Business Practices, eNews

Cash Flow Statements: Analyzing Financial Health

We all know the saying “cash is king” rings as a true statement in the credit world. It’s critically important to look closely at where and how a business generates its cash, looking no further than the Statement of Cash Flows. This statement provides information on a business’s cash during a specified period, helping credit professionals analyze its financial health. Understanding cash flow is critical for assessing risk and the financial outlook of a company.

We all know the saying “cash is king” rings as a true statement in the credit world. It’s critically important to look closely at where and how a business generates its cash, looking no further than the Statement of Cash Flows. This statement provides information on a business’s cash during a specified period, helping credit professionals analyze its financial health. Understanding cash flow is critical for assessing risk and the financial outlook of a company.

“Cash is the lifeblood of the firm, so it is not surprising that the statement of cash flows is one of the primary financial statements we use,” said George Schnupp, CCE, director of global AR operations at Anixter, Inc. (Glenview, IL). “It provides investment bankers, commercial lenders, equity analysts and credit professionals with a thorough explanation of the changes that occurred in a firm’s cash balances. And understanding the flow of cash is critical to having a handle on the risk of the firm.”

Knowing what to look for within cash flow statements is an essential skill for all credit professionals. Cash flow statements have three parts, detailing different sources and uses of cash: Operating, investing and financing activities. Operating activities show how much cash is generated from ongoing, regular business activities or operations, such as manufacturing and selling goods or providing a service to customers, while investing activities show the cash generated or spent relating to investment activities, such as a purchase or sale of an asset, cash out due to a merger or acquisition or loan proceeds received. Because cash flow statements include details about cash relating to debt and equity, financing activities show how the business raises capital and pays back its investors. Financing activities include issuing and selling stock, paying cash dividends and adding loans.

Typically, income statements or balance sheets are the what and cash flow statements are the how. Balance sheets show what your assets are, while cash flow statements show how assets are spent and help determine if cash turnover is sufficient to cover expenses. Anyone can acquire several assets but still not be able to pay their bills, so you must know if the cash will turn over within the correct amount of time to get paid.

Schnupp said cash flow statements are just one important piece of the analytical tool puzzle. “They show the adjustments made to net income in order to calculate cash flow from operations,” he explained. “The statements should be analyzed to determine why cash flow from operations is negative or positive. Also, the analyst should consider cash flows over a period, looking for patterns of performance and exploring underlying causes of strength and weakness.”

Though financing activities are an option, some credit professionals find borrowing or financing to be synonymous with unreliability. Many people relied on financing during the pandemic in 2020 for their businesses to stay afloat, however, if companies are still relying on outside sources for financing, it can impact their long-term stability. This causes the risk assessment for those whose cash flow is not from operations to be much bigger. “Too often users of cash flow statements will look at the overall cash flow rather than drilling down to see the cash flow from the components of operating, investing and financing,” said Brian Lazarus, CPA, CGMA, MBA, instructor for NACM’s Graduate School of Credit and Financial Management. “Financially healthier companies will always have a positive cash flow from operations. If not, the needed funds would have to be raised from selling some of its valuable assets or borrowing funds in order to cover its regular operating expenses. This should be a huge red flag for creditors.”

