Business Practices, eNews

From chaos to calm: Crisis management for credit teams

It’s no secret that companies across industries are grappling with the ripple effects of shifting supply chains, severe weather events, rising costs and mounting tariffs. This economic volatility can significantly impact businesses by creating unpredictability in customer behavior, supply chains and financial planning.

Why it matters: By developing a crisis management plan, credit professionals can shift from a reactive approach to a proactive one, helping to minimize risk and improve decision-making. In addition, they can protect their company’s reputation, maintain customer trust and reduce financial and operational fallout.

What is crisis management?

Crisis management is the process by which an organization prepares for, responds to and recovers from unexpected events or disruptions that threaten to harm its people, operations, reputation or financial stability. Key elements include:

- Preparation – Identifying potential risks and developing a crisis response plan.

- Response – Acting quickly and effectively when a crisis occurs to minimize damage.

- Communication – Keeping stakeholders informed with clear, timely and accurate messaging.

- Recovery – Restoring normal operations and learning from the event to improve future readiness.

Because every business is unique, no crisis management plan will be the same. If you don’t have one in place, it’s best to prioritize what’s most important to your company and go from there.

A recent eNews poll revealed that during periods of economic uncertainty, 40% of credit professionals surveyed prioritize strengthening risk assessments. A quarter of credit professionals focus on improving collections while 22% focus on increasing their communication with customers. The remaining 13% concentrate on tightening credit limits.

Strengthening risk assessments

Risk assessment is the process of identifying, analyzing and evaluating potential risks that could negatively impact a business’s operations, finances or reputation. It is a key function of the credit department. Evaluating a customer’s ability to meet its financial obligations and determining the level of credit risk they pose is essential in a volatile economy.

“We conduct fairly robust credit assessments on new applicants and further increase the frequency during challenging times,” said Tony Acevedo, director, credit at Smith Drug Company (Spartanburg, SC). “We find that by doing so, we get greater clarity as to the quality of our accounts receivable and isolate some areas of higher risk. In the meantime, we focus on maintaining awareness of what’s happening in our market and our industry.”

Improving collections

Amid market unpredictability, maintaining a healthy cash flow becomes more critical than ever. To manage financial strain, customers may delay payments or request extended terms. By strengthening collection efforts, credit professionals can improve the likelihood of timely payments and reduce overall risk.

“Our contractor who handles collections has a thorough, systematic process,” said Terri Peck, CBA, credit and A/R manager at Dynapac North America LLC (Fort Mill, SC). “He uses reminders and pulls data from our system, primarily through Excel, which I then review for any anomalies. Lately, my focus has been on anticipating large invoices that will be due at the end of the month. I send proactive reminder emails to customers ahead of time to check if there are any issues we should address before the due date.”

Increasing customer communication

When facing unsteady economic times, increasing communication with customers is essential. By keeping open lines of communication with customers, credit professionals can stay informed about potential payment issues, build trust and address concerns before they escalate. This helps to strengthen customer relationships and creates opportunities to negotiate terms, resolve disputes and reinforce mutual understanding during challenging periods.

“Make calls with customers a part of your routine—it’s one of the most effective ways to uncover information you’d never find in reports,” said Jon Hanson, CCE, CCRA, vice president, director of corporate credit at OVOL USA (Carrollton, TX). “I also try to build a rapport with the CFO or the controller of the customer, which makes them more open to disclosing information or providing us insights into their company like if they’re undergoing a merger or are facing liquidation.”

Tightening credit limits

To better mitigate risk, credit professionals must be proactive in their credit limit assessments for new and existing customers. During times of economic uncertainty, credit professionals reduce the amount of credit they extend to customers, either by lowering their existing credit limits or being more conservative when approving new credit. Since some customers may be more impacted than others, credit professionals may need to reassess and adjust credit limits accordingly.

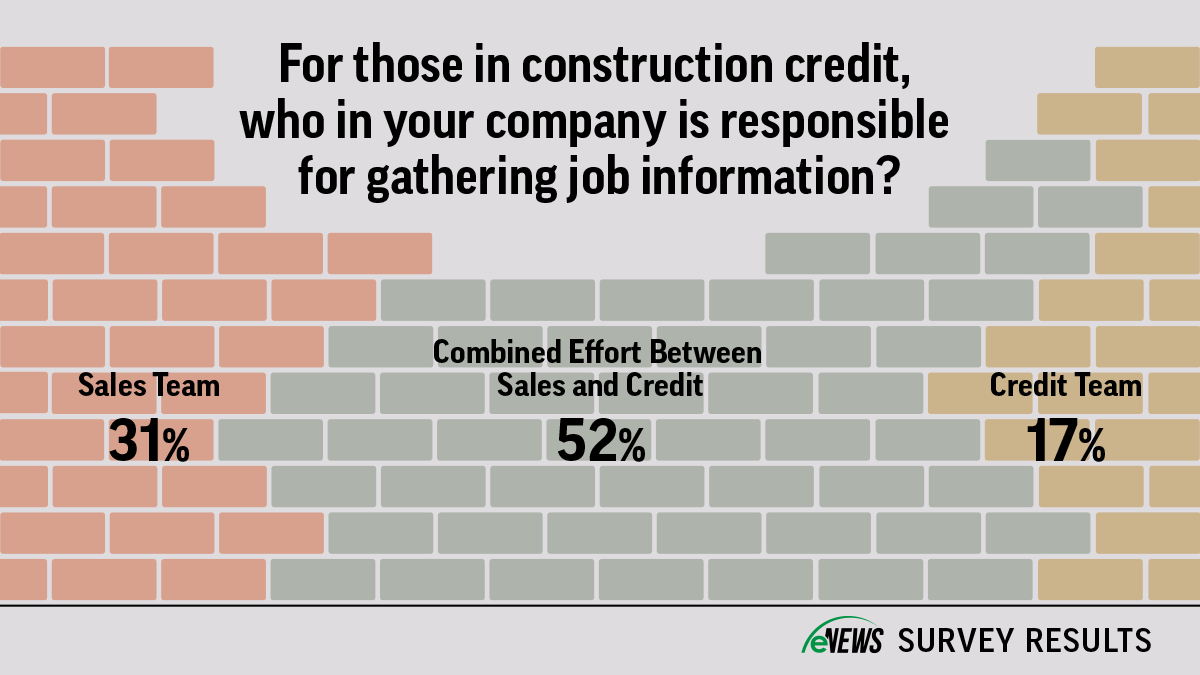

Collaborating with sales

Sales teams are often considered the “eyes and ears” of a company because they’re out there on the front lines, interacting with customers daily. They hear about competitor moves, pricing changes and industry shifts directly from customers. Their close relationships allow them to pick up on subtle changes in customer tone or behavior, making them a valuable early warning system for identifying risk and supporting proactive credit management.

“Our salesmen, whom we call territory managers (TMs) communicate with the customers way more than we do,” said Melinda Wells, CBA, credit manager at Northwest Cascade, Inc. (Puyallup, WA). “With their help, we’re able to run a monthly report for anybody who is $5,000 or more past due for 60 days and hold meetings with each state’s operations manager to discuss what they’re doing and come up with solutions.”

The bottom line: When the economy is on shaky ground, it’s natural to feel on edge. The key is to focus on proactive solutions or return to the basics to ensure nothing is being overlooked.