Business Practices, eNews

Emails, texts and AI: How modern credit managers connect with customers

Communication methods for B2B credit managers have evolved significantly over the years. Traditionally reliant on face-to-face meetings and postal correspondence, credit managers now benefit from a range of digital tools such as email and online portals and text messages.

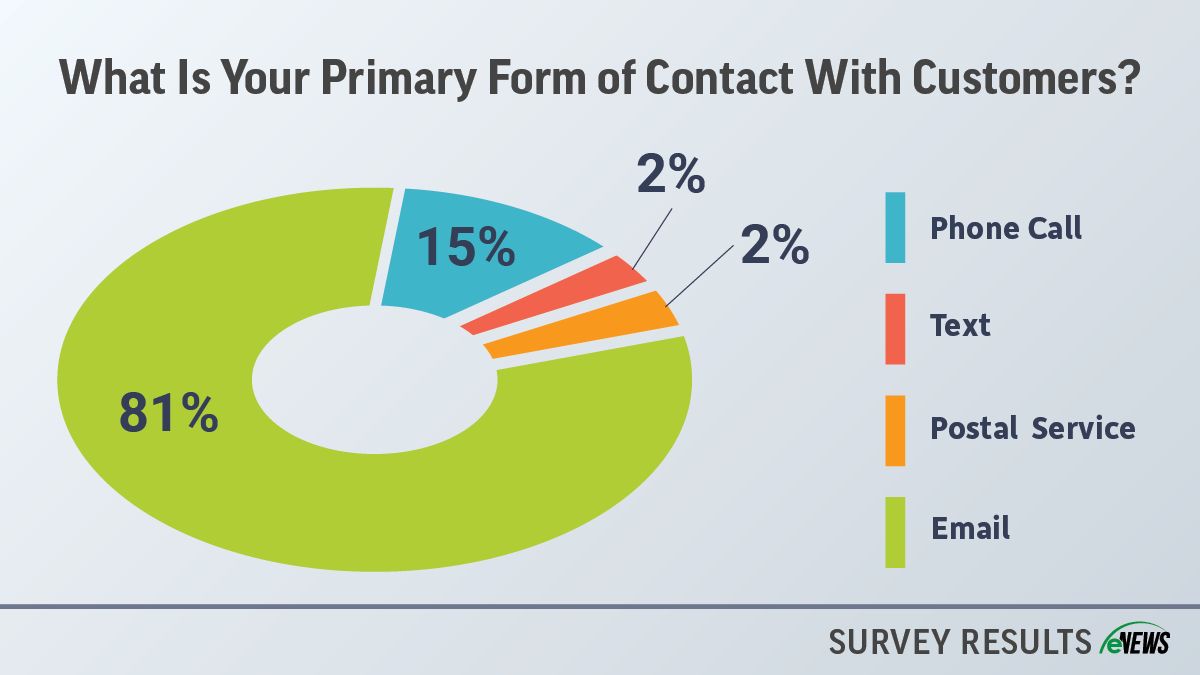

By the numbers: A recent eNews poll shows that 81% of credit professionals prefer email as their primary communication channel with customers, a 6% increase since last year. In contrast, only 15% favor phone calls compared to last year who said 21%, while text messages and postal service lag far behind, each at just 2%.

Why it matters: Understanding these different communication methods can streamline processes, enhance efficiency and improve overall communication with clients and stakeholders.

Emails

Emails remain the top communication method with customers because they are efficient and easy to reference. “With an email, I have all the information right in front of me that I can always go back and look at,” said Tracie Levie, mining account specialist at Campbell Companies (Salt Lake City, UT).

Its delayed response time reduces pressure that comes along with phone calls and text messages. “But it’s probably not appropriate to email a customer if you need to place them on cash on delivery (COD) or take legal action,” Levie said. “But otherwise, if it’s just asking for a payment update or checking if you received invoices, email or text is appropriate.”

Email is helpful when sharing summaries and reports, but some information can get lost in translation. Facial expressions, nonverbal cues and tone can become blurred. Email also eliminates the ability to build rapport with a contact than other methods of communication.

Fraud is on the rise and the impact of customers being phished more consistently is a growing concern. According to a Perception Point report, Business Email Compromise (BEC) attacks have surged by 1,760% from 2022 to 2023, marking one of the most profound escalations in cyber threats in recent years.

Anytime you change the format or request within an email or email template, you run the risk of your customers doubting the authenticity of the email. “If our customers don’t trust our email, they may disregard it without notice,” said Michael Barnidge, CCE, CICP, vice president of finance at Quality Bicycle Products (Bloomington, MN). “A lack of response may identify them as hard to reach or engage with, when in reality they are being cautious to requests about payments due.”

Phone Calls

Phone calls are efficient for customer communication, allowing credit professionals to reach out at any time and leave voicemails if needed. “Phone calls are necessary if you are discussing credit terms, fact finding on a delinquent job or lien waiver request or if you are going to restrict credit,” said Bernie Faller, director of credit at US Air Conditioning Distributors LLC (City of Industry, CA). “A phone call may not be appropriate when responding to a document request.”

The main disadvantage to phone calls is that fewer people want to speak over the phone. Other reasons include:

- Intimidation: It can be difficult to gauge how someone feels or thinks about you when you can’t see them on the phone.

- Interruption: Phone calls can be disruptive, especially if they are unplanned.

- Fear of making small talk: People may feel pressure to make small talk on the phone.

Artificial Intelligence (AI)

AI phone agents, such as Bland AI, use artificial intelligence to interact with customers over the phone in a human-like manner. Because they’re dynamic, they can hold conversations about any topic, sometimes even better than a human.

