eNews

Credit tightrope: Balancing trust and risk with marginal customers

Not every customer has a perfect credit score or strong balance sheet, but that doesn’t mean they aren’t worth doing business with. Marginal customers often stand in a gray area: high potential, but higher risk. The challenge is to identify whether open, unsecured credit can be extended to a marginal customer or whether other tools must be used to create guardrails around the transaction.

Why it matters: Customers don’t become marginal overnight. It often happens gradually due to changing circumstances, financial stress or business instability. By knowing their customers, and using the right strategies, credit professionals can manage both short- and long-term risk while still supporting viable customers.

What is considered a marginal customer?

That depends on the credit manager, their business and their industry. Generally, a marginal customer is defined as one who presents a higher credit or payment risk due to limited financial history, poor credit or low capacity to pay but is still considered for business based on character, opportunity or necessity.

“For me, marginal accounts fall into two categories. One is a customer of high character but isn’t sitting on a pile of cash—they’re just trying to get from one job to the next, make money and earn a living,” said Lisa Moran, corporate credit and collections manager at Crescent Electric Supply Company (Bloomington, IL). “Then there’s the other type, which is a customer who comes up with all kinds of disputes on the back end of a job. In my experience, they’re much harder to work with.”

It may seem risky to work with a marginal customer, but with the right approach, it can pay off in the long run—both financially and relationally. “It’s important to keep in mind that the economy has a major impact on the liquidity of many customers,” Moran said. “Hearing them out and providing good service fosters a sense of loyalty and they will be more likely to follow through on their financial obligations.”

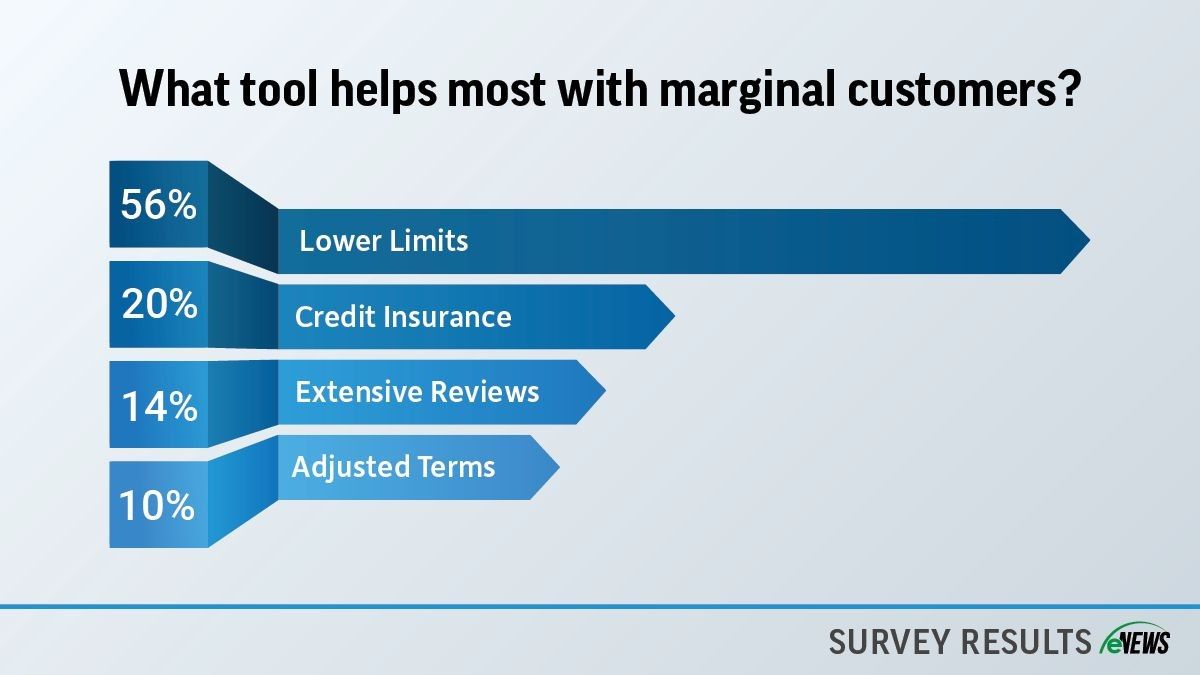

A recent eNews poll revealed that 56% of credit professionals extend credit, but with lower limits, while 14% conduct extensive reviews when managing marginal accounts. Of the remaining respondents, 20% indicated that using credit insurance has been helpful, and 10% reported that adjusting payment terms is an effective strategy.

Extensive reviews allow credit managers to get a sense of the customer’s financial standing and discover what may have caused their financial troubles. “Whether it’s a new customer or an existing customer, I want a completed credit application,” said Moran. “Depending on the dollar amount requested, I ask for bank statements because a banking reference alone can’t tell you if the customer is serious about doing business. I also check all their references and do a Google search on them to verify their company address and see where they live. I also look them up on LinkedIn.”

If a customer isn’t willing to provide information or financials, speaking to the sales team can help reveal the missing information. “A customer may open up more to the sales VP, especially if the issue lies with the general contractor or owner,” said Lorraine Pigott, credit manager at Baldwin Paving Co., Inc. (Marietta, GA). Speaking to other credit professionals can also help uncover a customer’s financial situation. “If you’re involved in an association like NACM, you can find credit professionals in your industry who can help you.”

Lowering credit limits is a popular mitigation tool. “For new ‘marginal’ customers, I start them off with a low limit, and for existing customers who become marginal for any number of reasons, I will temporarily lower the limit,” said Mark Micelli, credit manager at Builders Products, Inc. (Houston, TX). “Even if a customer has great credit, I’ll sometimes lower their limit if I suspect short-term issues and allow certain accounts to pay very slowly. Overall, temporarily or permanently adjusting limits helps reduce exposure and keeps small issues from becoming bigger problems.”

Adjusting payment terms is a favorable way to ensure timely payment from marginal customers. “Once you know your client and the reasoning behind their financial difficulties, you can adjust terms either through a payment plan or accommodating more than 30 days, if necessary, within reason,” said Glen Eichelberger, director of credit and AR at Total Apartment Solutions (Dallas, TX). “Most importantly, being in communication with customers helps us understand their circumstances and whether we should allow for extended payment terms.”

For some credit professionals, streamlining the payment process through Automated Clearing House (ACH) or wire transfer can ensure prompt payment. “These options allow us to receive payment either the day of or within a couple of days as opposed to having it mailed or delivered by someone from the company,” Pigott said. “At a certain point in time, we’ll ask for payment or give them a friendly courtesy call to say, ‘Hey, your payment’s due next week or within so many days.’”

Ultimately, keeping a close eye on marginal accounts will help you make the best decision on how to proceed. “We also monitor the account more frequently and make sure to get complete job information upfront on those marginal accounts,” Pigott said. “We monitor how they are paying other creditors and if their payment behavior changes like if they stop paying other creditors. In that case, I contact the customer directly to figure out how they plan to pay our company.”

The bottom line: Marginal accounts may carry significant risk but when managed effectively, the potential rewards can far outweigh the risk. “Achieving a sense of openness and trust usually allows the account to continue operating reasonably, which builds goodwill and keeps payments coming,” said Eichelberger.