Construction, eNews

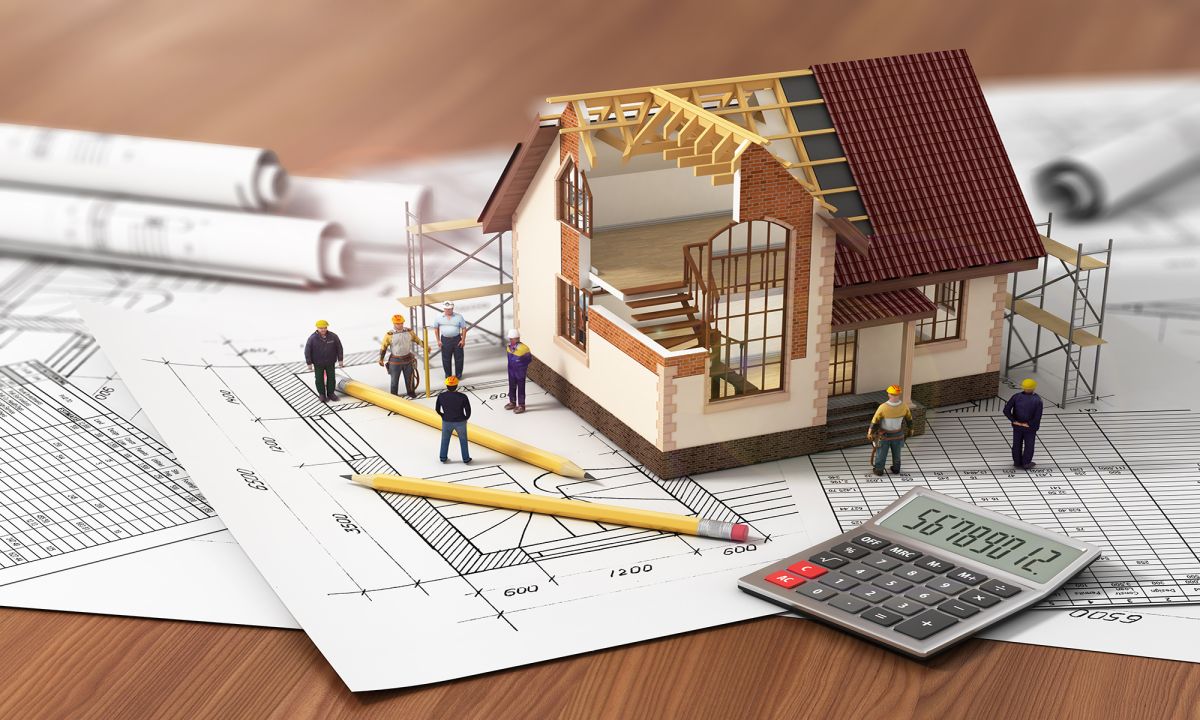

How to Analyze Repayment Ability of Construction Contractors

When lending to construction contractors, credit professionals should carefully review financial performance and cash flow. The main concerns of bankers are within areas related to how contracts are managed and how contractors expand their businesses. If suppliers who sell to construction companies are unable to receive the materials needed, it can delay projects and bolster costs. But with major shifts in the economy, such as high inflation rates, the delays in the supply chain have caused gross profits of contractors to decline 12%, said Dev Strischek, principal of Devon Risk Advisory Group, LLC, during NACM’s webinar on Analyzing, Underwriting and Lending to Construction Contractors.

Bankers also can become concerned with contractors that take on multiple projects in different states because this requires more project managers. If contractors expand their scope of work—i.e., hotel projects, highway projects, stadium projects, municipal water treatment facilities—contractors will need to increase hiring. The increase in demand that comes from expansion can also cause supply chain issues due to multiple projects that need materials to be shipped.

In unplanned circumstances, construction companies can use different accounting approaches when operating on long-term contracts called completed contracts or percentage of completion. Under a completed contract, no revenue, expenses or profit are recognized until the job is completed—which is standard to use in an event such as a natural disaster, where uncertainty and credit risks are higher.

Percentage of completion is an incremental sale, as buyers will accept portions of the project. When a credit analysis is completed, professionals should consider their primary repayment source to come from cash flow, followed by collateral and guarantees as their secondary source.

When repayment is required by banks, agreed structure deals are put in place with different conditions and covenants. For example, Strischek mentioned that covenants can require or restrict actions of borrowers. Borrowers required to take action must meet a minimum criterion, or borrowers can be prohibited with maximum criteria put in place. “We typically want to make sure that we have rules put in place among bonding capacity and making sure that we’re up to date on information,” he said. “We want to make sure that if there is a covenant violation, we are quickly on it.”