eNews, Technology

As automation grows, are credit managers losing essential skills?

New technology has transformed the credit management profession. From automated collections to data processing, the day-to-day work of a credit manager today stands in stark contrast to the workflow only a decade ago, as credit managers increasingly rely on new software to make more efficient credit decisions.

Why it matters: Technology can drastically improve credit managers’ workflow by automating time-consuming processes, but many fear that new credit managers who rely on these automated processes might never develop a thorough understanding of the key tenets of credit evaluation and risk mitigation.

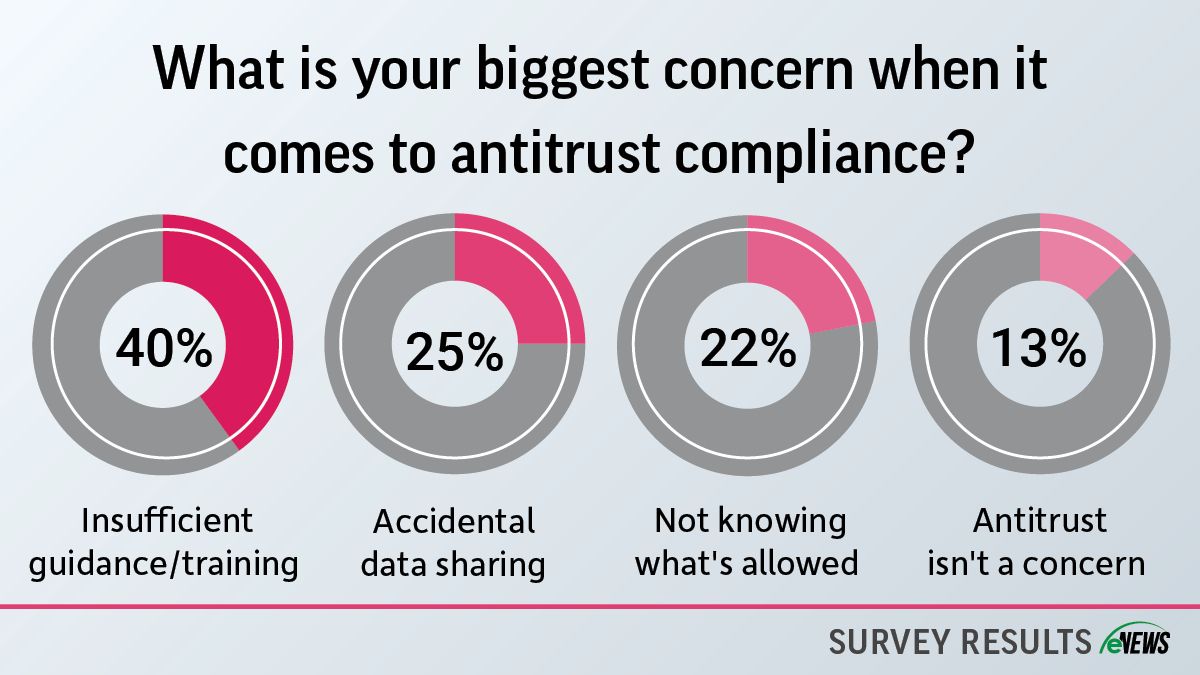

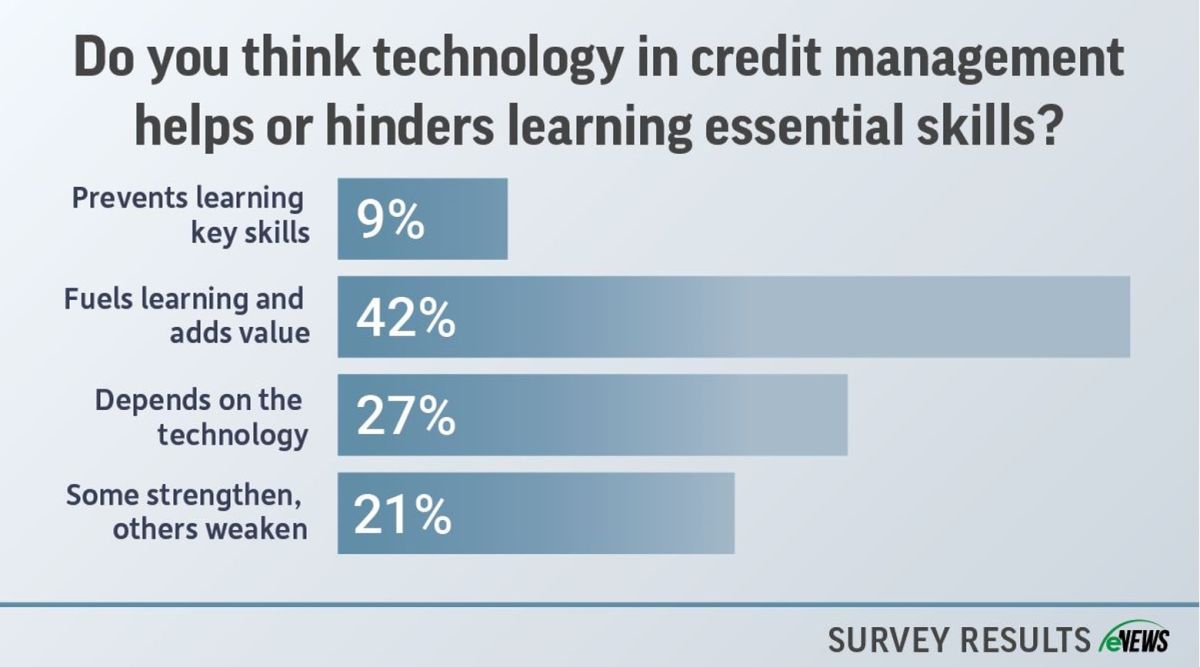

By the numbers: According to an eNews poll, 42% of credit managers found that technology fuels learning and adds value rather than hinders learning essential skills. Comparatively, 21% found that technology both strengthens and weakens skill-building.

The role of technology in credit management varies from office to office and from credit manager to credit manager. There is a host of software available that makes processing and organizing data more efficient and easier for credit managers. For Cecilia Cassella, CCE, senior finance manager, A/R at Glenmark Pharmaceuticals (Mahwah, NJ), automating the cash applications accelerates the data-gathering process.

“I don’t think technology will completely replace the risk decision process made by the credit professionals,” Cassella said. “It can, however, greatly assist in shortening the data gathering aspect required in making a sound credit decision, which certainly serves as a helpful supplemental tool in the decision-making process.”

Automating certain credit processes can also help busy credit departments alleviate their workload. “We have always done our cash application manually, but we have grown so much that we can’t keep up with a headcount that we have,” said Terry Tucker, A/R specialist for Peaq (Carlsbad, CA). “Our management team has decided to look more into software instead of hiring a body. We’re not eliminating any positions; we’re just adding software instead of adding a person.”

Despite the benefits, overreliance on technology is risky, and it is important to keep in mind that software, as advanced as it may seem, can make mistakes. With this in mind, Steve Winn, director of credit for Marek Brothers Systems (Houston, TX), finds it is important to learn the key skills of credit management to ensure that mistakes made by any software are caught.

