Strategic Global Intelligence Brief for April 26, 2019

Short Items of Interest—U.S. Economy

Unexpected and Welcomed News

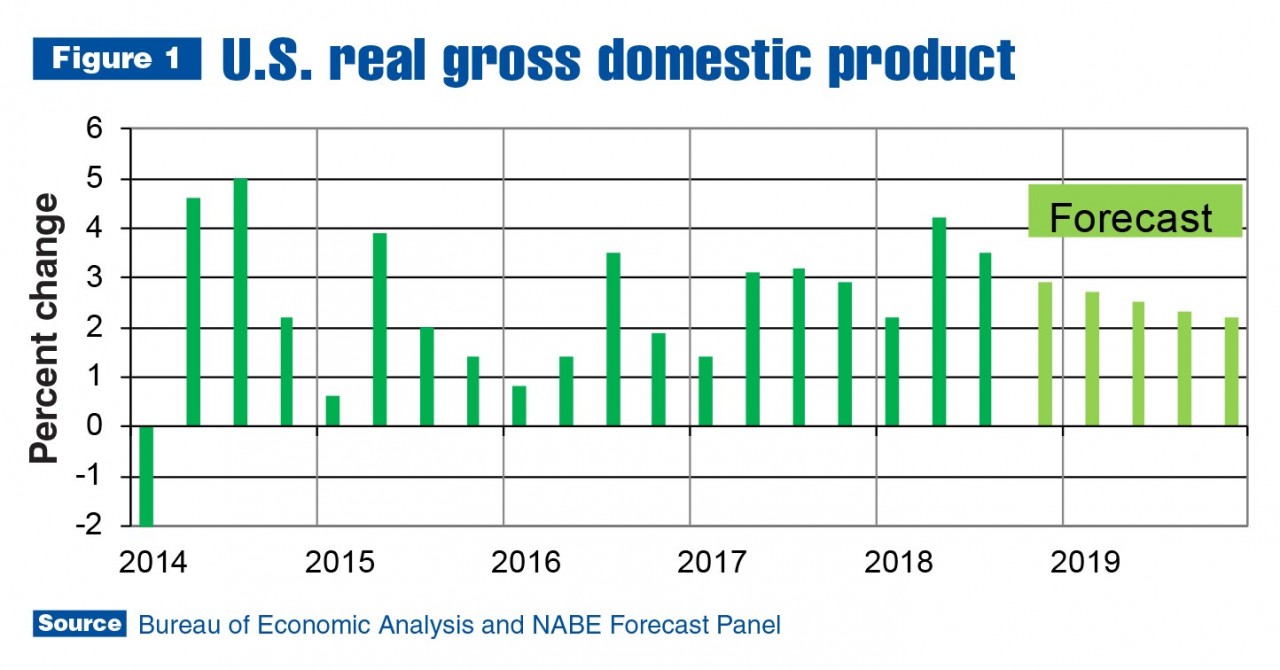

As discussed later in this issue, there had been a sense that economic growth was falling off at the end of last year and at the start of this one. The part that was not as clear was what has been happening lately. By most accounts, the beginning of the second quarter was strong, but it was not clear when the rebound got underway. It turns out that the recovery started quite a bit sooner than had been expected and the result was a 3.2% growth rate for the first quarter when the dominant assumption was for growth near 2.5%. The factors that propelled the growth were expanded exports and the dramatic increase in inventory as business tried to get ahead of any potential tariff and trade restrictions.

Consumer Enthusiasm Fades a Little

So here comes the first contradiction. The question now is which might influence which. The level of consumer confidence has started to falter a little, according to both the Conference Board and the University of Michigan. The question is now one of influence. Will the better-than-expected GDP growth numbers pull up the consumer confidence numbers next time around or will the weaker consumer confidence data pull on retail and, thus, on the economy? Bear in mind that inventory accumulation was largely responsible for the growth in Q1 and that means that consumers now have to do their job. If they don't help deplete that inventory build, it will end hanging around the neck of the business community like an albatross.

What Does Q1 Have to Say About the Rest of the Year?

It is obviously dangerous to extrapolate from one quarter to the next, much less to the remainder of the year. The poor performance of Q4 in 2018 had people assuming the worst at the start of 2019. Now we have good news for Q1—will that last? It seems that Q2 has some good momentum from the previous quarter and that should set up another solid growth quarter. Beyond that, it is hard to say. There are some fragile parts of the Q1 data and the headwinds that have been on everybody's mind are still in place. At this pace, it is likely that Q1 and Q2 will be the peak quarters and slowdowns will mark the last six months of the year.

Short Items of Interest—Global Economy

Sri Lankan Bombers from Privileged Background

The bombers that killed over 300 people in an assault on churches during Easter weekend were not the usual terrorist recruits. The family at the heart of this conspiracy is wealthy and privileged. Slowly, it appears that they became radicalized to the point of becoming mass murderers and this has many in Sri Lanka deeply worried about reprisal attacks. The Islamic population in the country is very small and many are fearful they will become targets of intense anger from the Hindu, Christian and Buddhist majorities.

