Business Practices, eNews

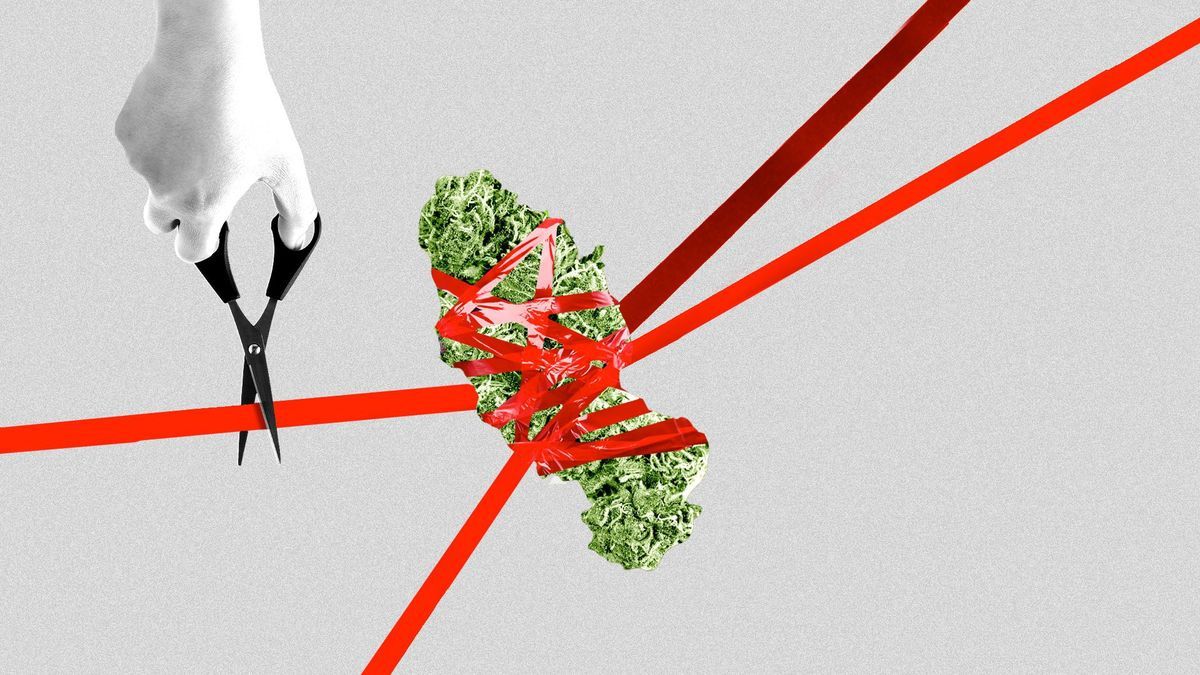

Credit management in the cannabis industry

Since Colorado first legalized medical cannabis in 1996, more than half of the U.S. has legalized marijuana for recreational use today. But possession and distribution or sale remains illegal under federal law—meaning any money that can be traced back to state cannabis operations could expose banks to significant regulatory risk.

Why it matters: Understanding the implications of liability is key for everyone in states where marijuana is legalized and for those conducting business with companies in these states. For credit professionals, there are many questions regarding how or if you should engage with customers in the cannabis or agricultural industries where marijuana is grown. This decision depends on many factors.

As more states decriminalize weed or make it acceptable for medical purposes, the substance may be headed to reclassification on the federal level. Marijuana was previously classified as a schedule I drug, defined as drugs with no accepted medical use and a high potential for abuse. However, federal law is looking to move marijuana to a schedule III drug, which is defined as drugs with moderate to low potential for physical and psychological dependence.

What they’re saying: “It won’t open up the floodgates on the recreational use, but once it is rescheduled from one to a three and is regulated, I think that’s going to really blow the doors wide open on the medical marijuana industry,” said Karen Hart, Esq., attorney partner at Bell Nunnally & Martin LLP (Dallas, TX). “The tension comes from the states being able to legalize it in different forms. It’s what makes the broad-brush development of the industry from a national level and causes issues of not having a national based business unless it’s legalized across the board.”

Similarly to the prohibition era in the U.S. from 1920 to 1933 that prevented the manufacture, sale and transportation of alcoholic beverages in the U.S. under the 18th amendment—although it was a federal law, bootlegging (the illegal production and sale of liquor) and speakeasies were vastly common across the U.S.

“It took time for all of our cultural attitudes towards alcohol to shift, but one by one, each state began doing away with pro statewide prohibitions on alcohol and most states would leave it up to county by county or municipal,” Hart said. “In terms of marijuana, it is kind of the same thing. I think we will see a similar progression once there is an industry-wide sense of stability, so if we decide to do that as a country to de-schedule it altogether, then that will open up the market even further.”

Yes, but: Not being regulated on a federal level means many businesses in the cannabis industry are not included in taxes because deductions cannot be made for illegal operations. This has a significant impact on the overall business climate across the U.S. as cannabis businesses operate in cash only.

However, the Safe Banking Act, or the Secure and Fair Enforcement Banking Act of 2023, was a key piece of legislation designed to bridge the gap between state-legalized cannabis industries and the federal banking system. The Act protects both banks and credit unions from facing legal penalties by federal bank regulators that provide services to cannabis-related businesses. The Act also prevents the limitation of deposits and protects banking institutions from asset losses related to cannabis business transactions.

“Most banks are federally regulated under the FDIC and there are a few banks that are governed by state regulations,” said Jason Mott, CCE, NACM Board director and corporate credit manager at MFA Incorporated (Columbia, MO). “Credit unions are governed by federal credit union acts and those institutions have to abide by federal law. This means they cannot accept any deposits from sales that result as part of the cannabis.”

The biggest current risk for credit professionals lies in customer stability. If federal laws allow, companies will have more access to finance tools that are not currently available. Because there is no prior information for credit managers to reference with customers in the cannabis industry, it creates a higher risk for determining creditworthiness.

“There hasn’t been a bank for traditional lending that credit managers could look back on and call for references,” said Mott. “I think it’s something that we as a company are going to look into because as of July of 2023, the governor of the state of Missouri signed a bill that allows cannabis businesses to access banking services. I would still say the banking industry overall is still wary of marijuana and cannabis simply because of its prohibitions on a federal level.”

The bottom line: The evolving legal status of cannabis across states presents a complex landscape for credit professionals. However, learning to navigate all potential risk due to federal law discrepancies in the cannabis industry is essential.

What’s next: For more information, be sure to attend session 33027. Cannabis Law Update: Where We are Now, How We Got Here and Where We are Headed at Credit Congress on Monday, June 10!