Strategic Global Intelligence Brief for April 29, 2019

Short Items of Interest—US Economy

Personal Income and Spending Data Today—In the wake of the better than expected GDP data issued last week, there will be considerable attention focused on a couple of data points that will be released today. One of these is personal income and the other is consumer spending. Thus far the rise in personal income has been less than impressive given that the rate of unemployment has been at record lows for months. The expectation had been that wages would have been rising sharply by now, but they have only started to hike and the gains have been slow. The expectation is that income will be up by 0.4%. Consumers have been more active than they were expected to be, and the gains here are expected to be around 0.7%, although that is a tenuous number as much of this spending gain has been enable by the extended use of credit.

Fed Policy Statement—Most of the early assumptions regarding Fed policy have been reversed thus far this year. At the start of 2019, it still looked as if the economy was stuttering a little and pressure had been mounting for the Fed to engage in more stimulation. Now we are just four months into the year and many of these circumstances have changed. The first quarter numbers have been impressive and thus far there has been little to suggest inflation is going to rear its ugly head. This likely means the Fed will be even more comfortable with their current policies: keeping rates right where they are. There is really no motivation to increase them or decrease them.

Supply Side Drives Long Term Growth—The fact of the matter is that only supply side expansion can drive long term growth—this is the impact of greater worker productivity and an expanded labor force. These two factors have been in the doldrums for years but have turned positive of late. There has been an improvement in productivity due to investment in robotics and machines, and there has been a steady improvement in the labor force as Boomers have delayed retirement at the same time that Millennials are entering the workforce in greater numbers. How long this trend lasts is anybody's guess as it is fragile. That retirement boom may arrive at any point, and long-term productivity numbers have not been all that great.

Short Items of Interest—Global Economy

Spanish Socialists Do Better than Predicted—Right up to the last minute, the polls in Span indicated the ruling Socialists would fall short of being able to form a government—even with their usual coalition partners. By the time the dust settled, the Socialists had exceeded expectations and picked up 37 seats in parliament. They are going to try to govern alone, but if needed, the can unite with Podemos to form a center-left coalition. The right collapsed due to the rise of the populist Vox party. They took 24 seats and the majority came from the People's Party. It was once the ruling party and is now a shadow of itself.

US—Japan Trade Deal Seems Unlikely—Japan is standing its ground on trade and the Trump team seems unwilling to do much bending either. The U.S. wanted greater access to the Japanese agricultural sector, but that has been flatly refused. The U.S. has not offered Japan any concessions either, and Shinzo Abe has indicated that Japan has plenty of options and has hinted that the U.S. has far more to lose by a trade deal failure than Japan does.

UK Still Counting on US—The British have indicated for months that it planned to dramatically shift its trade priorities after leaving the EU. That means there will need to be a new trade deal worked out with the U.S., and that has been something that Trump had mentioned in the past. Ideally, there would be a pact that ties the U.S., U.K. and Japan, but this seems a bit of stretch right now.

Growth Expected Despite Lots of Travails

Each month we review the data collected by NACM to put together the Credit Managers' Index. This is an index that was modeled on the Purchasing Managers' Index and has proven to be a reliable predictor of economic trends—even giving an advance look at what the PMI is indicating. What follows is the executive summary—to see the whole CMI report go to the NACM website (www.nacm.org) and search for the Credit Managers' Index.

Last month, the consumer sector was the one that let the economy as a whole down, but this month, that same consumer is playing a more heroic role. The data in this month's CMI showed a slowdown in the manufacturing sector after a robust month in March. This month the service sector is demonstrating all the growth and the manufacturing sector slumped. This matches pretty well with other data that has been coming in from the data analysts. The latest retail numbers were unexpectedly strong with growth at 1.6% when expectations were for growth of maybe 1.0%. Last month there was a fall in the data despite the fact that consumer confidence numbers have been essentially solid—if not particularly impressive.

The combined score for this month's CMI is 54, and that is an improvement over the 53.6 notched the month prior. Over the last several months there has not been a great deal of variability in the combined score. The high point was reached in May of 2018 when it hit 56.6, and it was at or above 56 three times in the last 12 months. The low point was January when it hit 53.4. But it was at 53.7 in April of last year and 53.6 in March. The range has been fairly narrow. The combined index for favorable factors jumped back into the 60s with a reading of 60.1—about where it had been in February. The combined score for the unfavorable factors slipped back in the expansion zone by the narrowest of margins—50. It had fallen to 49.9 last month.