Spain Facing Months of Coalition Talks

The polls right before the election this weekend indicate that voters are deeply divided. The ruling Socialists will likely get around 30%, while their allies in the Podemos Party will take 13%. That is not enough to form a government. The main opposition People's Party looks to get 20% and their ally Ciudadanos will pick up around 15%. That is not enough to form a government either. The party that looks to take around 11% is Vox and nobody wants to affiliate with them at the moment as they are the far-right nationalist/populists that resemble the National Front in France or AfD in Germany.

Brexit and EU Elections

Now that the Brexit decision has been put off until Halloween, the battle is going to be played out in the EU parliamentary elections as both pro and anti-Brexit forces will be trying to claim support from the population as a whole.

Growth Expected Despite Lots of Travails

Over the last several months, there has been a steady drip of economic concern—lots of references to headwinds and other inhibitions. Later today, the first estimate of Q1 GDP will be released and most analysts are expecting pretty decent news despite all the expressed concerns. This begs the question, is the performance an indication that all those inhibitions and headwinds were really not all that important or are we in a period where the impact has been muted and delayed and will emerge as a crushing issue later? One can find a little ammunition for both interpretations at this point.

Analysis: The consensus view is that there was growth of 2.5%, although there has been a range of prediction that has gone from almost 3% to just under 2%. The current estimate is far more optimistic than had been the case even a couple of months ago. The view was the economy would be suffering from the impact of the longest government shutdown in history, the inhibitions of a trade and tariff war, consumer fatigue and a host of ongoing business issues such as labor shortages and a heightened sense of insecurity and unease as policy direction from the Trump White House has been tough to follow.

As analysts look over the data, there will be several factors that will attract the most attention. The first is that it appears that 2019 may be bucking a trend that has been dominant for several years the slow start. In prior years, the U.S. economy has gotten off to a slow start and then picked up speed in the second and third quarters. The end of 2018 was slower than had been expected initially and that seemed to ensure that 2019 would be sluggish. It is clear that momentum was gained as the quarter went on, but that increased pace started sooner than had been expected and appears to have been sustained into the second quarter of this year. Much of this expansion comes down to the behavior of the consumer and this can be a weakness or a strength going forward.

At the end of last year, the consumer was looking exhausted and unlikely to play the role of stimulator. Holiday sales were downright miserable at the end of the year and as 2019 started, that same gloom was in evidence. Then came further inhibitions such as the government shutdown and the impact of the bitterly cold winter. Even as late as February, the outlook for the retail sector was pretty grim. The reversal started at the beginning of March and picked up speed quickly. The consumer seemed to have plenty of pent up demand to work with. Beyond that the big issues for the consumer were trending favorably. The rate of unemployment was still very low, inflation had remained well under control and wages had started to improve. There was even continued reaction to the low borrowing costs. All this good news is also what poses some concerns. What happens if there is a significant uptick in joblessness or there is a spike in inflation due to those higher wages and increased costs of commodities? What if higher interest rates do start to inhibit borrowers? Not that any of this seems imminent, but a change in circumstances can be swift.

Close attention will be focused on the business investment numbers. They will doubtless be less impressive than they were at this point in 2018 as there is no big tax cut to work with. The question has been dominating analysis for the past year—did the tax cut make a permanent change or was this a "sugar rush." It seems that investment fell off at the start of the year but has recovered a bit of momentum since. A key measure is new orders for non-defense capital goods and the numbers in Q1 were up by 2.8% over what they were last year. There has been a little less investment than had been the case before, but it is apparently starting to pick up.

One area that will receive special scrutiny will be inventory build. It is expected that inventory played a big role in the Q1 growth numbers as it has been obvious that many companies have been stocking up. It is the motivation for that inventory build that is most critical at this stage. The healthy motivation is to build inventory in anticipation of being able to sell it to an eager consumer base later in the year. The unhealthy motivation is when a company anticipates an issue with getting the inventory needed and orders more than is needed as a hedge. Much of the stockpiling seems to be related to fears over the impact of the tariffs and trade barriers. If companies have purchased far more than they can reasonably deal with, that inventory will weigh them down later in the year and that will slow the economy's progress.

Growth and Trade

Along with the interest in overall growth there is intense curiosity regarding the status of the U.S. trade deficit. Most of the economic policies that have been promulgated by the Trump team have focused on trade and often at the expense of growth itself. The tariffs have added costs to the manufacturer, disputes with Mexico, Canada and Europe have affected business. Has all this resulted in a better long-term trade position?

Analysis: Thus far, it has been hard to make a solid judgment. The threat of tariffs and trade restrictions convinced many companies to aggressively import in order to avoid shortages. That made the deficit worse, at least temporarily. Later in the year, the numbers will improve as there will be a reduced need to import that which is now in inventory. The big question is whether the U.S. has been able to expand its exports and there is evidence that there has been some improvement. The gains in the export sector have been somewhat subdued, but given the situation in the global economy, that is still pretty good performance. The U.S. trade primarily with Canada, Mexico, Europe and Japan and all of these economies have been struggling to one degree or another. That the U.S. has been able to sell to them anyway is a good sign and there is the chance that U.S. exports will rise as these states become healthier. The manufacturing sector is propelling the export market for the U.S.

