Business Practices, eNews, Government

The new frontier: Learning, adapting and connecting in an ever-changing industry

The B2B credit industry is constantly evolving, driven by new policies, technology and vendor offerings. However, the sheer volume of information and change can be overwhelming, even for the most seasoned credit professionals.

Why it matters: To stay ahead of shifting industry trends, credit professionals must continuously learn and adapt. Often, this involves connecting with the right people and being in the right places. In this guide, we’ll highlight the place and people that will help you stay ahead of the curve and build the connections needed to advance in B2B credit.

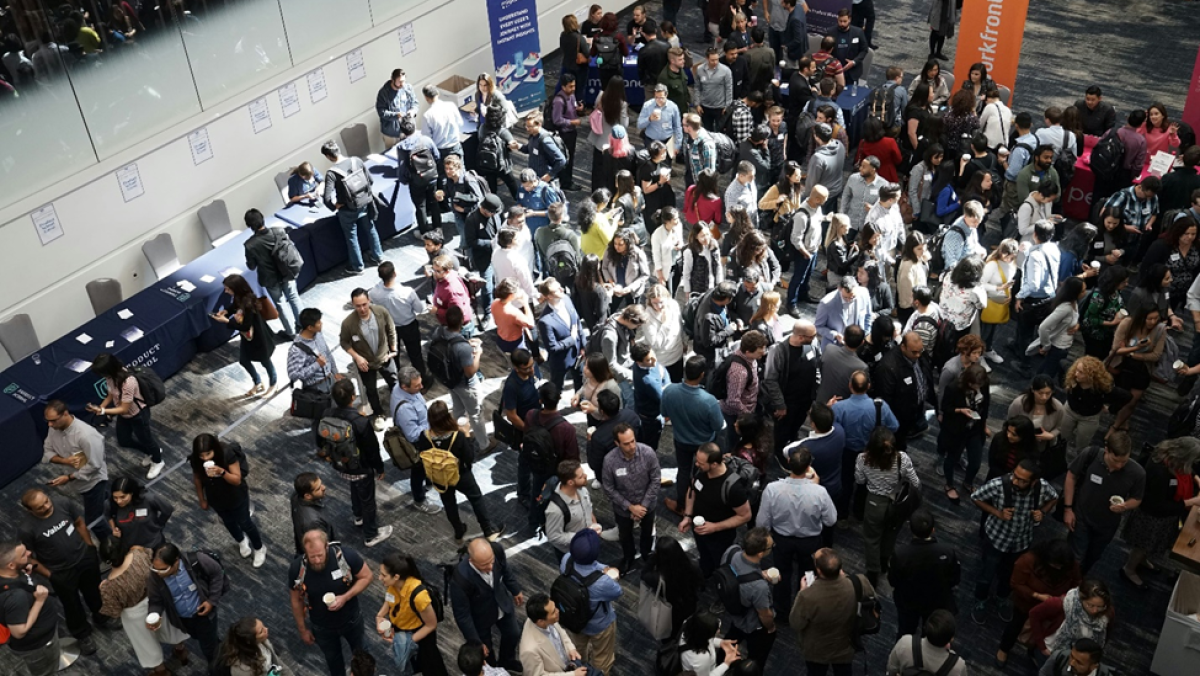

The Place: Expositions

An exposition is a concentrated opportunity to learn about new products and services. For credit professionals, it is a chance to gather together and network with industry professionals and discover emerging trends in a face-to-face setting.

“Lately, it’s more difficult to tell what’s important from what’s just noise, especially when technology moves so quickly,” said Logan Asche, sales director at Keyence Corporation of America (Itsaca, IL). “Expos allow you to focus your attention on macro-level changes in the market. By knowing where the industry is headed, and what’s working and not working for others, you can plan strategically for your organization.”

Whether you’re looking to optimize your credit processes or adopt the latest technology, attending expositions can help you discover cutting-edge products and solutions.

For instance, a credit manager struggling with high Days Sales Outstanding (DSO) and inefficiencies in collections can find solutions by attending NACM’s Credit Congress & Expo. “There, credit professionals can hear how companies are reducing DSO by implementing tools from solutions providers like Emagia or HighRadius,” said Veena Gundavelli, founder and chief executive officer at Emagia Corporation (Santa Clara, CA).

The live demonstrations and engaging exhibits can give you more insight into companies and their products and services. Becky Campo, CBA, credit manager at Standard Supply and Distributing Company (Dallas, TX), said she discovered Handle and United TranzActions after attending the 2023 Credit Congress & Expo. “I brought what I learned to senior management, who have taken my recommendations and will pursue the services of the vendors that best fit our needs,” she said.

The People: Vendors, Industry Experts and Peers

Expositions are filled with leading industry experts who assist professionals with their needs and challenges. There, credit professionals can consult with industry peers, solution providers and technology analysts and explore the right products for their company.

Speaking with finance and IT teams, for instance, ensures seamless integration with existing Enterprise Resource Planning (ERP) systems like SAP FSCM or Oracle Cloud Credit Management. Additionally, networking with NACM members, attending credit executive networking events or following fintech analysts from Gartner or Forrester offers valuable third-party perspectives on emerging trends. “These conversations help credit managers compare features, assess ROI, ensure regulatory compliance and select the best solution tailored to their company’s specific needs,” Gundavelli said.

Engaging with vendors like Esker can provide insights into AI-driven credit risk automation, while discussions with credit reporting agencies such as Experian and Dun & Bradstreet help assess data-driven risk management capabilities.

Even if your company isn’t actively seeking change or new solutions, just being at the exposition will help you meet and forge connections with like-minded credit professionals seeking to learn and adapt in their field.

The big picture: Building connections is key to growth and advancement in credit management. Forging relationships will help you find suitable tools and solutions to improve both business and credit practices.

“I believe it’s important to celebrate this profession and to be surrounded by others who understand the unique difficulties we deal with every day,” said Scott Michelsen, CCE, ICCE, director of credit and collections at Pave America (Warrenton, VA). “When we do our job well—collecting payments efficiently and staying on top of our books—we’re directly contributing to the company’s success. It’s something worth recognizing.”

What’s next? At the largest gathering of its kind, connect, network and learn from industry experts, leading service suppliers and colleagues who have a passion for the field of commercial credit management. Register for NACM’s 129th Credit Congress & Expo in Cleveland, Ohio this May 2025 before February 21 to take advantage of the advanced rate!