Business Practices, eNews

Manual vs automated cash application: Are you maximizing your strategy?

Cash application is a vital component of the accounts receivable (AR) process. It involves matching incoming payments to the correct customer accounts and invoices, and then posting the payments to the appropriate accounts.

Why it matters: This process enables businesses to track their cash flow and keep their financial records up to date.

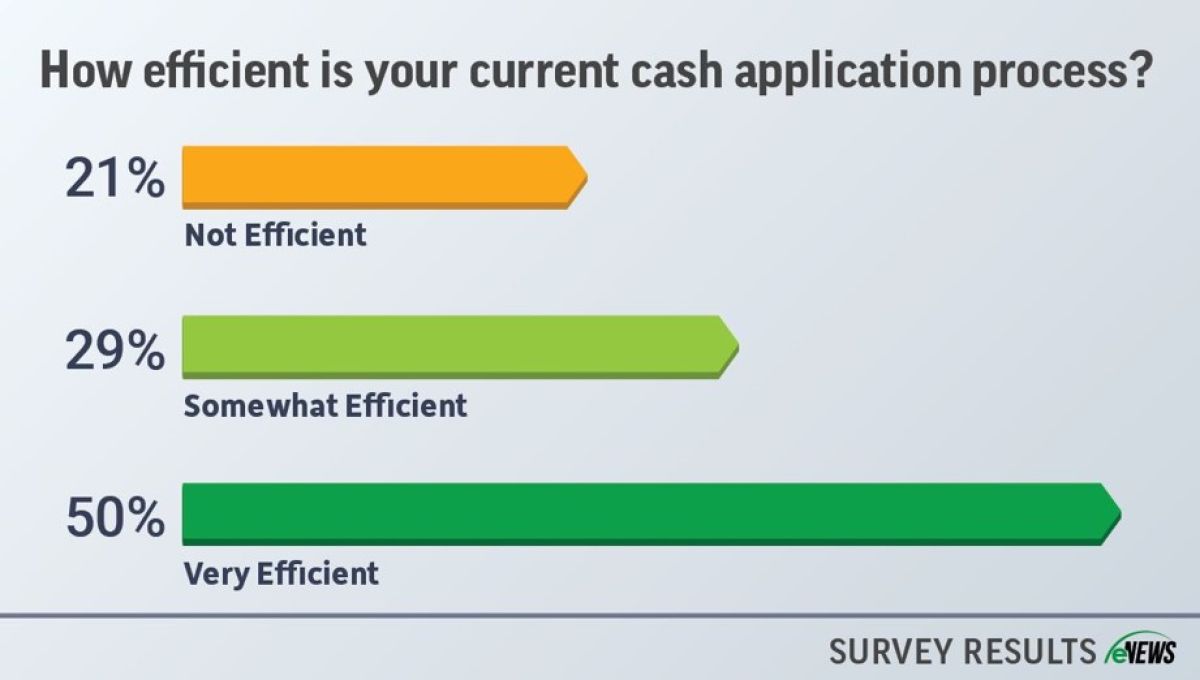

By the numbers: A recent eNews poll revealed that 21% of credit professionals believe their cash application process is inefficient.

- 29% of respondents say their process is somewhat efficient.

- Half of credit managers say their current strategy for cash application is very efficient.

The efficiency of your cash application process hinges on your company’s size, structure and industry. Inaccurate or delayed payment applications lead to misinformation and workflow disruptions.

55% of organizations have 1-2 team members managing the cash application process, according to a joint survey from NACM and BlackLine. “Manual cash posting allows our team to familiarize themselves with how postings work in our ERP, how to investigate customer inquiries regarding their payments and how to adjust them, when necessary,” said Misty Menashe, CBA, credit and collections supervisor at LaCrosse Footwear, Inc. (Portland, OR). “We also pick up on address changes, new signers or comments left by the customer on remittances when we are manually posting. With that being said, matching lines from a remittance to an invoice is a mundane task that doesn’t add value to our process.”

Automating the cash application process helps businesses collect payments faster and more efficiently, improving cash flow. “Before, we were manually entering our lockbox payments and our ACH payments, but we now have a hit rate of about 98%,” said Michelle Wilson, credit manager at Bega/US Inc. (Carpinteria, CA). “The challenge was the implementation as you are working with your banks, your software house, your IT department and your customers to ensure that they are sending in a remittance that can be read by AI to help automatch, particularly for those ACH payments.”

Automation also eliminates manual tasks like data collection and integration, ensuring fast and error-free processes. This frees finance teams to focus on strategic tasks. “It typically takes two hours daily to handle payment processing, with most of the time spent on preparation rather than matching payments,” Menashe said. “We do have an AR remittance email that would be better with an efficient reading tool to digest the information (standardize format) and reduce the time we spend manually logging and saving details today.”

Credit professionals can streamline cash application by using Electronic Data Interchange (EDI) to electronically process financial transactions. “We’ve improved monthly and daily account reconciliations and reporting, ensuring we identify issues and track program funding more accurately,” said Chelsea Hirn, CBA, director of credit operations at KGP Companies (Faribault, MN).

SAP software is useful due to its capability for extensive data uploads, allowing users to seamlessly import data from a file into Excel. “The bank can apply the payments to a file, which is then integrated with our SAP system,” said Denise Bonnet, CICP, regional credit manager at Daikin Applied Latin America, LLC (Miami, FL). “But many of the Latin American-based banks we work with are not fully prepared with this technologically as our U.S.-based banks have. Just to get access to a bank account can take months.”

Payment portals make the cash application process more efficient, accurate and transparent. Customers can pay in the portal and apply their payments and credits as they intend. “We still post the payment in our ERP but our manual hit rate is 100%,” Menashe said. “The portal also bridges our communication, reducing posting adjustments when deductions or duplicate payments occur, because the customer can see all of their invoices, credits and payments as we do.”

Electronic invoicing and payment processing also reduce the risk of lost invoices. “We have our bank lockbox linked to our accounting system to automatically apply payments,” said Molly Atlas, credit manager at MEMCO Staffing LLC (Houston, TX). “We also have a very detailed cash application department that reviews all automatic uploads before posting.”

Cash application best practices

#1 Follow company/credit policy. “Document how to handle debit and credit memos, write-offs and duplicate payments to ensure consistency and clarity,” Hirn said. “Make sure to leave room for exceptional cases.”

#2 Use internal resources. Before looking for outside automation, look at resources available in your IT package and internal software. “By micro-learning, we can better understand and independently implement software that we already have, without needing IT assistance,” said Menashe. “With that, we’ve been able to expand on some of our base skills, which helps us continue contributing to and adding value to our company.”

#3 Communicate constantly. Communicating across teams and management can offer new perspectives to improve and streamline the cash application process. “We are always working to improve our processes by keeping our eyes and ears open to new ideas and opportunities,” Atlas said. “Communication between accounting and sometimes customers is the top challenge that we face.”

This includes communicating with your customer. “We do not apply anything that the customer has not authorized because, in the past, payments were applied to the oldest invoice balances and when reconciling with the customer, that brought many differences and re-work,” Bonnet said. “We spend a lot of time communicating to our customers the importance of sending us every payment detail. Our invoices indicate, Payment details are required to be sent to our Accounts Receivable inbox for accurate payment application.”

The bottom line: Automating the cash application process helps businesses collect payments faster and more efficiently, improving cash flow. It also eliminates manual tasks, ensuring fast and error-free processes.