Business Practices, eNews

Controlling email overload for credit managers

As a credit manager, you’re no stranger to a thoroughly filled email inbox. Whether it’s an email from customers, team members or new credit applications, it can be hard to stay on top of all of it and even harder to keep it organized.

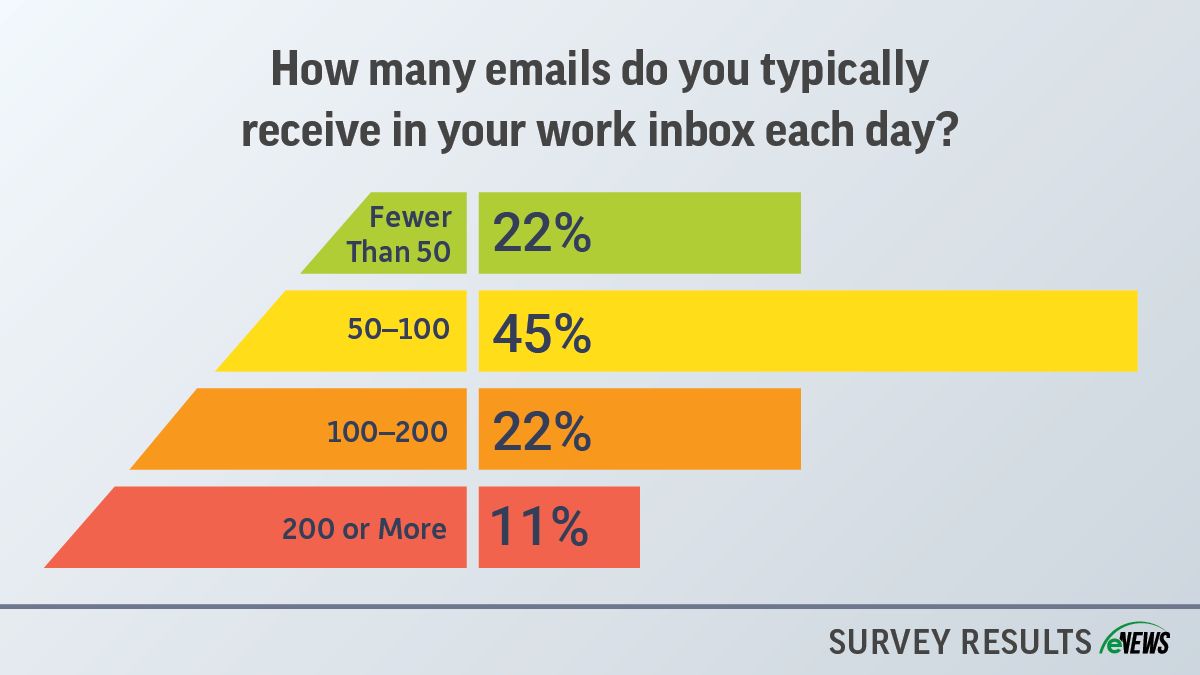

Why it matters: Credit managers receive tons of emails every day. According to recent eNews poll, 22% of credit managers receive between 100 and 200 emails a day and 11% report receiving over 200. The mountain of emails each day can be overwhelming, which is why credit managers have developed a few tricks to help keep their inbox in order.

For a lot of credit managers, inbox organization hinges on creating rules. For Outlook, right clicking an email and choosing to “create rule” allows you to automatically sort emails based on what the subject line contains. Doing so will create a folder of this email and others like it, for you to check periodically.

“Assess the type of emails and categorize them,” said Sherry Bushman, director of credit and collections at Esperer Holdings Inc. (Santa Barbara, CA). “Create folders that match that category and create an auto rule.”

It’s important to not just organize your emails, but to also set aside time to review your various folders to ensure nothing important has slipped your attention. Flagging important emails and using conditional formatting might help certain important but not urgent emails stand out a bit more when you’re checking your inbox.

“If after reading the email you find that it’s not urgent, flag it to follow up at a later date and time,” said Lori Thomas, credit manager at Golden Technologies, Inc. (Old Forge, PA). “You can also use conditional formatting to highlight certain words in an email or specific people the emails are from to make them stand out to catch your attention.”

Conditional formatting is another way to bring a bit of order to the most chaotic inbox. Maybe you want to automatically show emails from your higher-ups in red text or have emails with the word “meeting” in the subject line appear in pink text. These rules are easily made in Outlook’s settings under “Conditional Formatting.” Once you set the rule, it will apply to all emails, existing and new, that fit the description set.

While organizational hacks can make a world of difference to a messy inbox, it always helps to have a few practices within your office to help manage emails, whether that means redirecting customers when their problem is better suited for another department or just simple email etiquette.

Terri Eggebeen, manager of credit and collections for Fechheimer Brothers Company, (Cincinnati, OH), finds that it is important to be responsive and helpful to customers who have reached out to you, even when their email feels like one more message in your overflowing inbox.

“Always be polite, always offer to help,” Eggebeen said. “You never know how many times a customer has tried to get an issue resolved before the invoices went past due. Not every customer is a debtor. You may be the last stop in their frustration that leads them to a competitor. Be willing to get involved in clearing the issue not just say that’s XYZ’s responsibility.”

When redirecting the email to a department more adept at handling the matter, Eggebeen says to keep the customer looped in by copying them on your email. This simple act lets the customer feel less stranded as they try to resolve their problems.

“The credit and collections department doesn’t have to always be known as the pit bulls we can and sometimes have to be,” Eggebeen said. “Many times, it’s these actions that help bring in new sales and puts your company at the top of a customer’s want to pay list when they are struggling.”

For credit managers who feel inundated with all the emails stacking up in their inbox, it is important to remember that you are one person in a larger team. Regardless of how organized your inbox is, it can still feel like too much at times, so it’s important to remember you can delegate to the others on your team.

“If after reading the email you see that it’s something another team member can handle, pass it on,” Thomas said. “Do not feel that you have to personally handle every email you are sent. Most people send it to you as they don’t know who else can handle their request. There are days I feel like the accounting help desk.”

For those new to management positions, delegating these tasks can be key to helping those on your staff grow. Don’t be afraid to lean on your team when your workload feels unmanageable. Even with the most organized inbox, you still might need to ask for help sometimes.

The bottom line: To manage the overwhelming influx of emails, credit managers can use organizational strategies such as creating rules in Outlook, categorizing emails into folders, using conditional formatting and delegating tasks to team members.