Strategic Global Intelligence Brief for July 1, 2019

Short Items of Interest—U.S. Economy

Fed Reactions

Over the last several months, the Federal Reserve has repeatedly stated its one major concern as far as the U.S. economy was the potential damage from extended trade wars and tariff fights. This global battle would drag down world growth numbers, which would then affect the U.S. The possibility of a rapprochement between the U.S. and China has reduced the likelihood of a Fed rate reduction, but members of the Fed have been quick to point out little has changed as far as the corporate community is concerned. They still do not have any idea what to expect for trade and therefore will remain cautious. The assessment is rates will likely stay where they are, but if growth looks to be faltering, the possibility of a move is still there.

Boost from the Boomers

It really should not be a surprise given that the Boomer generation has long defied most of the traditional economic behavior of any given age. They spent more money, bought more houses, went into more debt and sparked more growth than any other cohort. They are now rewriting the rules when it comes to retirement. The majority of those that turn 65 are still retiring, but usually not for very long. A major percentage have decided not to retire at all. This willingness to stay on the job has helped with the labor shortage situation, but it also clogs the path to promotion for many Gen-X workers. If this pattern persists, it will require adjustments.

Looking Ahead to Friday's Job Numbers

Last month, the job numbers were as weak as they had been for the last few years—just 75,000 jobs added. There have been other months when that total fell, but these proved to be anomalies and numbers bounced back the next month. Will this be another month for a recovery or will there be a further decline? The betting is that numbers will still be lower than they have been, but slightly better than last month. There has been no sign of a major boost in business activity that would bolster job creation, but no sign of a business decline either.

Short Items of Interest—Global Economy

Oil Production by Russia and Saudi Arabia Will Stay Down

The decision on the part of the Russians and Saudis to reduce oil output was intended to be short-lived—a move designed to push prices back to levels that provided healthier profits. Both nations have indicated they will be continuing with this policy for a while longer although the impact on pricing has been far less than was expected. The fact is demand has been a little off and there has been abundant supply from countries like Canada and the U.S.—more than making up for the lack of oil from Russia and Saudi Arabia.

Bolsonaro Looks Powerless

The press and media in Brazil have taken to calling Jair Bolsonaro the "Queen of England." This is a reference to the fact that he appears to have power, but in reality, has none. He has been wholly unable to pass anything of import through the legislature and his executive powers are far more limited than in other nations. Brazil stripped the president of many powers as they dismantled the juntas that ran the nation for years. The legislature is dominant. It is one reason the nation can be so inefficient, but it is also the reason one person can't run roughshod over the country.

Iran Crosses the Line

Iran's government has been threatening to do this since the U.S. started to impose more sanctions, but had held off in hopes that European pressure would affect the U.S. It hasn't. Now, Iran is trying to play hard ball. They have exceeded the limits placed on the production of enriched uranium. That puts them in clear violation of the agreement. Iran asserts that the U.S. already broke the deal with its pressure and now they have no reason to abide by these rules. The talks on Iran's nuclear capability are back to the starting point.

Now What? The China-U.S. Saga Continues

It all came off as expected. The meeting between Presidents Trump and Xi Jinping took place at the G-20 meetings in Japan and as the conference ended, there was a deal of sorts. The U.S. will delay the additional tariffs planned on Chinese goods, but the threat of imposition still hangs out there. The Chinese for their part promised to buy more from the U.S., but there was no specificity. The analytical community had come to the conclusion that the two nations had far too much to lose if they went ahead with this expanded confrontation, but it is clear that neither Trump nor Xi is willing to pull back from their stated positions. The resumption of the trade talks will provide an opportunity, but something will still have to give before any sort of long-term deal is struck. The assumption is that trade confrontation will last for an extended period of time.

Analysis: What can really be expected? At this point, politics plays a huge role for both leaders. Trump is in full campaign mode now and has no desire to alienate his base. There is still considerable anger and frustration with China in the U.S.—much of it justified. China has not played by the rules of global trade for a long time. One can make the case that China has contributed to job loss and business failure in the U.S. In most respects, the U.S. and China are enemies with highly divergent foreign policy aims. The connection to China is purely economic. As powerful as that can be, it plays less during an election year. Xi has his own reasons to delay a final outcome as the Chinese are well aware that 2020 is an election year in the U.S. They know there is a chance they will not be dealing with Trump much longer. It is not that the other candidates are any less suspicious of China, but Xi can hope that trade wars will not be the focus for the next president. It means that China will wait it out and try to maintain the status quo.

