Strategic Global Intelligence Brief for July 3, 2019

Short Items of Interest—U.S. Economy

Jobless Claims Fall

The employment picture is complicated these days. The fact is there are far more jobs available than there are people to fill them. The unemployed person today is either wholly without skills or is in the wrong place at the wrong time. The business community has been struggling for some time to find the people needed. Once they find them, they are very reluctant to lose them. The result has been a very low level of job turnover. There are just not a lot of layoffs and that has reduced the number of people filing claims for unemployment. Another sign of a tight labor market has been the rise in the number of people willing to simply quit their jobs without an assurance of a replacement—the so-called quit rate. It is at a high not seen since the end of the recession in 2010.

Trade Gap Widens Dramatically

There have certainly been efforts to deal with the persistent trade deficits. The Trump administration has tried to impose tariffs on almost every trade partner the U.S. has and there have been threats of more. Thus far, these efforts have not accomplished much. The fact is consumers buy lots and lots of stuff from other nations and likely always will. The trade and tariff wars may alter which nations sell to the U.S., but the demand for those imports remains strong. China loses market share in the U.S., but Vietnam gains. The U.S. buys less from Japan and more from South Korea. Making a difference in this kind of deficit will have to rely on expanded exports. Right now, that pace is far slower than the pace of imports.

A Word from a Hawk

Loretta Mester is the head of the Cleveland Fed and will be a voting member of the Federal Open Market Committee (FOMC) next year. She is the former head of research for the Philadelphia Fed and a disciple of the former head of the Philly Fed—Charles Plosser. He was long one of the most hawkish members of the Fed; Mester has continued the tradition. She remains unconvinced that lowering rates will accomplish much although she no longer suggests that rates need to come up anytime soon. Her position is that rates are so low as to not matter much—the same position that has been taken by the current hawk on the FOMC—Esther George of the Kansas City Fed.

Short Items of Interest—Global Economy

Drop in Turkish Inflation

The rate of inflation in Turkey remains high, but it has fallen from the peaks reached late in 2018. It is now sitting at 15.7% as opposed to 24% less than seven months ago. The rampant growth of inflation was a reaction to everything from political turmoil to economic crisis brought on by Middle East tension and the challenges facing Europe. As the rate is still high, there remains deep concern over what the leadership of Erdogan looks like after his significant political losses. There is speculation the central bank will be able to reduce interest rates now that inflation seems to be waning a little.

India and the Monsoons

The Indian capital of Mumbai has been hit by some of the worst flooding it has seen in decades. This is just the latest set of weather-related issues to beset India this year. There have been droughts followed by intense rains and unrelenting heat. It has taken its toll on the farm community, but also the urban infrastructure as the power grid has been overwhelmed. The government of Narendra Modi has been hit with this major crisis just as it begins its second term.

Another Surprise Choice in Europe

The selection if Cristine Lagarde as the head of the ECB was a shock, but the elevation of the German Defense Minister to the post of European Commission head was a bigger one. Ursula von der Leyen has been described by those in her own party as the weakest of the Cabinet members, has been disliked by the generals and has few supporters—other than German Chancellor Angela Merkel, and this says it all.

Surprise Move in European Leadership Struggle

Very few analysts had any inkling that Cristine Lagarde was a consideration in the race to replace Mario Draghi as head of the European Central Bank (ECB). Even fewer thought she would be interested in leaving her position as the head of the International Monetary Fund (IMF). Her nomination has already accomplished two important things—it has rallied the bond markets as the expectation is that she will continue the ultra-loose monetary policies pursued by Draghi and her selection will have a ripple impact on who fills the other leadership posts. The odds-on favorite to take the ECB position had been Jens Weidmann of the German central bank, but he scared many investors with his hawkish views. He tried to calm critics with more supportive statements of late, but years of being a chief critic of Draghi and the ECB policies of stimulus were not easily ignored. There was a fear that he would end those bond-buying programs that had been used to bolster the EU. Lagarde has been consistently supportive of these and other programs designed to boost European growth.

