eNews

Talking credit without crossing legal boundaries

Credit professionals handle confidential information day-in and day-out as they manage customers and work to mitigate risk. While confidentiality comes with the job, it is critical that credit managers understand what can and cannot be shared with those outside the credit department, whether they’re talking to a member of their sales team or a credit manager from another company.

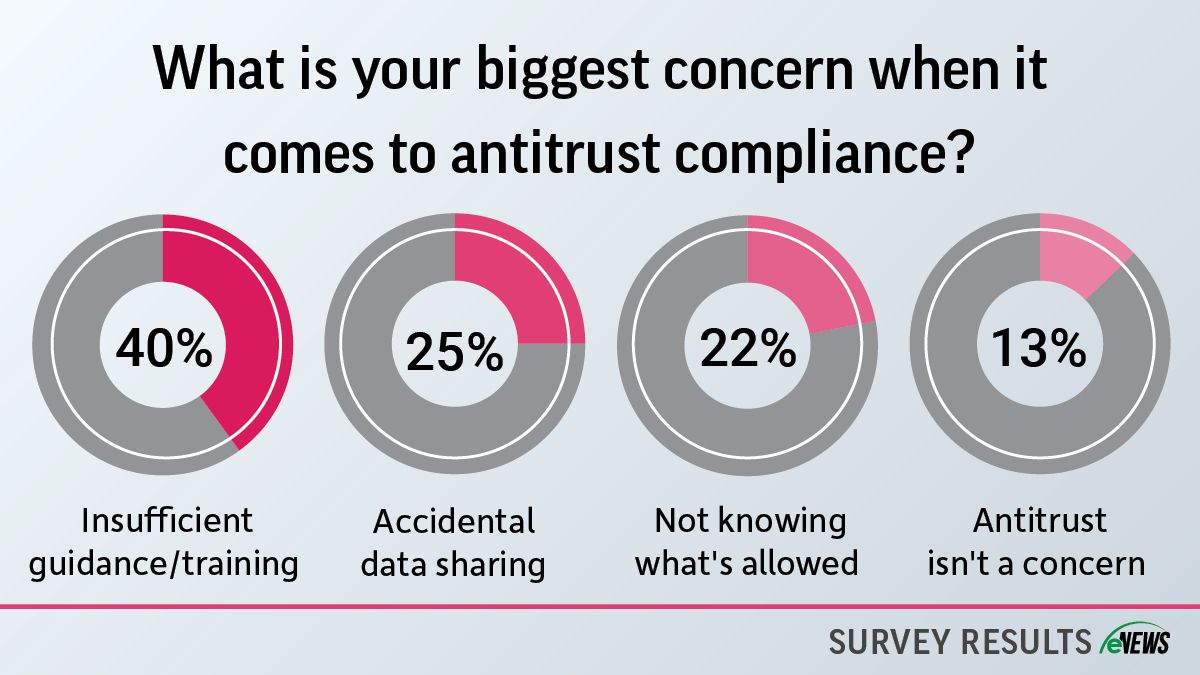

Why it matters: Antitrust laws protect businesses by allowing fair competition and preventing any one group from forming a monopoly. These laws inscribe a strict standard for how credit managers can discuss customers with other credit managers, with clear boundaries between a productive conversation and collusion.

There are three major federal antitrust statutes:

- Robinson-Patman Act, which makes it unlawful to discriminate with price and to fix prices. Credit terms fall under this law, as terms are a function of price.

- The Sherman Act, which prohibits the restraint of trade and conspiracy to create a monopoly within an industry.

- The Federal Trade Commission Act, which provides enforcement authority for antitrust violations to the Federal Trade Commission.

Credit managers do not need to forgo conversations with other credit managers outside their department to uphold antitrust standards; they simply must be aware of what they can and cannot say about their customers. Credit managers can share factual, historical information on their customers, but they cannot discuss future actions or give advice to other credit managers on how they should treat their customers. Furthermore, any discussion on the terms offered to a customer is a violation of antitrust laws because terms are a function of price.

“Whether in a meeting or in conversation with a competitor sharing information on a customer, a credit manager must provide only factual information on completed transactions,” said Wanda Borges, Esq., member and shareholder at Borges & Associates LLC (Syosset, NY). “There must be no discussion as to what the credit manager is thinking of doing or planning to do. The information can only be comments like ‘this customer pays within terms,’ or ‘this customer is delinquent’ or ‘we have instituted suit against this customer.’”

When it comes to conversations within their company or with fellow credit professionals, having internal credit policies related to antitrust can help uphold confidentiality standards. “All credit departments should have a written policy that follows all antitrust guidelines that is followed and enforced,” said Rocky Thomas, CCE, CICP, president of NACM Southeast (Duluth, GA). “This should specifically include all actions that involve the exchange of credit information, how credit decisions are made and restrictions on what information is shared internally and externally within the organization.”

The credit department handles lots of sensitive information, from financial statements to credit reports to payment history. While credit works with sales when managing customers, there is a clear boundary on what can be shared between departments as information is shared for the credit purposes only.

“Information gathered in credit reports, financial statements or payment history must only be shared with the credit department personnel who need to have that information,” Borges said. “As a general rule, none of this information should be shared with the sales personnel, except in the circumstance where sales and credit are combined and work together as a credit team. Under no circumstances, should any of this information be shared with the customer.”

By creating credit processes and procedures with confidentiality and antitrust standards in mind, credit professionals can ensure that there is a company-wide understanding of what information can or cannot be shared outside the credit department. Additionally, credit departments can create policies that prevent sensitive information from being shared internally, while carving out exceptions for less sensitive information, like payment history or credit status, to ensure that the sales team is still informed on their customer.

With a full understanding of antitrust laws, credit managers can approach conversations with credit professionals outside their company with ease as they find a balance between discussing shared industry and customer information without crossing legal lines. NACM Affiliate industry credit groups are an excellent example of this balance, as Certified Group Administrators facilitate discussions and carefully monitor the conversation to ensure that participants heed antitrust guidelines.

“We read the antitrust statement at every meeting and make sure members are aware of antitrust laws,” said Themis Vlahos, CCE, CGA, director of group services for NACM Connect (Hoffman Estates, IL). “We’re a third party; we make sure that the antitrust laws are followed. Our members should feel comfortable in this space and they shouldn’t have to worry about legal ramifications because we are here to guide the conversation. In addition to reviewing the statement, our group members also have a refresher course on antitrust with an attorney every two years.”

Group administrators set clear standards for conversation, allowing members to feel safe sharing their experiences as they convene with their industry peers. “Every conversation we have is strictly confidential,” said Claudia Barragan, CGA, assistant manager of customer care and collections for NACM Business Credit Services (Burien, WA). “We stick to the facts and focus on everyone’s credit experience without discussing pricing, terms or strategies.”

Members typically have no trouble staying within legal boundaries, but group administrators are there nonetheless to stop any conversations that seem to head toward dangerous territory. “My rule is I will ask a member to either stop saying what they’re saying or say ‘let’s move on’ if the discussion becomes too negative,” said Vlahos. “If we have to, I will say ‘let’s take a break.’ We can always end the meeting entirely, but in all my 23 years of facilitating credit group conversations I’ve never had to do that because our members know what they can’t say.”

The bottom line: Conversations with other credit professionals, whether it’s within industry credit groups or not, help credit managers build and refine their credit practices. To have these conversations, credit managers must heed antitrust laws and ensure that confidential information is treated as such. Rather than avoid discussions of credit out of fear of violating these laws, credit managers should learn how they can talk about their work without crossing legal boundaries.