Economy, eNews

The U.S.-China trade war and what it means for credit managers

Tariffs have long been a tool of international trade policy, used by countries to influence economic relationships and protect domestic industries. However, they can also result in higher prices for consumers and provoke retaliation from other nations—actions that may weaken exports and slow economic growth. When countries impose tariffs or other trade barriers on one another, it can escalate into what is known as a trade war.

A clear example of this is the current trade dispute between the United States and China. Amid escalating trade tensions, U.S. President Donald Trump initially imposed a 10% tariff on all imports from China and Hong Kong. The rate was soon doubled to 20%, marking a major increase in trade tensions. In response, tariffs on Chinese goods surged as high as 145%, prompting a retaliatory move from Beijing, which imposed a 125% tax on American products.

Why it matters: The evolving U.S.-China trade war has sparked uncertainty across global economies by disrupting supply chains and causing payment delays.

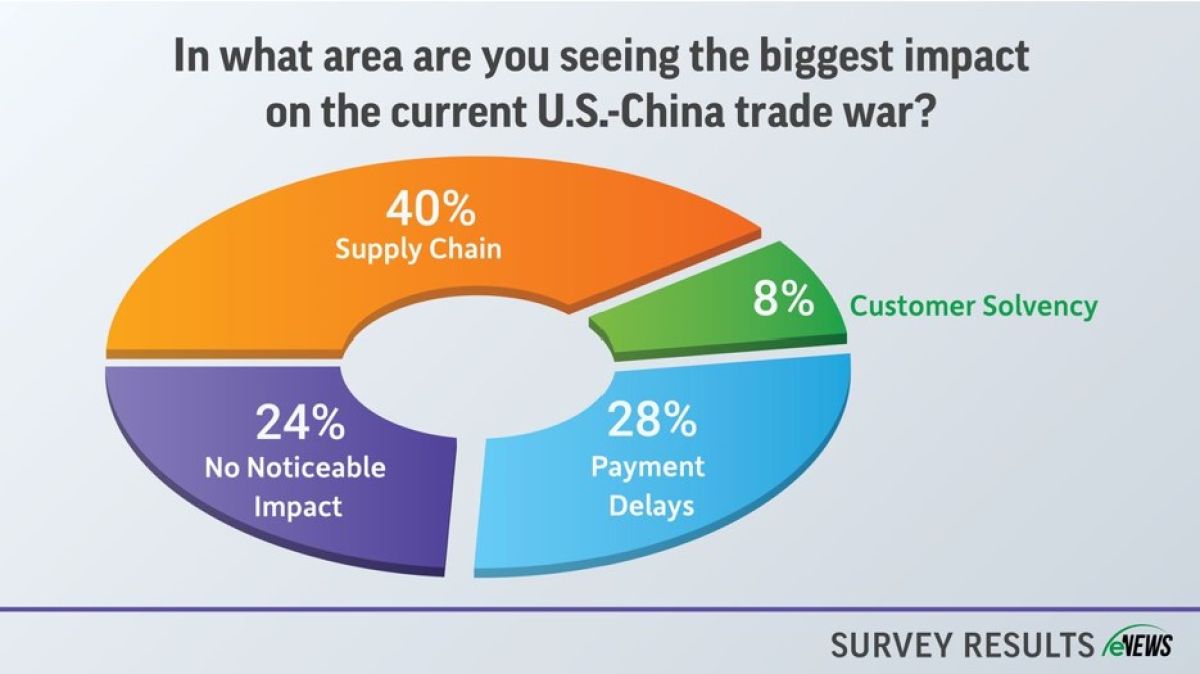

In a recent eNews poll, 40% of credit professionals say the trade war is significantly impacting supply chains. Rising shipping costs, particularly from China, have led to reduced shipments, potential product shortages and higher consumer prices. On April 17, the Office of the United States Trade Representative (USTR) stated that it will begin charging fees on Chinese shipping companies and other shipping firms that have China-made vessels in their fleets, beginning in 180 days.

To offset these pressures, customers are exploring negotiations with manufacturers and even considering relocating supply chains—an option that is both expensive and logistically challenging. “We recently had a customer cancel an $8 million contract for a single load of oil products,” said Esther Hale, ICCE, senior analyst and treasury-global credit at Phillips 66 Company (Bartlesville, OK). “They then attempted to find another buyer. It made sense—the customer couldn’t afford to import the goods and pay the invoice once the tariff was applied.”

Additionally, 28% of credit professionals reported an increase in payment delays, while 8% observed a rise in customer insolvency. Customers reliant on China for key inputs and imports, yet dependent on strong economic ties with the U.S., are among the most affected. “A lot of the products we sell are supplied from China, so whenever tariffs are added, that cost is passed down to our customers who are already struggling to keep their services affordable,” said Matthias Montgomery, accelerated credit associate at Ferguson Enterprises (Seattle, WA). “This also affects how we produce goods. The natural response to these fees is to consider manufacturing within the U.S. but making that shift quickly is difficult given the current political climate.”

To stay ahead of potential disruptions, customers are placing larger orders in advance. “Even if shipments are scheduled for later, they want to ensure their inventory is on track before these changes begin to significantly impact their operations,” Montgomery said. “This is especially important for our small- to mid-sized customers who are working hard to keep costs low for their own clients.”

Although some credit professionals haven’t experienced a significant impact yet, many are staying vigilant and preparing for future challenges. “We are noticing that importers are holding back, waiting to see how the situation unfolds,” said Tim Bastian, ICCE, senior director of corporate risk at Western Oilfields Supply Company dba Rain for Rent (Bakersfield, CA). “In Q1, there was a notable surge in early ordering in anticipation of these changes. As that inventory moves through the system and inbound shipments decline, we could start seeing shortages. Given that we’re an equipment rental company, we can curtail large purchases for a period without major impacts.”

Amid the challenges of the escalating U.S.-China trade war, it’s important to recognize the opportunities that have emerged for credit professionals. “One major positive is that we’re purchasing more U.S.-based businesses—particularly from smaller manufacturing companies,” Montgomery said. “It makes a lot of sense for us to acquire companies that are already successful in producing goods domestically since they’ve already onboarded their teams and have solid operational processes in place.”

Several credit professionals have adjusted their shipping schedules and patterns to address supply chain disruptions. “We’ve had to purchase more products up front to help navigate around upcoming tariffs and trade restrictions,” Montgomery said. “As a result, we’ve been holding more inventory—which, in our case, has been a positive because we’re turning it over quickly.”

What’s next: The U.S.-China trade war may be on the verge of de-escalation after it was reported on Wednesday that China had quietly compiled a list of U.S.-made goods exempt from its 125% tariffs, aiming to ease trade tensions without public concessions. Companies that rely on U.S. technologies, such as pharmaceutical firms and chipmakers, are being discreetly informed about these exemptions.

“The quiet approach allows Beijing, which has repeatedly said it is willing to fight till the end unless the U.S. lifts its 145% tariffs, to maintain its public messaging while privately taking practical steps to provide concessions,” reads a Reuters article.

Trump said on Tuesday he believes a trade deal with China is within reach, adding, “But it’s going to be a fair deal.” China’s commerce and customs ministries have yet to respond to requests for comment.

The bottom line: While the U.S.–China trade war has complicated global trade and risk management, credit professionals can also find new growth opportunities and refine their operations. Staying alert, being proactive and increasing communication with customers, stakeholders and other credit professionals can help mitigate future risks.