Jan 30, 2025

eNews

Tame today’s workloads with time management skills

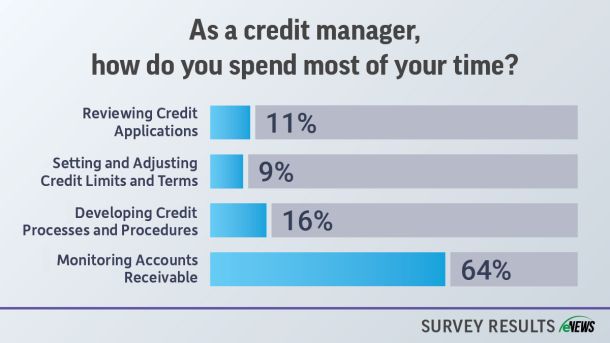

Time management can be tricky when your day-to-day work feels unpredictable. Credit managers know how easy it is to get so wrapped up in a single task that their entire to-do list slips their mind. Whether you carefully schedule out every second of your workday or keep a tentative list of tasks that need completion, it can be hard to organize your time as a credit manager because there is so much to do.