Education, eNews, Leadership

The pitfalls of rushed credit decisions

The pressure to make quick decisions can often compromise the integrity of due diligence processes. When faced with tight deadlines and mounting expectations, credit managers may find themselves forced to cut corners and make rushed decisions.

Why it matters: Maintaining a balance between efficiency and thoroughness is crucial to ensuring accurate risk assessments and protecting the company’s interests when financial stakes are high.

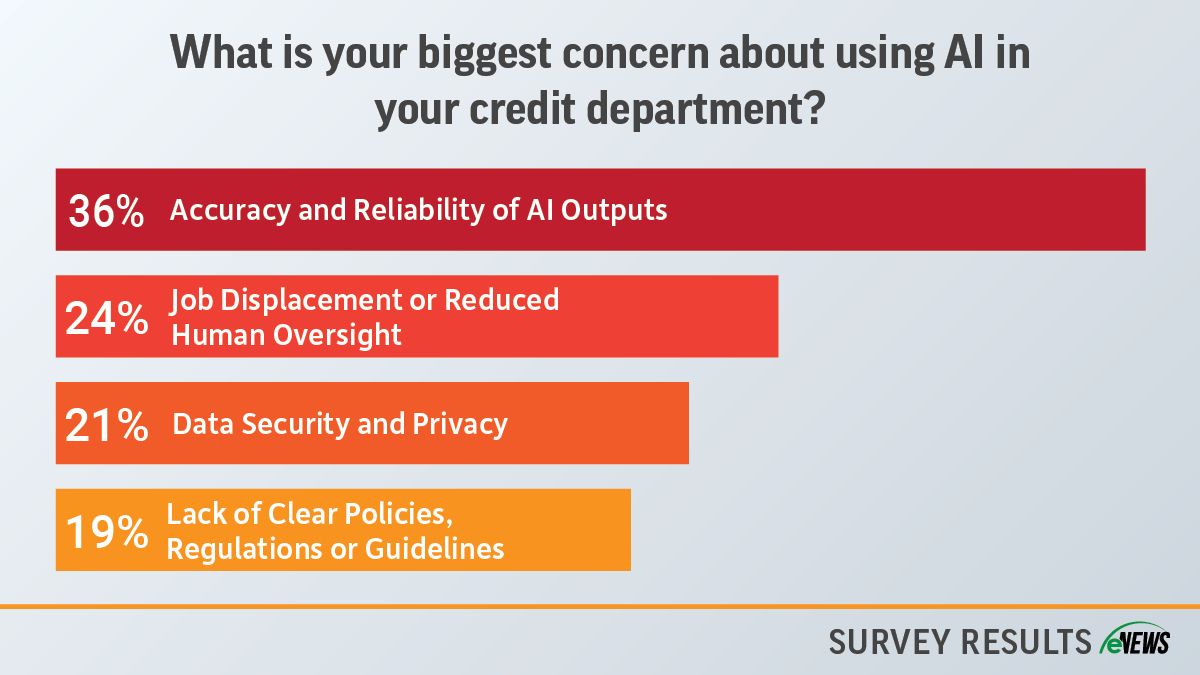

By the numbers: According to a recent eNews poll, 79% of credit professionals said that their companies have experienced adverse consequences due to a lack of due diligence.

It is important to maintain due diligence standards, even in the face of intense pressure. “In my early career at a different company, we faced C-Suite pressure to onboard a Turkish company without adequate data,” said Annette Hagemann, ICCE, CPC, CCP, director of global credit at APL Logistics North America (Scottsdale, AZ). “This decision not only caused issues but also resulted in unpaid invoices. And in another previous position, we had a customer in Mexico whom we met with and got payment assurances for, but we couldn’t get its financials and had already made this company a distributor. My mistake was not pushing harder to get that information.”

Whether a buyer is local or international, due diligence is essential. Hagemann, serving customers across six regions, has developed a comprehensive credit policy and a customer onboarding ‘cheat sheet’ detailing necessary criteria and information from customers in each region. “We also have credit insurance in place which triggers reporting within 60 days of being past due and creates an email trail of information,” she said. “If we’re not able to get that information we escalate the situation to senior management so that it can be resolved, and they are aware that we are doing our due diligence.”

The process of due diligence will vary depending on the company, industry and customer. Hard due diligence primarily focuses on concrete aspects such as financial statements, market data, legal documentation, physical assets and operational processes. Soft due diligence considers factors such as management team competence, corporate culture, brand reputation, customer relationships and industry trends.

“Hard due diligence concerning the numbers and data in B2B credit is often a labor-intensive investment to even gather the appropriate financial records, much less properly analyze them to ascertain risk,” said Steven Prensner, CBA, senior credit analyst at MasterBrand Cabinets, Inc. (Jasper, IN). “Soft due diligence is often equally important but even harder to evaluate as credit professionals are not always the primary customer relationship contact. There are many factors for business success that the numbers cannot capture, like quality of management, company culture, customer base loyalty, manufacturing flexibility and similar elements.”

It’s not only the credit team that needs to do due diligence, but also the entire company, said Gary Juliano, CCE, credit manager at ATI Specialty Materials (Monroe, NC). “There has to be good synergy between finance, operations and credit so that everybody’s aware of the situation.”

Maintain regular communication with the sales department and consider participating in their conference calls to enhance collaboration and insight. “Make sure you have a pulse on what’s going on in the market and make sure to talk to your customers or your partners,” Juliano said. “Build relationships through customer visits or conference calls. This will aid in your due diligence and provide insights about your business, customer and product.”

Developing a checklist or questionnaires for onboarding customers will help you stay organized and collect meaningful information. “This helps me track the various elements critical to assess and score the risk in your specific industry,” Prensner said. “As the relationship progresses, your team can cross-reference back to past and current scores to help spot trends and hedge against increased risk exposure in the future.”

Hagemann rates her customers on a one-to-five scale, one being the most critical because they’re slow payers or they’re a brand-new company that we’re closely watching. “We also take a look at outside credit reporting for financial information and input into an SAP database,” she said. “That way, we can easily evaluate our customers on a daily basis in addition to having guidelines in place.”

Use your resources. Hagemann uses NACM and FCIB as sources for information such as monthly country risk analysis. “I also make sure to use Know Your Customer (KYC) practices to truly understand a business and gather all the information that we need to make a credit decision.”

The bottom line: To mitigate the risks associated with rushed decisions in credit management due diligence, organizations must prioritize a culture of thoroughness, diligence, and integrity.