Business Practices, eNews

How to read a credit report

A credit report is a statement that includes all credit activity, both current and past, including payment history, credit limits and debt. Credit reports help credit managers uncover a customer’s risk level and likelihood of getting paid on time.

A credit report is a statement that includes all credit activity, both current and past, including payment history, credit limits and debt. Credit reports help credit managers uncover a customer’s risk level and likelihood of getting paid on time.

Why it matters: Understanding how to properly analyze a credit report is key for making informed decisions and managing credit risk effectively.

Know when to use one. Some credit professionals will run a credit report during the credit application process of a new customer, and others will use credit reports when a business’s ownership or structure changes. In most cases, credit reports are used throughout the entirety of a customer’s business with the credit manager’s company. “Not all credit reports are built the same,” said Jennifer Walsh, CCE, CGA, chief executive officer at NACM Commercial Services (Spokane Valley, WA). “There is more behind just looking at a score. Credit professionals must understand their company’s risk tolerance while analyzing suggested credit limits and prediction scores.”

When potential customers submit credit applications, it is typical for them to provide references along with the application. However, customers giving their best references that they pay the best may not paint a full picture of their habits. “Doing your due diligence means pulling credit reports to see how a potential new customer is paying other vendors,” said Angela Harwood Brent, CGA, president and chief operating officer at NACM Southern Valley (Knoxville, TN). “It is also a good time to pull a credit report if there’s a sudden change in their payment history.”

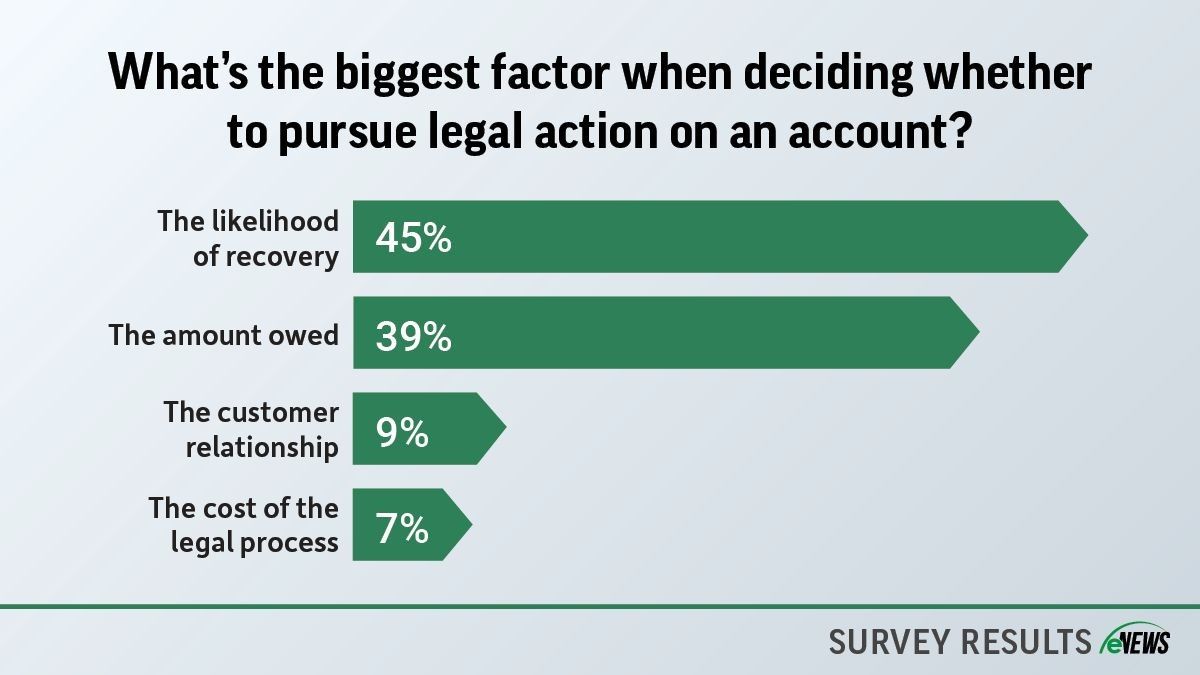

By the numbers: Half of all credit managers say credit bureau reports are the single most important data source when assessing customers, according to a joint NACM-Nuvo survey.

Know your customer. Even though credit reports are a major help in assessing customer worthiness and risk, the knowledge of a credit manager should always be the final factor in determining if credit will be extended. “There is no self-standing business credit score that can answer all the questions related to extending credit,” said Anton Goddard, president of NACM South Atlantic (Orlando, FL). “Credit professionals should look first for a quarterly summary on the NACM National Trade Credit Report (NTCR), for example. That part tells the story of how the subject has paid their bills over the past one-year period.”

Spot the red flags. Credit reports contain a lot of information, so credit managers must know exactly what to look for. Here are a few examples:

- All trade lines are small balances. For example, if a customer asks to open an account of a $1,000 balance with a $50,000 limit and there’s no evidence on the credit report to support that it is their normal purchase history.

- Mismatched information. If basic information such as addresses do not match with their credit application, or the company name is incorrect, it could be a sign of fraud.

- History of unpaid bills. “You can see payment history and financial information on an NTCR report through the database and view the number of reported tradelines it contains,” said Frank W. Sebastian, CBA, director of business development at NACM Commercial Services (Evansville, IN). “It is extremely important to have as many as possible to get the full picture of the customer and payment history.”

- High-risk lenders listed in the report. “While UCC’s indicate that the subject has secured some assets, financing, or lending, some lenders charge high rates for loans and factoring, which indicates the subject’s desperation,” said Goddard. “Just because a report’s balance is mostly zero does not mean a customer has a good payment record. Consider that suppliers may have stopped selling, and there are no balances for that reason.”

Though credit scores and applications are both great lines of defense against potential risk, credit reports take a detailed look at finances that other information may not uncover, assembled all into one document. It can also be used as a back-up source of protection against risk when you compare the information to credit applications as well.

The big picture: Credit managers must understand how to read a credit report to assess customer risk level, make informed decisions and manage credit effectively throughout the entirety of a customer’s business relationship.