Iran and Oil

The U.S. has elected to apply more pressure on Iran with the extension of sanctions on countries that are currently buying oil from the Iranians. Up to this point, they had been granted exemptions and had been allowed to continue buying Iranian output. Now, these countries can face financial sanctions from the U.S. The list of affected countries includes China, India, Turkey, Japan and South Korea. The U.S. had allowed the purchases to go forward both as an incentive to Iran to reduce its engagement in development of nuclear weapons and as a concession to the nations that needed Iranian oil. The other motivation for lifting the sanctions was to put some downward pressure on the global price of oil. Cutting the world off from Iranian oil at a time when OPEC and Russia have been actively reducing their output levels was seen as a risk as it could contribute to oil prices in the $80 to $90 a barrel level—higher than they have been in several years.

Analysis: This is a classic example of competing strategic priorities and it is difficult to determine whether the effort is good or bad for the U.S. in the longer term. Iran is very defiant and its foreign minister asserts that they will have no trouble continuing to sell oil to these countries and others. The fact is that the U.S. is not being held in very high regard in China and Turkey at the moment and both governments have insisted they will defy the restrictions, essentially daring the U.S. to make good on its threats. Japan and South Korea are more sensitive to the needs and priorities of the U.S. and are more likely to comply. India is a major question as they are watching their oil demand rise sharply every year and need that access. On the other hand, the Modi government doesn't want to challenge the U.S. on issues like this.

The aim of the Trump administration is as it has long been. There is a deep animosity toward the Iranian government and the Trump team has advocated a complete reversal of strategy from what was tried under Obama. It was something of a carrot and stick approach before, offering better access to the global economy in return for backing away from the development of nuclear weapons. Now, the approach is all stick with an eye toward encouraging some kind of regime change. The Iranians are back to working on that nuclear capability and have become even more active in terms of backing radical Islamist groups in the region. The highest priority for the Trump White House has been the security of Israel and everything else has come a distant second if it matters at all.

The immediate impact on oil prices was somewhat subdued as the price per barrel rose by only about $5 and settled back pretty quickly. As of this writing, the per barrel price for WTI was $62.60 and Brent was at $70.90. Both of these prices are down from what they were after the sanction announcement. The thinking in the oil markets is that the sanctions will not appreciably affect Iranian oil output or sales. There is a wait-and-see attitude in place and most expect key nations like China and India to ignore the threats. On the other hand, the U.S. might choose to make a much bigger issue of this and there could be a reaction —one that would propel oil prices higher and perhaps high enough to have a negative impact on the U.S. economy.

Macron Tries to Revamp Reforms

The "yellow vest" protests have continued in France and even the burning of Notre Dame has not altered the mood in the country. Within hours of the disaster, there was an outpouring of generosity aimed at restoring and rebuilding the cathedral, but the determination to build it back also provoked waves of protests from the yellow vest groups that demanded at least as much money and attention as the cathedral was getting. Macron is now desperately trying to regain control over his reform agenda.

Analysis: As Macron has tried to mollify the protestors, he has promised to lower taxes on the poor and the middle class and he has further indicated that he will raise pensions and avoid any further closure of schools and other institutions. He has also suggested that the government be decentralized further. It is not clear that any of this will really impress the "yellow vests" as they do not seem to have a real agenda other than protesting Macron and setting cars on fire. The employer's federation has been swift to respond and are dead against the plan as it aims to tax corporations heavily in order to allow the tax reductions. They point out that this scheme has been tried many times in the past and always has the same outcome. Companies will largely attempt to pass the tax hike on to consumers and many will simply elect to leave France altogether to avoid the tax burden. The corporate community has pressured Macron to make good on his promise to reduce the number of government employees, but there have been more hires since Macron has taken office, not less.

The Joys of Cooperation and Compromise

There has been a real dearth of either of these behaviors of late. The art of compromise and negotiation has been lost as what passes for interchange is nothing other than people screaming into each other's face as they insist on their way or the highway. That being said, I have had an opportunity to see some of that old-fashioned compromise and cooperation of late and am still impressed with how well it works.

The first step in all of this is to actually identify what really means the most to you. There are too many people with the instincts of a toddler who insist that everything they want is the absolute top priority. It can't be. Some things are core and fundamental and worth the energy to defend, most aren't. They are in the category of "nice to have" if practical. The latest of these cooperation scenarios involves a friend that works the night shift and every day faced the challenge of trying to sleep when the neighbor elected to operate lawn equipment and allow the family dog out to bark at everything. By and large, the neighbor has been a good guy, but the tension was building. Rather than letting it escalate, my friend approached him and explained the issue. The other guy had no idea any of this was a problem and agreed to hold off on lawn care until later in the day and that left the dog. The fact is that the pup has to go out and he barks. The compromise was that the neighbor build a run on the side of the house opposite my friend's bedroom, a run my buddy paid for. The dog isn't consigned to the run all day, just the morning. The decision was made that neighborhood relations were more important than the cash required for that run.