Business Practices, Economy, eNews

Mixed success for small business Subchapter V bankruptcies

In the four years since Congress amended the bankruptcy code to assist small business reorganizations, credit managers still have mixed opinions on the success of these filings.

Subchapter V of Chapter 11 of the U.S. Bankruptcy Code offers small businesses an alternative path for filing for bankruptcy that is more expedited and cost-efficient than traditional bankruptcy filings, but it presents distinct challenges for credit managers.

Why it matters: Despite its benefits, Subchapter V also raises concerns. While it has been praised for its success in streamlining the bankruptcy process, questions remain about whether it truly leads to successful reorganizations or merely postpones inevitable business failures.

This mixed response is indicative of how several key factors play a huge role in small businesses’ ability to reorganize. Credit managers often find that, without a strong trustee and critical vendor status, it can be harder for credit managers to ensure that they are properly paid in a timely manner.

August saw an 8% increase in commercial bankruptcy filings year-over-year, according to Epiq AACER. Among these filings, 185 distressed small businesses filed for Subchapter V, a 5% increase year-over-year. This is a 40% decrease in the number of debtors that filed for Subchapter V in June before the debt limit dropped from $7,500,000 to $3,024,725.

It is too soon to tell if the change in the debt limit will have a large impact on these filings, according to Mike Mandell, corporate collection manager at Ryder Truck Rental, Inc. (Miami, FL), “I think it has forced the debtors with debts between $3 million and $7.5 million to work harder to make deals with their lenders or lessors because they know Chapter 11 is expensive and uncertain,” Mandell said.

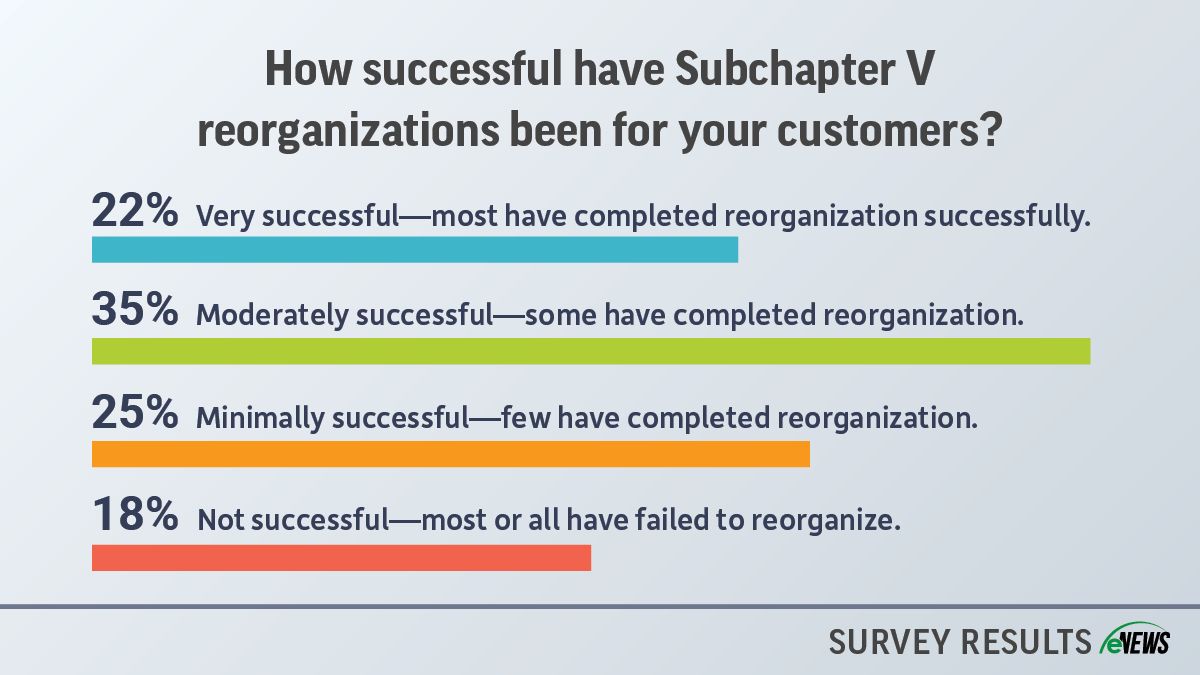

By the numbers: According to an eNews poll, 22% of credit managers have found that most small businesses that file under Subchapter V have successfully reorganized and 35% of those polled found that some have been successful. Conversely, 25% say that these filings have been minimally successful and 18% found that most, if not all, have failed to reorganize.

