eNews, Technology

AI reshapes credit management

There are very few professions that have not been touched and reshaped by the introduction of artificial intelligence. AI technology holds the potential to revolutionize professions through its ability to streamline day-to-day workflows, with increased efficiencies giving way for more impactful work.

Why it matters: AI has touched every part of the credit profession, with credit managers employing the technology to assist them in many different facets of their work, whether it’s a writing assistant or a tool to evaluate credit applications. While AI reshapes the workflow for a new generation of credit managers, there are still skeptics. Each credit executive has their own perspective on AI’s role in the office, as well as the extent that the results yielded can be trusted.

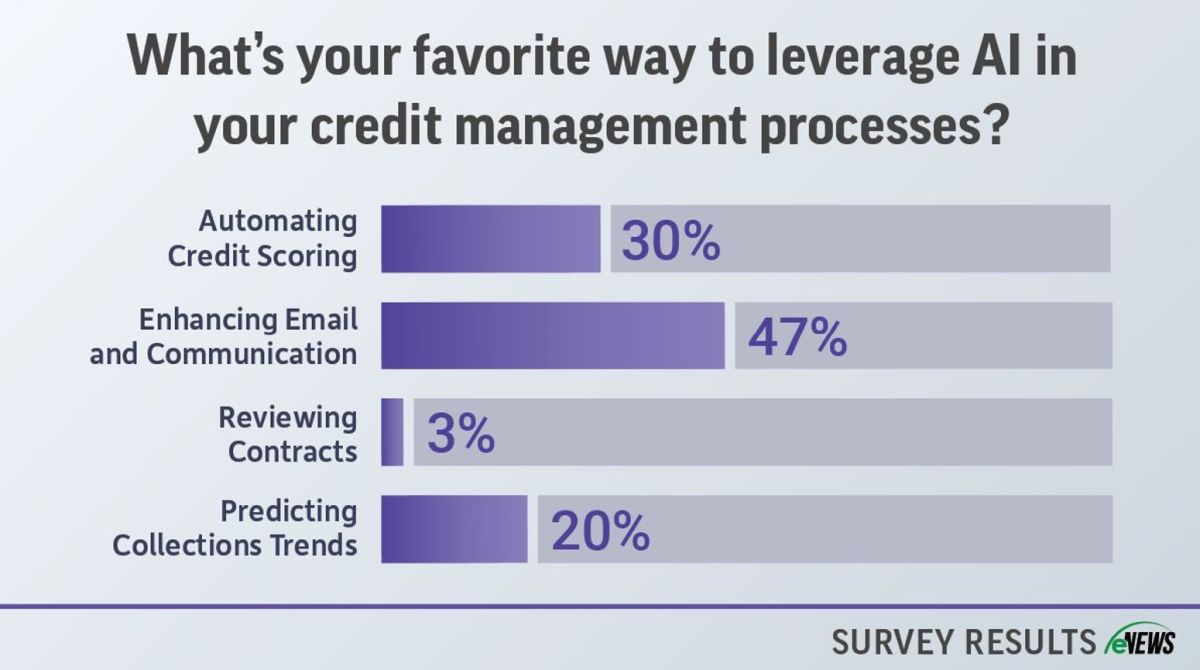

By the numbers: Most credit managers say their favorite way to leverage AI is for enhancing email communication, according to an eNews poll.

AI can help credit managers with the underwriting or approval process, according to Jason Mott, CCE, NACM Board member and corporate credit manager at MFA Incorporated (Columbia, MO). “We’ve gone from paper-and-pencil underwriting of credit to using automation and computer scoring models in order to simplify and create additional efficiencies in how we do our work,” Mott said. “Through technology we are enabled to run processes a whole lot more efficiently.”

While the technology is undeniably helpful when it comes evaluating the ever-mounting pile of credit applications received each day, Mott said that this does come at the cost of younger credit professionals potentially relying on AI instead of honing their credit and financial analysis skills. To address these concerns, it is important for credit managers, especially those in management positions, to create a careful balance between using AI and working manually.

“AI is still only a tool, and you can’t fully take the human element out of a credit decision,” Mott said. “For example, if a customer applied for credit, you ran it through a scoring model and it came back fine and it gets approved, but you know that ten years ago you took a bad debt write-off on that particular customer, that’s not something that the computer can take into consideration.”

Mott’s solution is to employ AI when it comes to those smaller customers, allowing credit managers to focus on those larger accounts. “You can’t spend all day on a $5,000 application,” Mott said. “At some point, you just have to turn it loose and let the computer make the decision and move on. From that standpoint, we let the AI handle those smaller ones and focus on working on the larger ones ourselves.”

“It helps us focus on the accounts that need more attention,” Wooten said. “It tells you where your higher-risk customers are and helps you spend more time on those customers rather than your lower-risk customers, it really helps prioritize the workflow for the collector.”

Rick Wooten, CCE, director of accounts receivable at BG Multifamily (Plano, TX), uses a collections software that employs AI to evaluate customers based on a few different factors to create a credit score. From there, the software advises collectors on how to customize their collections process to each customer based on their score, with higher-risk customers receiving more collections calls than lower-risk customers.

AI can also be helpful when it comes to writing, whether it’s a short email or a memo draft. For Rebecca Talavera, CBF, Western Washington credit manager for Star Rentals, Inc. (Kent, WA), AI can help draft emails to customers to streamline their communication and clear up any potential confusions.

“I don’t spend a lot of time trying to compose an email to a customer I just tell AI what I want to say and it’s easy for me to make adjustments to what AI comes up with,” Talavera said. “I slowly incorporated AI into my daily work because it scared me a bit and was something new but once I saw what it could do for me, I embraced it.”

The bottom line: Regardless of where AI helps you in your day-to-day work as a credit manager, it is important to find a balance that serves you best. While trusting AI can be tricky at first, finding ways to incorporate it into your workflow can help you work more efficiently and effectively.