The markets reacted positively to the deal, but that rally will likely be short-lived as there remain a lot of unanswered questions. The resumption of talks does not mean that new concessions have been offered by either side; all of the same logjams are in place. It remains likely that future talks will stall and will then come down to whether Trump or Xi wants to escalate the tension again. The assumption for the time being is that it will be business as usual, but it is already evident many in the U.S. have started to hedge their bets as far as China is concerned. That may be the more important development.

As has been noted many times, the U.S. has long run a substantial deficit when it comes to manufactured goods—especially those aimed at the consumer market. Until the late 1990s and early 2000s, that deficit was spread around as the U.S. imported these goods from a wide variety of nations. China began to gobble up market share after 2000, as they invested heavily in trade infrastructure such as highways, ports and airports. They also heavily subsidized those manufacturers that were aimed at the export market. Soon enough, the world was buying almost exclusively from China. Today, those nations that lost out to the Chinese over the last 20 years are seeing an opportunity to get back in the game. They will continue to push even as the U.S. and China seek an opportunity to bury the trade hatchet. The challenge these nations have are the same as they have been for the last two decades—they lack that trade infrastructure so their total landed costs are higher than those in China. They also have to gear up for the ability to produce on the needed scale. Much of what made China competitive was the growth of companies like Wal-Mart. The supply demand placed on a manufacturer by something the size of Wal-Mart is massive and most can't produce at that scale. Chinese companies could. That gave them an advantage. It remains to be seen whether countries like Vietnam, India, Brazil or Mexico can match that Chinese productivity output.

What Is Really at Stake with China?

The trade confrontation with China is real enough on its own. The U.S. has a great deal at stake with this issue and so does China. This is not the only issue, however; it is just one of the reasons that relations between China and the U.S. are so complex. There are three other areas of tension between the U.S. and China. Over the years trade has been used as both carrot and stick when it comes to having an impact on these issues.

Analysis: At the top of the list is geopolitics. The Chinese are currently putting immense pressure on Hong Kong and they have long had designs on Taiwan. The Chinese back North Korea and they have supported many regimes the U.S. has opposed—Iran, Venezuela, Syria and so on. The U.S. opposes Chinese intentions as concern the South China Sea and other disputed territories. To some degree, the U.S. has tried to use trade to change Chinese behavior toward these nations.

The second issue is competition for commodities and raw materials. China has invested a great deal of money in Africa, Latin America and Asia as they try to secure access to the materials their industrial community needs. That brings them into conflict with the U.S. as these are resources the U.S. wants access to as well.

Finally, there is the ideological confrontation. The U.S. is a democracy and China most certainly is not. The autocratic leadership of China has been behind vicious crackdowns on dissent (Tiananmen Square, Falun Gong, Uighurs and Tibetans, etc.). The Chinese remain committed to spreading their ideology and worldview just as the U.S. is committed to spreading the worldview it holds. This rivalry has intensified as they have emerged as the two dominant economies in the world. Both assert their path to this prominence is the right one and seek to influence other nations in their development efforts.

EU Leadership Fight Continues

The compromise that was worked out between the members of the major European parties would have sailed through with nary a peep of opposition had this contest taken place a year or so ago. Back then, all it really took was determination on the part of Germany's Chancellor Angela Merkel. It would have been a done deal, but today, her influence is much reduced and she was unable to beat back opposition from within her own party. It was thought the deal she struck with France, Spain and the Netherlands would break the deadlock over who would govern the European Commission, but her center-right allies in Germany balked at the notion of promoting Frans Timmermans from the Netherlands as he is from the Socialist Party. Now, the whole issue of who governs the EU is back in play and there is no clear second candidate.

Analysis: The selection of Timmermans was seen as a compromise by the Germans in the first place as Merkel had been pushing Manfred Weber for the post. It became apparent that he lacked the support of other key European states and she backed off of his nomination as she shifted tactics to push Jens Weidmann as the new head of the European Central Bank (ECB). Now, the impasse is back as the Germans are still holding out hope for Weber while the French, Spanish and others are back to supporting a candidate that hails from the southern tier of states.

All involved assert that no compromise seems to be in sight, but Donald Tusk, current European Council president will test the waters with a slate that keeps Timmermans as the new Council president but makes concessions to the nations that had opposed him. He would be joined by Weber as the head of the European Parliament, Belgium's Charles Michel as head of the European Commission and a female leader from the European People's Party (EPP) and from central Europe as the head of foreign policy. This would seem to satisfy the center right and the center left as well as the western Europeans and the east-central Europeans.

