eNews

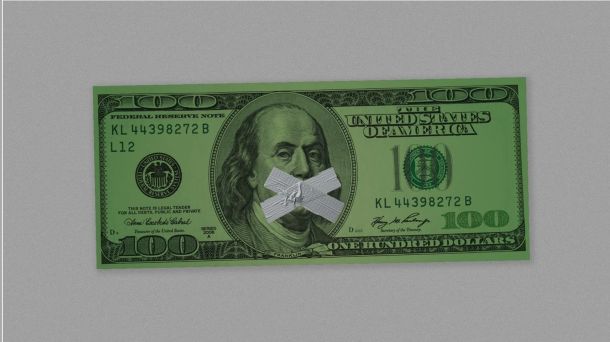

Cybersecurity has emerged as a critical component of credit management, earning its place as the unofficial sixth ‘C’ in the traditional five Cs of credit (Character, Capacity, Capital, Conditions and Collateral). As businesses increasingly rely on digital platforms for transactions, data storage and communication, the risk of cyber threats has escalated, making it essential for credit professionals to prioritize cybersecurity in their risk assessments.

Why it matters: Factoring in the risk cybersecurity poses in credit decisions is no longer a choice but a necessity to safeguard sen…