In Case You Missed Our Blog Posts …

July 25, 2024

🥇 With the 2024 Olympics top of mind, let’s uncover the winning strategies and latest trends in credit risk management, providing you with the tools you need to achieve gold in your role.

- 🌪 Disaster planning for credit professionals

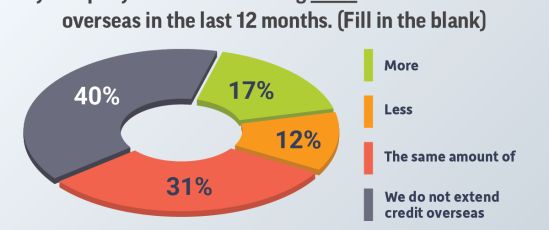

- 🌏 Plus: Geopolitical tensions