Business Practices, eNews

Navigating contractual challenges

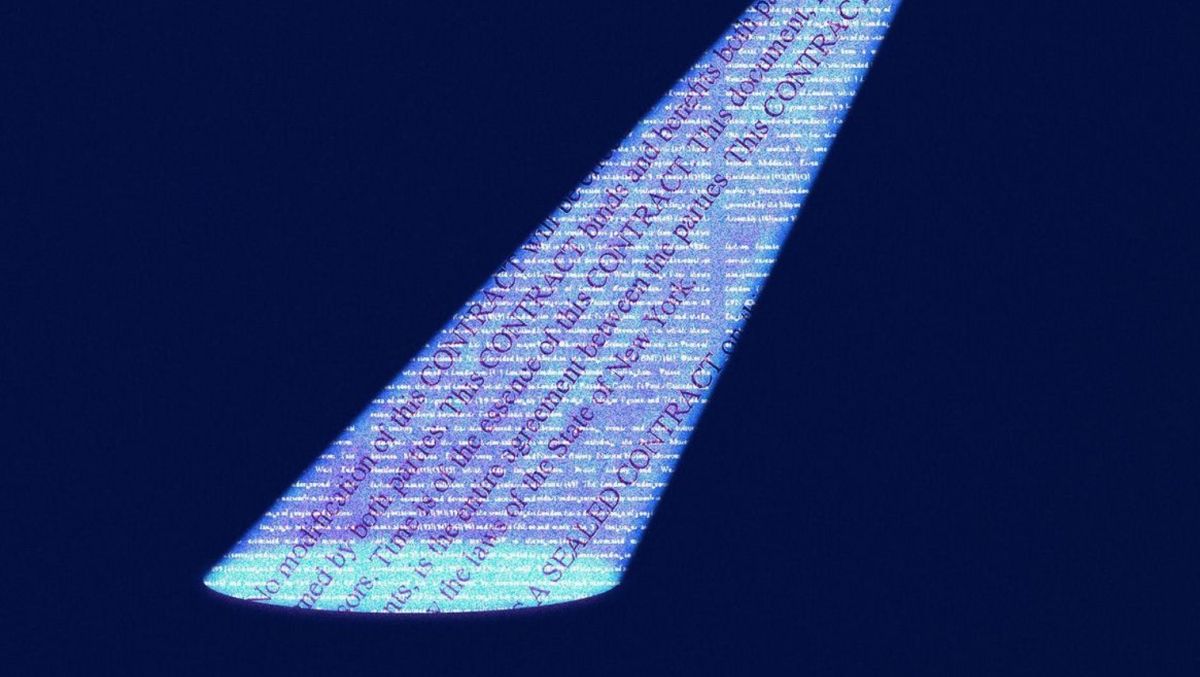

One of the biggest challenges in business credit is ensuring customers adhere to contractual terms and agreements. Often, this requires negotiating terms and going the extra mile to protect your rights and ensure obligations are met.

Why it matters: Whether it’s a credit application, sales contract or supplier agreement, getting customers to commit to terms and conditions can be difficult. Here, we’ll share best practices and expert advice on how to bind customers to contractual terms while maintaining a strong customer relationship.

By the numbers: A recent eNews poll revealed that 46% of credit professionals report their customers frequently fail to comply with agreed-upon terms and conditions. Additionally, 43% say this happens some of the time, while 8% say it occurs rarely.

#1 Include a personal guarantee

A personal guarantee is a legal commitment where an individual pledges to cover the business’s debts if the promise to pay an obligation is broken. If the business can’t cover expenses, the creditor can initiate legal action to seize personal assets for debt repayment. Susie Berry, credit manager at Architectural Woods, Inc. (Tacoma, WA), says that when she accepts a customer’s credit application, she requires personal guarantees. “If the company defaults, we can pursue the individual who signed the guarantee, not just the LLC,” she said. “It’s an effective tool to ensure accountability and makes it clear that, if they don’t pay, we have legal grounds to pursue them personally.”

If a business fails to meet agreed upon payment obligations and the creditor enforces the personal guarantee clause, it could trigger financial repercussions and potentially lead to a court case.

#2 Make modifications

Provisions, legally binding conditions or stipulations that outline the rights, obligations and limitations of the parties involved, can be added or subtracted from a contract after an original contract exists. Provisions include payment terms, delivery dates, confidentiality agreements and dispute resolution procedures. By reviewing and adjusting provisions, you can ensure that terms and conditions are met.

Modifications can also occur in long-term contracts with successive, repeated deliveries. For instance, the price of weekly or monthly deliveries of cement for a construction project may be set for a long period of time or fluctuate with the market. The price change would then become a modification to the supply contract. Modifications can also occur in short-term or delivery contracts. It’s important to be aware of and object to any suggestions or assertions that would change the contract unfavorably.

#3 Escalate the situation

Credit professionals can enforce terms and conditions with customers by sending them notifications via email, phone or email. If the customer violates a contract, you can escalate the situation to collections or court. “If a customer isn’t responding or meeting payment expectations after multiple attempts, we escalate by turning them over to collections,” Berry said. “We work with NACM for collections and, if necessary, we consider legal action. However, in Washington state, there are limitations on pursuing legal action in certain cases.”

#4 Negotiate when necessary

Sometimes, you have to negotiate with the customer to meet contractual obligations. For instance, a customer may suggest extending credit terms past what you’re comfortable with. In this case, you must find a mutually beneficial agreement and adjust the terms accordingly. “Generally, we won’t accept pay-when-paid terms or agree to certain indemnity clauses,” said George Demakis, corporate credit and accounts manager at Scafco Corporation (Spokane, WA). “Most of the time, customers understand this, recognizing that as a supplier, our position is different from, say, a subcontractor or a long-term supplier to a manufacturing company.”

However, if they continue to push back, you can escalate the issue to upper management. “We would escalate the issue to our Head of Sales and our Chief Operating Officer saying, ‘They’re not agreeing to our terms and want to impose their own. Are we okay with this from a business perspective?’” Demakis said. “From there, we either agree to their terms or we decide it’s not worth it to compromise, and we continue to push back.”

#5 Document any and all changes

No matter the terms or type of contract, documenting any changes can help protect you from potential disputes or litigation. “For example, the construction industry is a fast-paced industry, focused on getting the job done, but if you haven’t followed the proper change order procedure, you’re not going to get paid for work that falls outside the original scope,” Karen Hart, Esq., partner at Bell Nunnally & Martin LLP (Dallas, TX) said. “If you’re adding work or changing contract amounts, make sure it’s all documented in writing—it will protect you down the line.”

The bottom line: Ensuring customers adhere to contractual terms is a common challenge in business credit, often requiring negotiation and proactive measures.