Analysis: Bond yields move inversely to prices. With this announcement, there has been a spate of bond reductions that have swept through Europe and even affected the U.S. The assumption is that more stimulus is coming rather than less. The talk of an interest rate hike at some point to combat potential inflation has been utterly abandoned at this stage. The only issue is how much rates will be cut around the world and how soon. Germany's 10-year bond fell again to a negative 0.397% and the French 10-year also fell deeper into negative territory. Across the board in Europe, two-year bond yields are sub-zero. The expectation is Draghi will no longer feel constrained when it comes to adding to the stimulus effort as he will be confident that his strategy will continue once Lagarde is in place as his replacement.

Meanwhile, there is the ongoing battle between President Trump and the Federal Reserve. There are still assertions that Trump will fire or demote Fed Chief Jerome Powell, but it is clear this is not power Trump wields. That is the purview of Congress and there is no desire to pursue that course of action. The latest nominees to the Fed's Board are Judy Shelton and Christopher Waller. Shelton has been an ardent critic of the Fed for years and has compared its power to "Soviet-style leadership." She objects to the rate-setting system in place now and wants a more market-based approach and possibly a return to the gold standard. Her views are held as radically unorthodox by most in economic circles, but she has been an advisor to Trump since 2016. Waller is less known, but is currently the head of research at the St. Louis Fed and generally reflects the views of the St. Louis Fed head. James Bullard was the only voting member of the Open Market Committee who dissented at the last meeting and urged that interest rates be cut sooner than later.

Generally speaking, there has been a significant change in attitude among the world's central banks since the end of last year. The data at the end of 2018 was mostly positive with renewed growth in the U.S. dominating the thinking of most analysts. Europe was in the doldrums, but seemed ready to start growing and there were few real worries about what was happening in China. In the six months since all that relatively good news, there has been a steady drip of negative news and opinion. The growth in Europe never manifested and China began to falter demonstrably. The U.S. also showed signs of strain and the emerging markets were all reacting to this bad news as well. The mood of the bankers shifted fast and interest rate policy abruptly went from concerns about impending inflation to worries about a general economic slowdown. Now the banks are all talking about rate cuts, and sooner than later. The ECB is heading away from that hawkish position everyone assumed would be manifesting under Weidmann. The Bank of England and Bank of Japan are talking rate cuts and so are many of the second-tier central banks such as the Reserve Bank of India, Reserve Bank of Australia, Bank of Canada and so on. The Fed has not yet reached the conclusion that a rate cut is in order, but there is no talk of a hike at all. Most assume the Fed will cut rates before the summer is out, but will warn that going from 2.5% to 2.25% isn't going to change all that much. Investors have already assumed that rates will be generally down for the foreseeable future.

Five Economic Indicators to Keep an Eye On

This piece was originally written for the Kentucky Society of CPAs in advance of a talk I will be giving later this year. It seemed to have relevance to our other readers, so I apologize if the readers in Kentucky are feeling like they have seen this before.

Even the casual observer of the economy and business matters will be inundated with data on a daily basis—all purporting to provide some insight into what is going on in the local, regional, national and global economy. To be honest, most of this is only barely relevant as it usually applies to some very specific aspect of the economy. It will be of paramount importance to those in transportation to understand the implications of movement in the Baltic Dry Index, but most other businesspeople will be less engaged. Are there measures that can be counted upon to be reliable and generally relevant? It so happens that there are.

Some of the most commonly quoted measures are pretty vague and so general as to be unhelpful. Others are so broad they don't really provide much insight on a given business environment. The overall unemployment numbers tell us very little as they look at the entire nation. They obscure the fact that some states have lower rates than the national norm and other have higher rates. GDP growth is so broad as to provide no useful detail on what is growing in the economy and why. There are five measures that do provide insight on the economy as a whole. These are not specific to one industry or sector, so it is always important to pay attention to the specific numbers that pertain to one's own sector.

