Business Practices, eNews

Startups pose high credit risk

While startups often present exciting opportunities for growth and innovation, they also come with significant uncertainties. Unlike established businesses, startups typically lack a proven track record, stable cash flow and robust financial history, making the assessment of their creditworthiness a complicated challenge.

Why it matters: Understanding these risks can impact your decisions and your company’s financial success.

Startups vs new, small businesses generally

A “startup” business is usually focused on developing and testing new business models or innovative technologies that can disrupt or create markets, whereas small businesses operate in more established markets and rely on proven business models. Some well-known examples of extremely successful companies that were once “startups” include: Google, Facebook, Apple, Amazon and Uber.

While these (and other) startups have been wildly successful, many startups—by their very nature—engender significant risk of failure.

Startups often prioritize rapid growth, in many instances sacrificing initial profitability and instead focusing on disrupting the market, introducing a new technology or otherwise being a “change agent” with the goal of rewarding investors by achieving a significant valuation in the medium term. In contrast, new small businesses that fall outside of the realm of startup focus on sustainable growth and long-term income, growing organically and more slowly, as they prioritize steady returns over quick gains.

The definition of a startup can vary depending on your industry or company. For instance, Tracy Mitchell, CBA, AR senior team lead at Trinity Logistics (Seaford, DE), does not distinguish startups from new businesses. “For a startup or a newly formed business, we’re looking at less than a year in business or less than a year of financial data,” she said.

Yes, but: Startups are the riskiest business model with the highest risk of failure. According to the U.S. Bureau of Labor Statistics (BLS), approximately 20% of new businesses (which includes startups) fail during the first two years of being open, 45% during the first five years and 65% during the first 10 years. Only 25% of new businesses make it to 15 years or more.

Why are startups risky?

Startups often secure funding from venture capitalists, while small businesses typically use personal savings, bank loans or traditional financing. Startups typically have limited cash flow. “I’ve seen relatively small startups that when they start to hit the end of the line of their liquidity, sometimes a lender comes in,” said Michael Papandrea, from the Bankruptcy and Restructuring Department at Lowenstein Sandler LLP (Roseland, NJ). “But a lot of times, they’re waiting for another round of investments to resolve those liquidity issues.”

Startups also pose a high credit risk due to their lack of business experience and insufficient financial data. “With startups, you’ll have a limited supply chain because they’re not going to have those established relationships,” Mitchell said.

🔨 Risk mitigation tools when extending credit to startups

To mitigate financial risk, creditors must build relationships with customer contacts, including C-Suite and upper management. “Make regular customer visits during the first year or two that you’re in business with the startup company,” Mitchell said. “Communicate regularly and look at their patterns of growth and decline. If you can, get them to give you financials for every quarter, or at least semi-annually.”

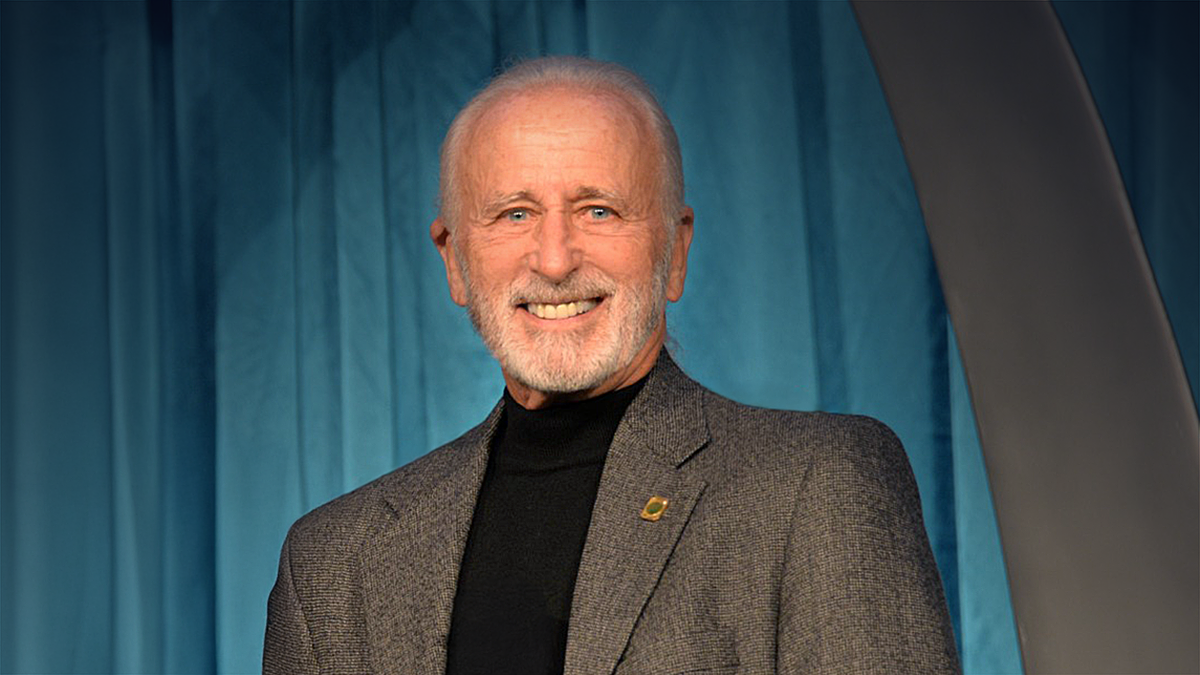

Creditors should also make sure they understand the collection risks of guarantees provided by principals or owners of new businesses or startups. “You have to look at the guarantor’s financial condition, identify their assets that are and are not jointly owned or are exempt from collection and look at the state in which the guarantor lives,” said Bruce Nathan, Esq., partner in the Bankruptcy and Restructuring Department at Lowenstein Sandler LLP (New York, NY). “If the guarantor doesn’t have their own assets, the guarantor jointly owns assets with their spouse, the assets are exempt or the guarantor lives in a community property state and a creditor sues on that guarantee, the creditor is not going to collect very much, particularly if the guarantor dies before his or her spouse does or the guarantor lives in a community property state.”

The bottom line: Extending credit to startups carries significant risk due to their high failure rate, reliance on external funding and lack of financial history, necessitating careful assessment and regular monitoring of their credit.