Bland AI creates a layer of conversational awareness that manages the interplay between the following three models:

- A transcription model that listens to audio and converts it to text.

- A language model that decides how to reply.

- A text-to-speech model that converts the language model’s response into human voice.

Using conversational AI tools, like Bland AI, creates an inbound phone number that enables businesses to answer every call. This means that small enterprises can capture every single dollar and drive more purchases. Companies must provide AI with all necessary information to enable tasks like making purchases and updating hours.

Text Messages

A text message offers a dependable means of communication, as it provides written documentation of the exchange that can be referenced at any time. “If you get into an adversarial situation, you can always pull the text messages out and use them in court,” said Jason Mott, CCE, NACM Board director and corporate credit manager at MFA Incorporated (Columbia, MO). “Whereas, if we got into a disagreement over the phone or Teams without recording it, it would be your word against mine.”

However, text messages can be misinterpreted easily and may be viewed as unprofessional. “The main disadvantage of not speaking to someone verbally is the difficulty in conveying tone,” Mott said. “What you intend to say can be interpreted very differently by the receiver. But if you’re not getting anywhere, sometimes it’s best to call or have a conversation face-to-face with the customer to help avoid potential misunderstandings.”

Some credit professionals find that texting is more effective for the customers they have a close relationship with. Even so, if they aren’t answering their email or phone call, they’re unlikely to respond to a text. “My industry has a selective, busy dealer base often away from their computers, so a quick text for them to call me or a payment reminder can be effective,” said Terri Eggebeen, manager, credit and collections at Fechheimer Brothers Company (Cincinnati, OH). “But texting is blocked for customers who don’t respond to calls or emails, even if you have their cell number.”

WhatsApp Messaging

Another form of customer communication is WhatsApp, a free messaging app that allows users to send messages, make voice and video calls and share media across platforms, particularly used among Latin American countries.

Not only is WhatsApp convenient, but it is also available 24/7, serving a region with high mobile phone use. “The communication is encrypted, so most businesses, including banks, offer products, services and customer support through the app,” said Alfredo Puerta, CICP, director of credit Latin America at Osterman & Company, Inc. (Cheshire, CT). “In addition, you can use the app on your PC to share and download documents directly from your workstation. That level of flexibility is not available with a regular landline phone call.”

Using WhatsApp reduces person-to-person interaction and may pose security risks. While in-app communication is encrypted, clicking external links can expose your personal and business information to breaches. To mitigate risk, ask for the customer’s consent before using WhatsApp as a form of contact. “Usually, the customer provides his personal or company number to communicate through the app or authorizes a seller to share the number, and I believe that is important because you do not want to send unsolicited information to a private number,” Puerta said.

Postal Service

The postal service uniquely delivers tangible messages, adding a formality unmatched by other methods. “If they still don’t respond, we send a formal demand letter by UPS overnight,” Eggebeen said. “This usually gets their attention and shows the severity of the situation.”

Managing postal services can be challenging due to slower delivery times, higher postage costs, limited tracking and potential delays or losses. International customers add complexity with varying cultural norms and country-specific risks causing further delays.

In-Person vs Virtual Customer Visits

In-person customer visits have been essential to credit management for gathering information, collecting payments and building relationships. However, technological advances and the global pandemic have shifted these interactions online. As older generations retire, younger professionals are increasingly using Zoom and Microsoft Teams for both internal and client communications.

By the numbers: Last year, an eNews poll revealed that more than half (63%) of credit professionals no longer conducted customer visits as part of their credit investigation. But for the 37% of credit professionals who still visited customers face-to-face, the value gained is unmatched.

One reason is that virtual meetings save time and are far more cost-effective than in-person meetings. “We recently had a Teams call with a customer and our sales team to sync up the needs of both companies,” Faller said. “If we had held the meeting in person at our San Diego office, two of us would have been out of the office all day.”

Exchanges with customers over Zoom and Teams are more fluid with the ability to share your screen. “You can show details such as customer disputes and settlements followed up with a subsequent email sent to sum up what was talked about,” said Cecilia Cassella, CCE, senior finance manager, A/R at Glenmark Pharmaceuticals Inc. (Mahwah, NJ).

In-person customer visits are typically reserved for critical situations, such as the collection of outstanding payments or conducting thorough investigations concerning a customer. “It’s if the account is in danger of being placed on COD or pursuing legal action and you must develop a strategic plan,” Levie said.

But face-to-face interactions prove effective for authentic relationship-building. “Our credit manager will visit customers at their worksites to see how business is going,” said Levie. “This helps us learn more about the customer, catch on to their body language and get a feel for their character. A disadvantage is that many people do not enjoy in-person meetings, or they have to constantly get rescheduled.”

Customer Portals

Another communication method for credit professionals is customer portals, which allow customers to submit inquiries, request support and provide feedback. “Some customers have website portals where we can view the status of payments,” Cassella said. “If available, then no further communication is needed. Only when it’s not, then we go through the route explained above.”

With the generational change and the advent of AI technology, more business communications and document fulfillment requests will be electronically generated and processed. “The majority of our invoices and statements are emailed to customers, and customers can text our branches with order requests or stock checks,” Faller said. “We send out electronic courtesy notices (past-due statements) on the third week of every month along with an informational insert, so we don’t have to call hundreds of past-due accounts, especially with small balances.”

The bottom line: Adapting to the preferred communication methods of your credit team and customers can enhance efficiency, build stronger relationships and improve overall credit management practices.