Analysis: The first of these is the Purchasing Managers' Index (PMI) published by the Institute for Supply Management. It takes advantage of the fact that every company has someone who procures the needed material to support the business and production. By noting the pace and extent of that purchasing, one can get a read on what is happening in manufacturing as well as services. The people responding to the survey are simply noting whether there was more or less purchasing taking place, so there is less temptation to finagle the numbers. The PMI also sports an easy-to-understand diffusion index where anything over 50 is expansion and anything under 50 suggests contraction. Over the last several months, the PMI has been trending lower than it was last year at this time. Beyond the PMI itself, there are several sub-indices that provide unique insights. There is a New Orders Index that tracks the most recent activity and thus has an orientation towards forecasting. There are export indicators and employment indicators—all derived from the data that comes from the PMI survey.

A similar index was created by the National Association of Credit Management using the same diffusion index. The Credit Managers' Index (CMI) looks at issues in the world of the credit manager—dollar collections, applications for credit, disputes, accounts out for collection, slow pays and the like. These issues often surface even before the purchasing managers make their decisions. Over the years, the index has been a good forecasting tool. As with the PMI, the numbers over 50 indicate expansion and numbers below 50 signal contraction. For the past year, the numbers that look at unfavorable factors (such as slow pays, disputes, bankruptcies, etc.) have been either in the very low 50s or the high 40s. The favorables (dollar collection, sales, applications for credit, etc.) have been either in the low 60s or the high 50s.

The third tool to pay attention to is the Job Opportunity and Labor Turnover Survey—the JOLTS report. This has several interesting aspects to it, but one stands out as a reliable and informative measure of the employment situation. There is a part of this that measures the willingness of people to quit their job without the guarantee of another one. When the quit rate is high, it suggests a very confident population—people willing to just leap into the labor pool with the confidence they will find a new position right away. The quit rate was at an all-time low during the recession of 2008-2009, but has since risen to a nearly 25-year high. The most consistent problem noted by employers today is a lack of needed workers. That has led to extensive poaching by companies that can't find the skills they need without raiding other employers. This has also stimulated the high rate of labor turnover.

The fourth of these useful measures is capacity utilization. The rule of thumb is that when industrial capacity numbers are between 80% and 85%, this is ideal. It signals manufacturers are efficiently using their machines and their personnel. When capacity numbers fall below 80%, it suggests there is slack and productivity will not be at peak. When the capacity number is beyond 85%, it signals there will likely be bottlenecks and shortages. It is when the capacity numbers are above 85 that business begins to think seriously about adding people and investing in new machinery as they strive to keep up with that new demand. For the last year, the capacity numbers have been close to the bottom end of normal, but have yet to break that 80% barrier. They have been between 76% and 78% for the majority of 2018 and 2019.

The last of these useful measures is the Transportation Activity Index (TAI)—a measure that was developed by Armada CI for one of our transportation clients. It is no surprise that an index which looks at the transport sector is predictive, as transportation has been referred to as the "canary in the coal mine" for years. The connection is simple enough—nothing happens in any sector until there is a delivery of some kind. Parts and raw materials need to be acquired and finished products need to make their way to wholesalers and retailers and ultimately to consumers. There is outbound activity spurred by exports and inbound activity spurred by imports. The TAI looks at all the modes of freight transport—ocean cargo, air cargo, trucking, rail, barge and anything else that is used to move these supplies. It also looks at some of the key inputs for transportation such as fuel prices and costs of equipment.

Looking at what moves the freight gives insights into the overall economy and even hints at what is growing. Air cargo comes into play when there are people willing to pay a premium for fast service, ocean cargo peaks as retailers start to get ready for the holiday season. The rail sector counts on coal and crops as their cash cow and there are different motivations for long-haul and small freight or less than load (LTL) trucking. Over the last year, the index has stabilized in the low 50s, but there are issues that have started to impact the rail sector.