As is usually the case, there was quite a bit of interesting data in the sub-sectors. The sales data jumped back into the 60s with a reading of 61 after stumbling a little to 58.2 the month before. The new credit applications also improved with a move from 57.8 to 59.7, but this category had been in the 60s for most of the last few years. It started to fall into the 50s in December of last year. The dollar collections data also improved but not quite enough to break into the 60s: It is still at 59.1. The amount of credit extended stayed in the 60s but fell a little from the month before, going from 63.5 to 60.6.

There was more variability in the unfavorable factors. The rejections of credit applications improved a little and stayed comfortably in expansion territory. The reading last month was 51.2, and this month the data was at 52. The accounts placed for collection remained in the 40s but improved from last month to this. It was at 46.4 and that was the lowest point seen in several years. Now it is at 48.5, and that is basically in the range that has been dominant most of the past 12 months. In contrast the disputes category slipped further back into the contraction zone with a reading of 48.5 after a reading of 49.5 in March. The dollar amount beyond terms fell out of the expansion zone with a reading of 47.6 after hitting 50 the month prior. The dollar amount of customer deductions improved a little with a reading of 49.7 compared to 48.8 the month prior. The filings for bankruptcies stayed very close to what it had been the prior month—a reading of 53.9 after one of 53.7 in March.

By and large the readings improved this month, but the real news has been the changing position of manufacturing and service sectors. At this stage it is not clear what is causing the shifts in these sectors and it is certainly too early to identify any kind of a trend.

Manufacturing Sector—The data from last month was strong and much of the gain in the CMI in March was due to improvements in the performance of the manufacturing community. It is not that conditions have dramatically changed but some of the enthusiasm has faded. This has been reflected in some of the other manufacturing data that has been released of late—the Fed's industrial index fell and there was some decline in the latest Purchasing Managers' Index (mostly in the New Orders Data).

The combined score for the Manufacturing sector fell from 54.6 to 53.7 and that takes this data to the low side of where it has been the last year. The numbers fell to 53.1 in January but most of the readings for the last year have been in the 55 to 57 range—at least in the last few months. The combined score for the favorable factors fell out of the 60s for the first time since January with a reading of 58.9 after a March reading of 60.3 and a February reading of 60. The combined score for the unfavorable factors stayed in the expansion zone with a reading of 50.2 following one of 50.7 the month before.

The data in the subsectors showed some declines in select areas but steady performance in others. The sales data stayed very close to what it had been – 58.6 as compared to 58.4 the month before. The new credit applications slipped out of the 60s with a reading of 59.8 compared to 61.2 the month before. The dollar collections data improved and that is always good news. It went from 57.8 to 58.6 but there was a big decline in the amount of credit extended as it moved from 63.9 to 58.5. Compared to the months before there were no readings in the 60s and that has not happened in well over a year.

The rejections of credit applications stayed almost exactly where it had been the month before—moving slightly to 53.1 after being at 53.2. The accounts placed for collection improved quite a bit as it moved from 46.8 to 49.3 but it remains in the contraction zone. There was a significant decline in the disputes category and it is now in contraction territory with a reading of 47.7 after one of 50.2 in March. The dollar amount beyond terms also fell out of the expansion zone with a reading of 48.5. This is in sharp contrast with the 51 noted in March. The dollar amount of customer deductions improved slightly as it moved from 48.4 to 49.5. Better than last month but still in contraction territory. The filings for bankruptcies slipped a little but stayed in the 50s with a reading of 53.3.

There is not a lot of consensus as to what has been pushing manufacturing up and down of late but the dominant view is that uncertainty in the trade sector has played a big role. There have been on again and off again tariff threats and manufacturers have been struggling to keep track of the changes that have swept through various trade talks. One minute there is no hope for a pact with China and the next minute it seems imminent and the five minutes later there is an impasse that can't be overcome. This has also been an issue with Europe and with the reconfigured NAFTA (USMCA).

Service Sector—What a difference a month seems to make. Last month it was the retail sector that was worrying everyone: consumer confidence was ebbing and retail activity was lackluster at best. Fast forward to April and the consumer has woken up along with the daffodils and grape hyacinth. The jump in retail activity was wholly unexpected as most analysts put the expansion at no more than 1% (and that was from the optimists). The actual growth was 1.6% and this activity was spread around over several sectors. The biggest gains were seen in gas stations as the price of fuel has gone up but there were gains in terms of clothing sales, furniture and car parts. About the only area where gains were missing were in sporting goods—even luxury goods got a boost and all that activity showed up in the CMI data as well.

