Sep 11, 2024

eNews

Mixed success for small business Subchapter V bankruptcies

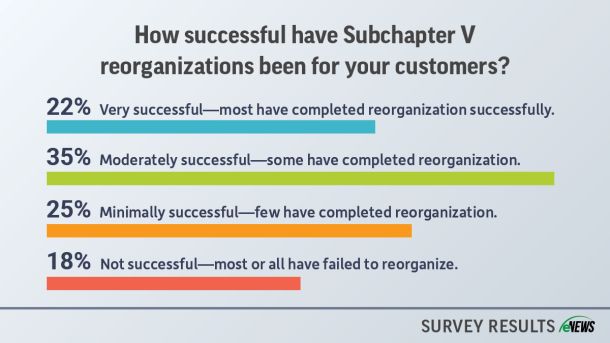

In the four years since Congress amended the bankruptcy code to assist small business reorganizations, credit managers still have mixed opinions on the success of these filings.