These are certainly not the only measures that can provide guidance but these are reliable, applicable to a wide range of industries and have been produced for many years—allowing comparisons between what is happening now and what has taken place in years past.

Patriotism

It is amazing what a controversial and divisive topic this has become of late. It would seem simple enough to express pride in one's country and gratitude for the life we are lucky enough to lead. The fact is few of us would swap places with the vast majority of the world's population. Each year, this issue of patriotism looms large as we celebrate the 4th of July. To be honest, the majority of people are only tangentially interested in what this day signifies—it is mostly an opportunity to blow things up, have picnics, head to the pool or beach and generally just hang out with friends and family.

I think of patriotism the way I think of family. Just because I am related to these people doesn't mean I approve of everything they do and say. They certainly don't approve of everything about me. I am a fierce critic of some behavior and proud as I can be of others. Being a critic hardly means that I don't love them and treasure them. I see my relationship with my country the same way. I am often very proud of the U.S. and of being a citizen. Often, I am appalled at what happens in the name of my nation and I desperately want that behavior to change. In my family, people are outspoken and entitled to their opinions. I do not always agree, but will fight for their right to express these opinions. That is how I feel about my fellow Americans. In fact, that is one of the things I treasure the most about being in this nation—my right to express myself. After nearly two decades of writing this newsletter, it is pretty obvious that I have lots of opinions on most everything and am not shy about expressing them.

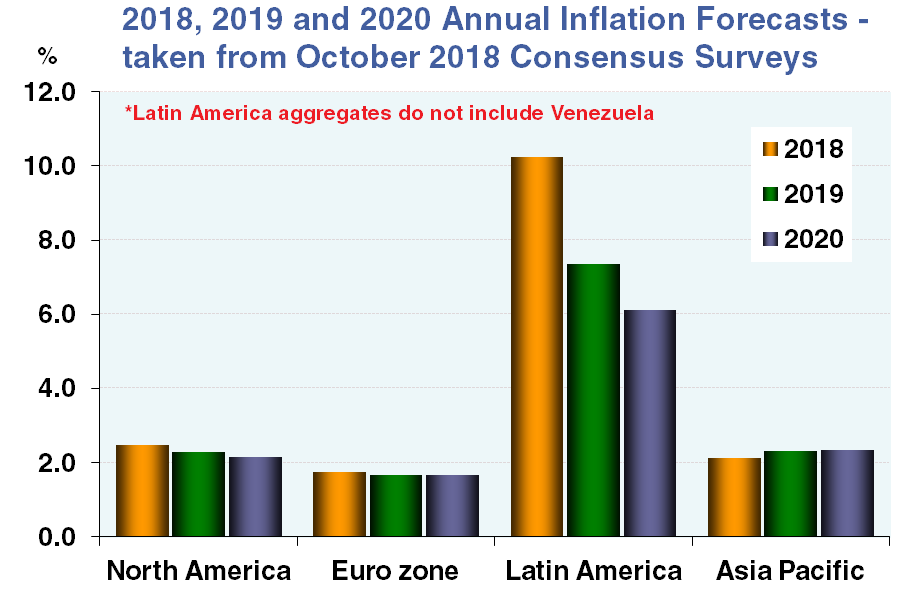

Annual Inflation Forecast

Inflation is not the only factor that moves central bank policy, but it is an important one. Every central bank has a dual mission of controlling inflation and promoting full employment, but in reality, the former is a lot easier to accomplish than the latter. To boost the economy, the central bank has only indirect tools—lowering rates with the hope that banks lend and business borrows. Getting control of inflation is hardly easy, but it is akin to yanking on a chain as opposed to pushing a string. Given that inflation globally has been falling and is expected to keep on falling, there is less pressure on central banks to yank on that chain.