“I have only seen one customer so far that has successfully completed their Subchapter V plan,” Mandell said. “Few of these cases have long-term success on the reorganization side. This is largely to be expected though. If you look at the success rate of Chapter 13 cases, it is similar. They confirm a plan and are not able to perform most of the time.”

For Marlene Groh, CCE, ICCE, regional credit manager for US LBM Holdings, LLC (Buffalo Grove, IL), only two customers have filed under Subchapter V. Of the two, one was eventually converted to a Chapter 7 liquidation, while the other has been successfully working its way through the Subchapter V plan for reorganization.

The success of the filing hinged on securing critical vendor status and having an experienced trustee at the helm of the reorganization. “By obtaining critical vendor status, we were able to recover about one third of the debt owed in the critical vendor approval process,” Groh said.

Subchapter V bankruptcy means a tighter, more expedited reorganization, and, with shorter deadlines, the trustee becomes a key factor in success. Having already established a relationship with the trustee, Groh’s company was able to open their account within one week of the small business filing.

“We were able to negotiate directly with the trustee and actually were almost in full agreement before they even submitted the plan because our legal counsel knew who might be appointed as the trustee,” Groh said. “And they were very accommodating in communicating with us what they felt would likely be approved.”

Those who question small businesses’ ability to properly reorganize under a Subchapter V bankruptcy have called in to question if the process is merely extending the business’s inevitable failure. Credit professionals testified that debtors should not be forced to prolong the life of a company that cannot successfully reorganize under Subchapter V.

“We do business with companies across all industries and sizes, so we have seen quite a few different types of bankruptcies, including many Subchapter V cases over the last few years,” said Jeff Weber, CICP, director of credit at Uline (Pleasant Prairie, WI), during testimony presented to the American Bankruptcy Institute (ABI) Subchapter V Task Force in November 2023. “These claims can be made over three to five years, so it creates a burden for us to collect and ensure payments are being made.”

Another primary concern of trade creditors is the inherent imbalance created by Subchapter V of the Bankruptcy Code, such as the elimination of a creditors’ committee, no absolute priority rule and less strict confirmation requirements.

Since Subchapter V allows debtors to stretch out payments on administrative expenses and confirm a plan without needing approval from any impaired creditors, it raises doubts about whether Subchapter V really leads to successful reorganizations. Instead, it might just be delaying problems for later. Confirming a plan might not be the best measure of success; a better measure would be whether the debtor sticks to the plan, makes all payments on time, and the business continues to survive afterward. “Our experience since 2020 is that Subchapter V cases that seek true reorganization have a low success rate,” said Mandell.

Risk mitigation

Nondischargeability refers to certain debts that cannot be eliminated through bankruptcy proceedings. For B2B credit managers, this concept becomes especially relevant when dealing with customers who have provided false financial statements or engaged in fraudulent activities. Under Subchapter V, creditors have the power to challenge the dischargeability of debts if they can prove that these debts were incurred through fraudulent means.

Credit managers should conduct rigorous financial assessments of their customers before extending credit. By scrutinizing financial statements and verifying their accuracy, credit managers can identify potential red flags early on. If a customer later files for Subchapter V and it’s discovered that they provided false financial information, the creditor may challenge the dischargeability of the debt, thus retaining the right to pursue full repayment.

What’s next: The possibility always exists that Congress will revisit the debt limit in the future given the popularity of Subchapter V among debtors and bankruptcy professionals.

Interested in learning more about ways to maximize recoveries when a customer files for bankruptcy? Register now for NACM’s online course Bankruptcy Bootcamp.