“I noticed that a DSO on one of our dashboards was impossibly wrong. I asked IT to look at it and they said, “no, it’s calculating by the formula. I said, “no, it’s not right,’” Winn said. “I asked them to dig a little deeper, and they found an asterisk was added into the spreadsheet and that threw off the formulas in the dashboard. Having a basic understanding of the practical manual skills can help, like documenting your DSO formula so that you can go in and check the software’s calculations.”

It’s important to understand the formulas and processes performed by your software for a myriad of reasons. Whether the software shuts down or makes a crucial error, understanding the functions performed will prevent huge blows to productivity when there’s a malfunction.

“You have to understand it to know where you can find the errors,” said Sherri Kratz, CCE, CICP, corporate credit manager at Green Bay Packaging (Green Bay, WI). “Without understanding it, how will you ever develop new software, or transition to technology five years down the road if you don’t understand what makes this one function or calculation in the manner that it does?”

While the work of a credit manager is transformed with each technological innovation, reliance on new software sparks fears that credit managers are no longer honing the key skills of the trade. Nate Yagle, vice president of credit at Premier Companies (Seymour, IN), said there are concerns that new credit managers trained mainly in automated systems might not understand the decision-making and evaluation processes performed by credit software.

“Traditional underwriting skills—being able to look at numbers, use a calculator, evaluate the 5 Cs, and back a deal in to get it approved—are becoming a lost art or skill,” Yagle said. “It seems to be heading to a place where numbers are just punched into the computer and a decision is spit out, which isn’t a bad thing as it can create efficiencies and possibly more unbiased and consistent determinations.”

As automated systems increasingly handle credit decisions, new credit managers may face challenges in identifying and correcting mistakes. Without a deep understanding of the underlying data and decision-making processes, they might struggle to spot errors that could impact the business.

“In some cases, the credit manager may never even see the numbers if it is completely automated,” Yagle continued. “The concern is a new credit manager who has been trained only on automated systems may see the numbers or the decision but not understand what they mean, how they are evaluated, how to use them, or why the decision was what it was.”

The bottom line: New tech might improve workflow in the office, but it does so at the cost of skill development for new credit managers. While embracing innovative software is key in the evolving industry, it is also important that credit managers do so without forgetting the skills of the trade.