eNews, Technology

Beware of outdated credit application processes

In the realm of credit management, each department operates under its own set of mysterious guidelines and formats for credit applications. While some cling to the familiarity of paper documents, others embrace the digital age with online portals, creating a patchwork of practices that can leave customers confused and frustrated.

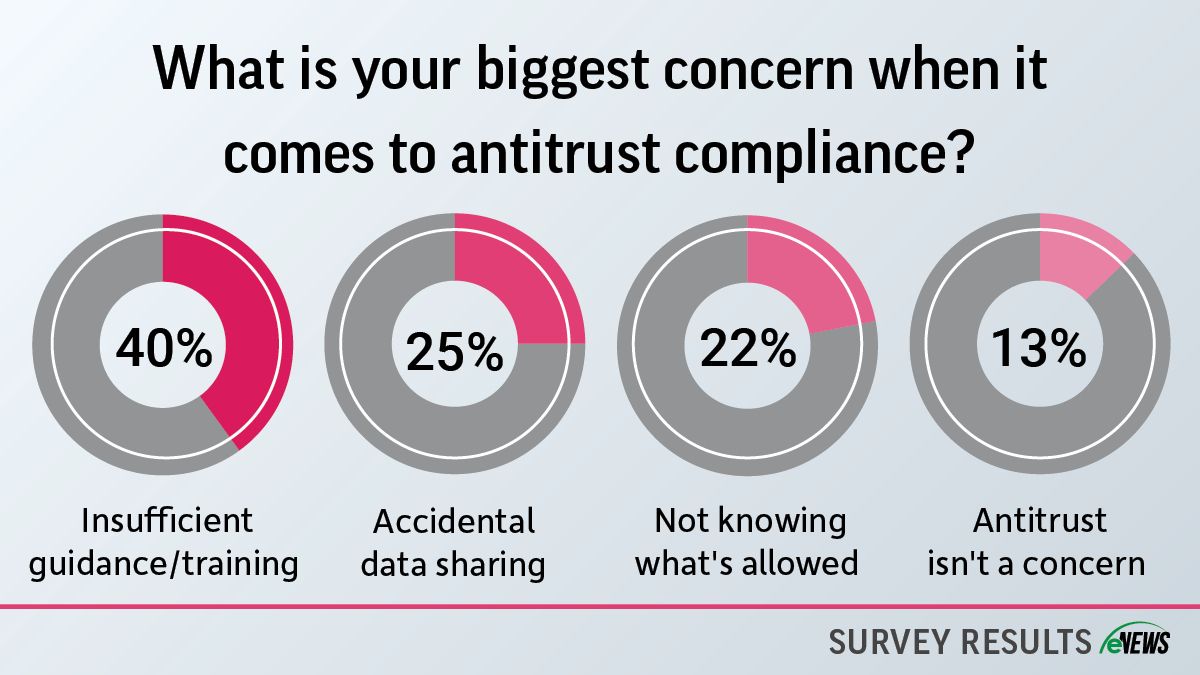

Why it matters: Credit managers use diverse methods for applications. Each method has its pros and cons, and it is key to understanding the potential pitfalls of unclear or outdated credit application processes.

By the numbers: 18% of credit teams process seven to 10 credit applications each month.

- It takes 43% of credit departments one to two days to approve a new credit application.

- 19% of credit managers say they spend the most time on credit applications and approvals.

- 42% of credit departments plan to implement digital credit applications.

- 46% of credit departments currently use email to process new credit applications and 24% use paper.

- 13% of credit professionals say their greatest delay in approving net terms is reworking credit application content with customers.

Many third-party software solutions are available that allow you to send customers a link to digitally fill out forms. This can expedite the application process while also offering analysis tools that can help evaluate customers.

“We used to use paper applications and manually sent reference requests,” said Laura Luotonen, regional credit manager at Orgill, Inc. (Collierville, TN). “Then we changed the process and started using third party to improve document storage, visibility and remove some of the manual processes of checking for credit references.”

Using an online portal also eliminates any struggles to read a customer’s handwriting or understand incomplete applications. Luotonen found that online applications make a big difference, namely in their “ease of use for customers and the efficiency of being able to quickly approve accounts with all necessary information.”

While digital signatures provide a convenient and efficient way to secure agreements, some remain skeptical about their legal standing compared to traditional handwritten signatures. This uncertainty can lead to concerns regarding the authenticity of agreements and the potential for disputes down the line, making it essential for credit managers to understand the regulations and best practices surrounding digital signatures.

For Erin Stammer, CCE, vice president of credit at PNW Railcars, Inc. (Portland, OR), the go-to format for credit applications is a Word document. “We have a Word document that we only use when we need more information about a new customer because very little is available online,” Stammer said. “We ask sales to send it to the customer to fill out. Sometimes a new customer will ask for our application out of the gate, which is also helpful.”

For Terry Tucker, A/R supervisor at Peag LLC (Carlsbad, CA), the format may switch from PDFs to Word Documents depending on customer preferences, but the content of the application is consistent. “I’ve been with the company almost four years, it’s the same document,” Tucker said. “Sometimes we update some verbiage, but it’s really been the same document.”

The rigidity of a company’s credit application process varies from department to department. Those who don’t take on many new customers each year or serve larger distributors might be a bit more flexible on the application process, with some adjusting their paperwork to fit how their customer does business.

Regardless of what format you choose, just make sure the instructions are clear to eliminate any miscommunications during the application process. “If it’s hard to fill out or understand, the customer is less likely to return it in a timely fashion and does not achieve a good starting point in a new relationship with them,” Stammer said.

The bottom line: Each credit department has its own preferences for credit applications, shaped by its industry, customer base and application process.