Business Practices, eNews

Hurricane season and trade credit insurance

The recent weather events remind us that natural disasters can have a significant impact on communities and businesses.

In late September, Hurricane Helene touched down on northern Florida and caused major flooding in North Carolina and Georgia. It killed more than 230 people and resulted in roughly $225 billion in economic loss. Just last week, Hurricane Milton made landfall in Florida creating at least $160 billion in damage and economic loss.

“With Hurricane Milton’s total damage and economic losses of $160-180 billion, the sum of two hurricanes in just three weeks elapsed time has a total damage and economic loss of near 2% of the country’s GDP,” AccuWeather founder and Executive Chairman Joel Myers said in a statement.

Why it matters: With more than a month left in the 2024 hurricane season, it is important for credit managers to understand the risks.

Severe weather events can impact credit risk, affecting a customer’s ability to pay you on time and fully recover their business. One way to protect against these losses is to use trade credit insurance.

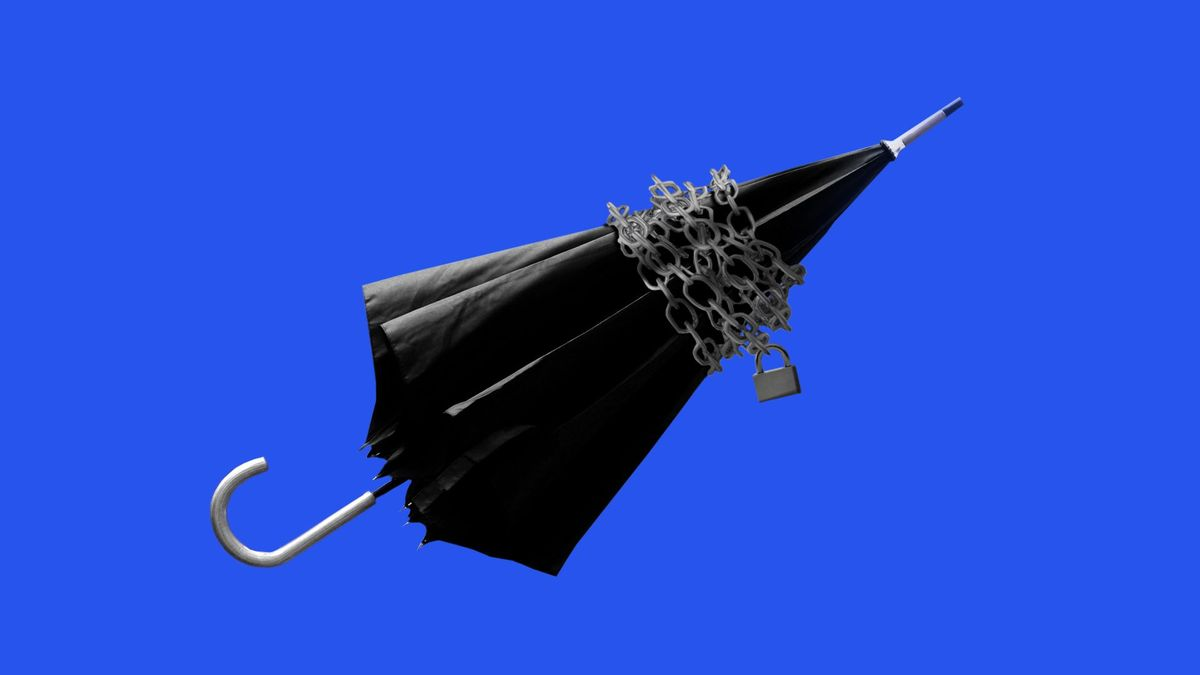

Trade credit insurance is a credit risk management tool that protects your business against losses due to non-payment of invoices. Most credit insurance policies will cover a non-payment caused by a natural disaster if the creditor goes bankrupt or cannot pay.

Although impactful for businesses, severe weather does not directly impact trade credit insurance coverage. “With my current and previous employers, we’ve seen limited overall impact from these types of disasters,” said David Culotta, SVP, head of risk underwriting at Coface (Hunt Valley, MD). “What’s more frequent are requests to extend payment deadlines or more favorable terms. That’s something we consider on a case-by-case basis.”

“So far, we haven’t seen credit insurance companies change their underwriting appetite in regions prone to natural disasters,” said Mark Regenhardt, managing director at Marsh USA, Inc. (Chicago, IL). “But some insurers, like those in Latin America, will exclude losses caused by natural disasters from their coverage. Although this is not something we see often in the U.S., trade credit insurance remains a sound risk mitigation tool to protect against circumstances not captured in financial statements.”

Yes, but: With so many options available, how can you find the right credit insurance for your company? “You have to look for the best policy at the best premium rate and the best coverages for your customer,” said Jay Tenney, managing director at Trade Risk Group (Irving, TX). “You also have to ask yourself: are they going to defend me if I get into a difficult claim situation? Are they going to suddenly cancel my policy?”

If you’re unsure about which insurance to choose, speak to an insurance broker. An insurance broker is a licensed financial expert who acts as a middleman between a business and insurance companies to help them find and purchase the best insurance policy for their needs. “It’s an opportunity to see what it looks like, but just getting a quote doesn’t mean you have to buy it,” Tenney said.

The bottom line: Trade credit insurance offers essential protection against financial losses due to natural disasters, helping businesses maintain stability in uncertain times.