements.

- Control: You have full control over the development process, updates and features.

- Integration: It’s easier to integrate with existing systems and workflows.

Cons:

- Cost: You will incur high initial development costs and ongoing maintenance expenses.

- Time: The development can be time-consuming, delaying the implementation of automation.

- Expertise: It requires a skilled development team, which might be difficult to assemble and retain. It may require a lot of IT and development resources. For this reason, small or medium-sized companies may not be equipped with adequate resources for building their own automation software.

“Anything you build is going to have to be maintained,” said Charles Edwards, Jr., CCE, VP of credit operations at SRS Distribution Inc. (McKinney, TX). “You have to continuously make updates or add changes where needed for the automation to perform the way you want it to.”

The hybrid automation approach

Since there is no cure-all automation software out there, some credit departments prefer to take a hybrid approach, where they use a blend of in-house and purchased automation software. By doing so, credit professionals can receive support from their vendors while working on improving their own automation.

Adopting a hybrid automation approach is also cost-effective, as customizing off-the-shelf software can be expensive, requiring help from vendors and IT personnel. By building some of your own automation, you can help offset these costs if you have multiple processes to automate.

Determine your department’s needs. When deciding to build or buy automation software, figure out if it meets your criteria for your department and discuss that with your team. “My objective for 2025 is to develop a Standard Operating Procedure (SOP) manual for the accounts receivable (AR), credit and collections functions within our department,” said Michael Pica, CBA, CICP, credit and collections manager at Civil & Environmental Consultants, Inc. (Moon Township, PA). “Although I began this project in 2024, I have identified numerous manual processes that are performed routinely.”

Conduct a cost analysis. Cost analysis or cost-benefit analysis (CBA) is a process that evaluates the costs and benefits of a business decision, project or initiative. Doing so will help you decide the best way to implement automation in your department.

Do your research. Conducting your own research on automation will help you decide what method is best for your department. By attending conferences and networking events, such as NACM’s Credit Congress & Expo, you can learn about the latest automation and speak to vendors about their products. “Over the years, we’ve developed what we feel is a very robust, effective vetting process where we look for automation software that closely matches our needs,” Edwards said.

The bottom line: By conducting thorough research, aligning with departmental goals and evaluating costs, credit professionals can implement effective automation solutions that streamline processes and support business growth.