eNews

To sue or not to sue?

Those in credit management know the feeling of dread that comes from a slow-paying customer, or the anxiety sparked by a customer who doesn’t pay at all. Troublesome payment habits can weigh on credit professionals, but they also prompt an important question: when is it time to pursue legal action?

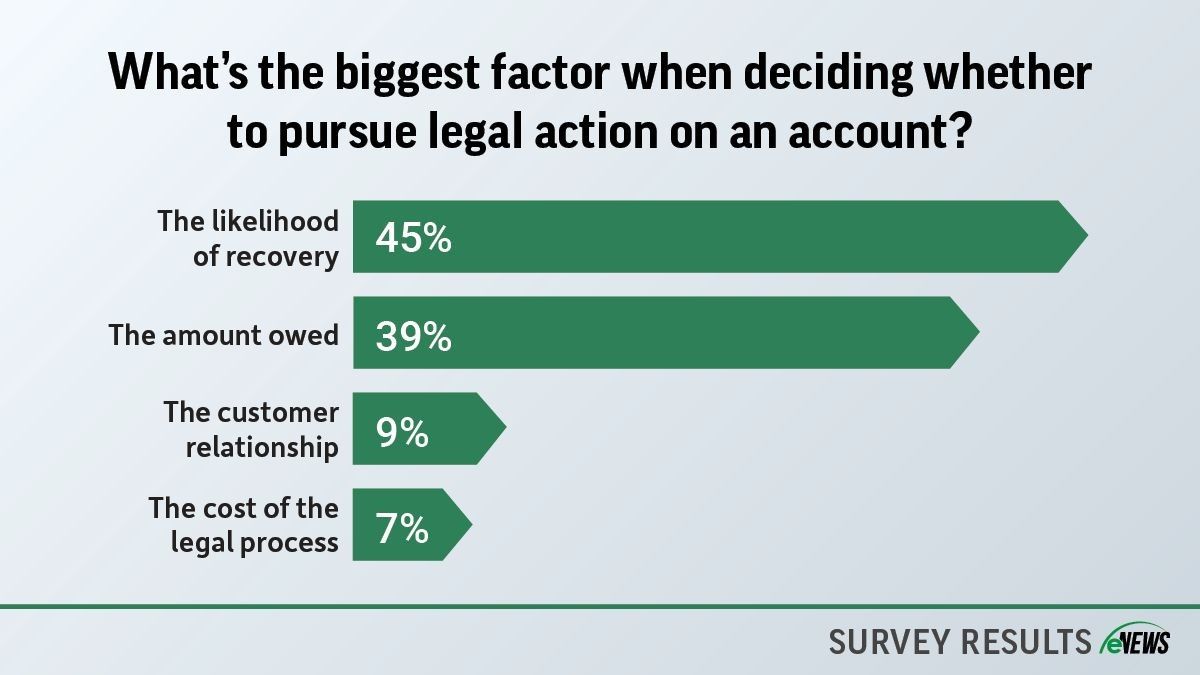

According to an eNews poll, 45% of credit professionals find that the likelihood of recovery is the biggest factor to consider when they decide whether to pursue legal action against an account. An additional 39% find that the amount owed is the largest factor, followed by the potential impact on the customer relationship (9%) and the cost of the legal process (7%).

The first step for creditors is reviewing the customer’s payment habits. “I review a customer’s payment history with our company so I can understand if the incident is an isolated issue or a part of a larger pattern,” said Vimal Patel, CCE, director of credit for OneSource Distributors (Oceanside, CA). “I check the contractual terms to ensure enforceability and assess whether alternative solutions, such as negotiation or mediation, have been fully explored.”

Considering the feasibility of legal action, Patel notes, “I evaluate the amount owed and compare it to the potential cost of litigation, as taking legal action must make financial sense. Smaller balances rarely justify the expense and time involved in litigation.”

There is no one-size-fits-all approach. The customer, your relationship with them and the issue prompting a call for legal action can vary significantly from case to case.

“Every account is different,” said Denise Boock, CBA, ICCE, director of credit and customer service for JB Group (Saint Michael, MN). “You need to take into account how long the business has been around, their payment trends with other suppliers, whether or not they own multiple businesses and the creditworthiness of the owner.”

It’s key to consider not only the size of the debt but also the probability of recovering it. “Another critical consideration is the likelihood of recovery, which I gauge by reviewing credit reports, financial statements and any available information on the customer’s assets and solvency,” Patel said. “Because the cost of legal action is a major influence, if legal fees and court costs outweigh the probability of recovery, it’s not a viable option.”

It’s important to think about the future you hope to have with this customer and recognize that taking them to court could strain that relationship. “I am always mindful of the potential impact on the customer relationship,” Patel said. “Litigation can damage trust and eliminate future business opportunities, so it is truly a last resort.”

While there may be hesitation pursuing a lawsuit for fear of hurting the customer relationship, that relationship is often already compromised by the time legal action is on the table. “For us, if we are at the point of legal action, the business relationship is already damaged, and the account has been on hold for a period of time,” Boock said.

The bottom line: The decision to initiate legal action is a complicated one. When in doubt, it is always smart to reach out to legal counsel to best understand the options available to you and what they would mean for your credit department.