Those who have watched this mess for the last several months assert this is the challenge of the EU in microcosm. Nobody is paying attention to whether the people suggested are really qualified for the jobs they are being touted for. It has been all about left vs. right, north vs. south, male vs. female, hawk vs. dove. The Financial Times editorial board has weighed in with a suggestion based on competence as well as potential effectiveness. These four would be considered a "dream team" were it not for the fact that this would be a politically impossible combination.

The European Council president would be Margrethe Vestager from Denmark. She has been a staunch defender of the EU and has stood up to Trump to the point that he has asserted that she "hates" America. Her organizational skills are legendary and that should be taken into consideration. The head of the ECB should be Finland's central banker—Erkki Liikanen. He is a solid choice and has backed Draghi on most of the important policy decisions of the past few years. The head of the European Council should be Angela Merkel although she has insisted that she is uninterested. This is a post that demands a world leader and a champion of the EU mission. The foreign policy chief should be Kristalina Georgieva from Bulgaria—a woman who has demonstrated her diplomatic skills repeatedly.

What Did This Latest Meeting with Kim Accomplish?

No American president has set foot in North Korea since the 1950s, but that streak has now been broken as Trump exchanged handshakes and pleasantries with Kim Jong-Un at the DMZ and crossed over into Democratic People's Republic of Korea (DPRK) territory. The event was unscheduled and came as Trump left the meeting of the G-20. There was no statement of purpose or any kind of agreement—it seemed to be simply a touchpoint and perhaps an invitation to more substantial meetings later.

Analysis: The gesture by Trump has been hailed in North Korea as another signal that Kim is a world leader and worthy of global attention. The South Korean leaders see this as encouraging, while Japan was alarmed. The problem from most perspectives is that nobody really knows what is now being asked of North Korea. The agreements developed in the past have yielded nothing at all—Kim has reneged on every promise made and has not only continued to test missiles, but has rebuilt some of his nuclear capability. There has been no sign of North Korea's desire to reduce its nuclear ambitions. Many observers feel that Trump's embrace simply proves to Kim that he doesn't have to follow through on much of anything as his failures to comply have not cost him anything. As long as he maintains this dialogue with Trump, he seems to be immune. In contrast, the Iranians actually complied with the terms of their agreement and were hit with sanctions and threats anyway.

Becoming a Great Grampa (Again)

Yesterday, my grandson, the large animal veterinarian, revealed he will be a dad next January. I don't want to say we were relieved by this news, but he is 33 and his wife is 31. His family will be just a few hours away in central Missouri, while my other grandchildren are in Florida.

I intend to go full Great Grampa—buying the kid things like a drum set and an air horn. I will feed them a diet of sugar and caffeine when they visit and will make certain they learn to make noises with their armpits as well as well as how to burp loud enough to set off car alarms. I look forward to being a very bad influence!!

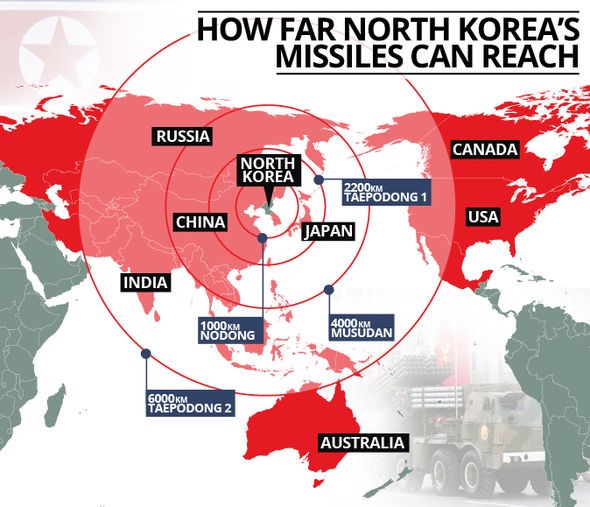

North Korea's Missiles

Not that we are trying to be alarmists, but it is useful to note that North Korea has the ability to inflict a lot of damage on the world with just the arsenal it currently has. Most of the U.S. western third is vulnerable to an attack and so is most of Asia. This makes negotiations with the current regime important, but it also means that extreme caution ought to be exercised. The U.S. has had confrontations with states in the Middle East, but none of them can touch the U.S.—North Korea has the ability to wipe out close to a third of the U.S. population.