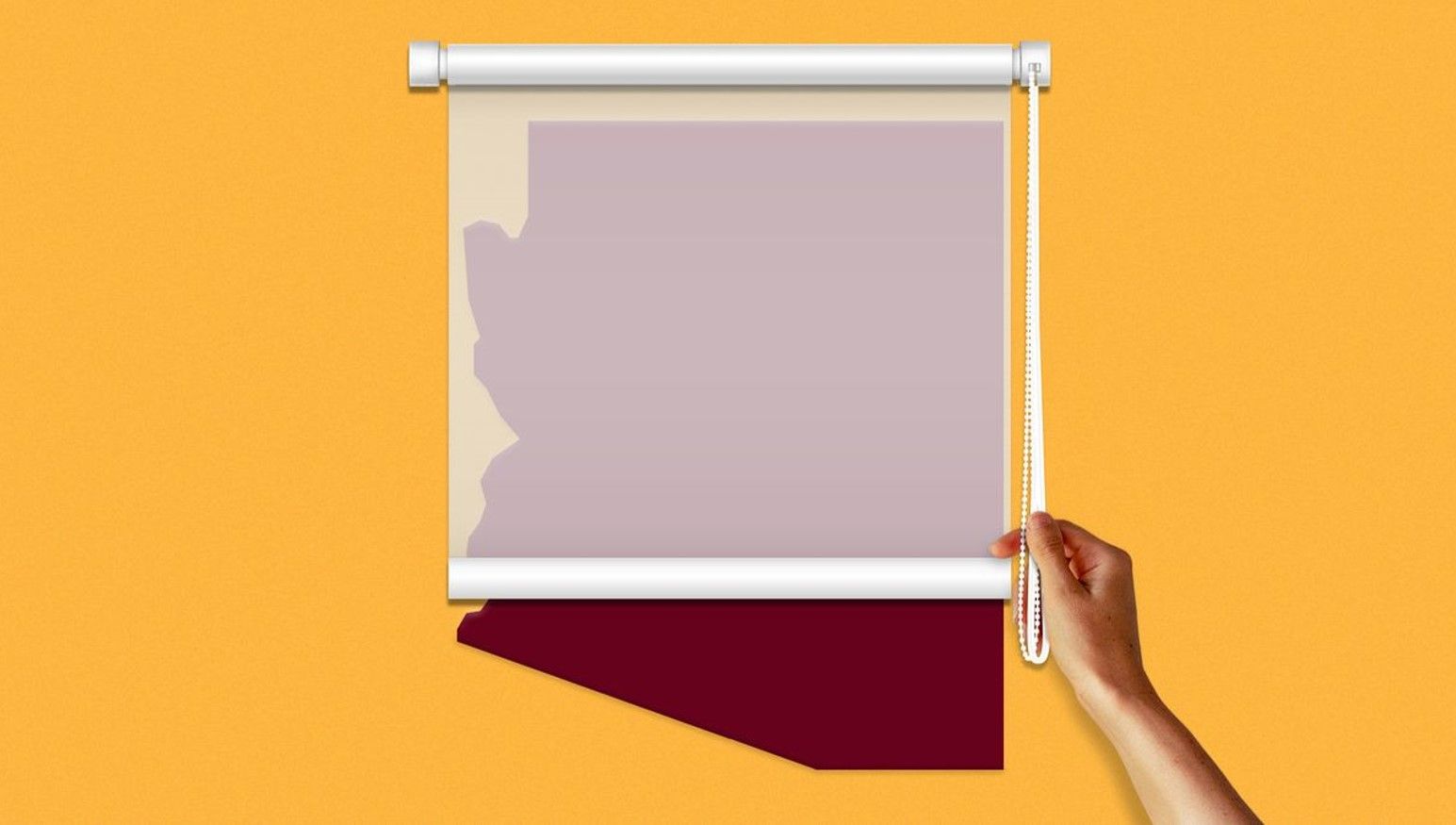

Because cash flow statements are a significant indicator of where a company gets its money and if the money is enough to keep the company alive—U.S. regulators are scrutinizing cash flow statements, how companies treat errors within them and the quality of the information that companies provide, according to the WSJ. But one major issue that stands out to the Securities and Exchange Commission (SEC) specifically is how companies treat errors within these cash flow statements. The most common error is misclassification, the WSJ revealed. Companies who fill out incorrect information when labeling cash flow under investing, operating or financing activities are not valid reasons to the SEC.

“Auditors play an important role in auditing financial statements, however, every credit professional must be cognizant of the limitations of an audit,” explained Lazarus. “An audit does not guarantee that the audited company has no embezzlement or fraud issues. So, it is critical that creditors familiarize themselves with the standard audit cover letter to fully understand how the audit was conducted and what its limitations are.”