eNews

When big customers pose even bigger risks

Having a customer who consistently pays on time and represents a large portion of a company’s earnings may be a dream for the sales team, but for credit managers, a single customer dominating their accounts receivable prompts concerns about concentration risk.

Why it matters: When too much revenue sits with a few customers, it can create vulnerabilities in otherwise healthy portfolios. While a consistent, large customer can be good for business, sudden changes to the customer’s payment habits could send a company reeling when the bulk of its sales is tied to a small corner of their portfolio.

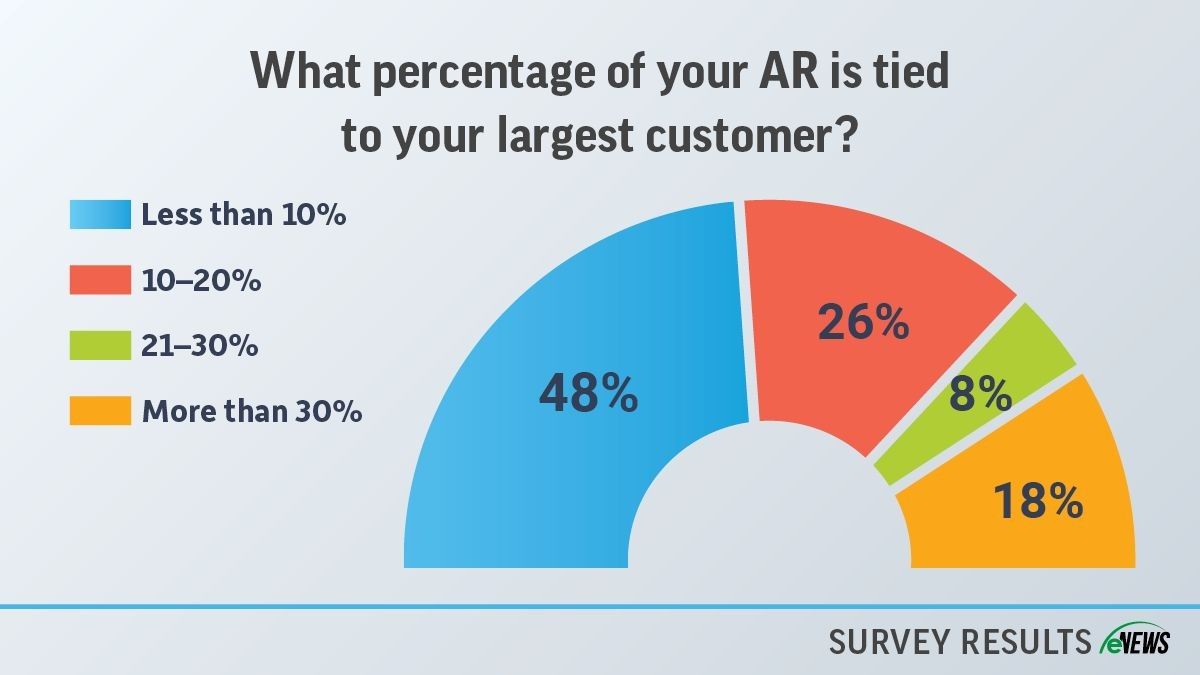

By the numbers: According to an eNews poll, 18% of credit managers have nearly a third of their accounts receivable tied to their largest customer. Another 8% attribute between 21-30% of their receivables to their largest customer, and 26% see their biggest customer taking up 10-20%.

Concentration risk is often understood as having one customer take up a significant portion of your company’s sales, but concentration risk is broad and can appear in many forms in a company’s receivables. Outside of concentrating business on one customer, a business can also concentrate their receivables in specific industries, regions or sectors.

Having a sizable share of your accounts receivable linked to a few customers is not inherently risky, as long as you know how to manage those customers. “Remember that, if you can’t measure it, you can’t manage it,” said Martin Zorn, Credit Congress speaker and partner with the NACM Quarterly Metrics Survey. “Credit managers need to be able to measure not only the concentration in sales but understand what the implications of that concentration are relative to margin. Ask yourself, if you were to lose that customer, what would happen? There’s nothing wrong with concentration, but what a good credit manager ought to do is understand what it would do to their revenue margin and working capital if something happened to that customer.”

Outwardly, credit managers treat these customers as they would any other. But once you notice a sizable chunk of your receivables concentrated around one company, region or industry, it’s best to take precautions to ensure you are fully vetted on those customers’ payment habits and broader operations.

“Concentration simply increases your need to perform good financial analysis and the due diligence to ensure you notice any changes in payment behavior,” Zorn said. “If you have a large concentration and you normally get annual financial statements from your customers, maybe you need to get quarterly financial statements.”

Credit managers are trained to spot risk, but your sales and executive team might have a harder time understanding the inherent risk of a large customer when their payment habits are normal. It’s best to keep those other teams abreast of what could happen to your company should your relationship with that customer change.

“I would recommend that credit managers document the risks so that everybody in the organization from sales to executive management to finance understands the risk,” Zorn said. “Then periodically you stress test it. Even if everything is going great, come up with a plan for adverse changes in that relationship, even if it is a very low possibility.”

Having policies in place for what constitutes concentration and how to manage those customers can help credit managers navigate these situations. “Put in concentration policies so that the rules don’t just apply to one company but are generalized and help you define what the credit department and executive team consider a concentration,” Zorn said. “Set a certain percentage threshold defining concentration. For example, once a customer represents 10% of your receivables, your policy can say that once a customer reaches that concentration threshold, you need to start getting quarterly reports and annual bank references.”

The bottom line: When you spot concentration in your receivables, it could prompt a lot of “What ifs?” Before you panic, remember that having a concentration is not inherently bad if you can learn how to manage it. Building policies around increased documentation, quarterly financial statements and regular bank references can help ease the risk of focusing too much business on one corner of a portfolio.