The combined score for the service sector was 54.4 and that compares very nicely with the 52.6 in March. This month saw the data return to the levels that had been seen over the last few months and the majority of that growth came from retail. The combined score for the favorable factors also jumped and ended up at 61.3 after languishing at 57.7 the month before. In the last year there have only been two months when the combined score was not in the 60s. The combined score for the non-favorables was 49.8 and that is still stuck in the contraction zone. It is, however, even closer to the 50 line than it was the month before when it was reading 49.1.

The sales numbers made a dramatic comeback, and retail was the impetus behind this surge. It is now sitting at 63.4 and it was at 58. There have only been two months when the readings were below 60, and last month was one of them (the other was December of 2018). The new credit applications numbers are very close to that 60 line as well – reading at 59.6 compared to the 54.3 last month. That is a substantial jump. Dollar collections also crept ever closer to the 60 line with a reading of 59.6 compared to the 55.5 notched last month. The amount of credit extended remained in the 60s but fell a little from 63.2 to 62.7. It seems that some of the order activity is a little calmer than it has been but the data is still very strong.

The rejections of credit applications numbers improved and moved into the expansion zone, albeit by a narrow margin. The reading this month was 50.8, and last month it was still in contraction at 49.1. The accounts placed for collection moved up a little but did not break into expansion territory. It was at 46.0 and now it is back to 47.7. This is not earth shattering but that 46.0 reading had been very worrying and it is good to see the numbers moving in the right direction this month. The disputes numbers also improved, but not quite enough to break out of contraction territory: It was at 48.9 and no sits just south of expansion at 49.4. The dollar amount beyond terms category slipped, and this is perhaps the most distressing reading of them all. In past months, there have been a connection between an expansion of slow pays and more serious credit issues. The reading last month was within shouting distance of the expansion zone with a reading of 49, but this month there has been a big fall—all the way to 46.7. If this pattern continues, it is expected that other areas will suffer—accounts out for collection and even bankruptcies. The dollar amount of customer deductions rose a little closer toward expansion but is still just short at 49.8—compared to the 49.1 the month prior. There was a nice rebound as far as filings for bankruptcies as the new reading is 54.6 and last month came in at 52.7. Last month had been the lowest reading seen since the numbers in April of last year when it fell to 52.4. Now it is back to what has been considered normal for much of the year.

Will retail continue to push economic expansion? There are as many reasons to think it might as there are reasons to think it will start to fade. The good news is that unemployment numbers are still encouraging, and there have been some recent pay hikes. The tax cut enthusiasm of last year has faded but so has fear of rapid inflation and a subsequent slide into recession. On the negative side, there are signs that housing and automotive are stalling as far as economic drivers and the trade war has started to affect the consumer.

April 2018 Compared to April 2019—Once again, we have another shift in momentum. Every time this happens it is tempting to declare this is finally a sign of a trend, but as soon as that statement is made, the data shifts again and in the opposite direction. It would seem that it is all steady for the time being.

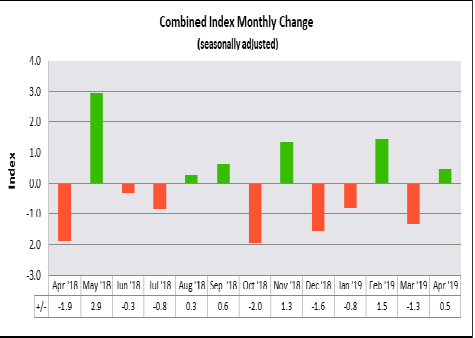

The chart above indicates the monthly change that has taken place with the Credit Managers' Index over the last 12 months. As you can see—it has been a bit of a roller coaster and it has been hard to determine any kind of long-term trend. Of late there have been more bad months than good, but there has been a major divide between the performance of the manufacturing and service sectors.

You Don't Miss it Until It's Gone

Storms rolled through last night—big ones with loads of thunder and lightning and heavy rain. They brought the usual chaos along with them. At 4:30 in the morning, the house alarm was triggered, and this siren is designed to be heard from at least five states away. Not the best way to rouse from slumber. It also terrified the cats, and it has taken all morning to settle them down. The power was not exactly interrupted but somehow half a dozen breakers were tripped and the cable went out. Some light fixtures now seem dead, although other lights in the same room work.

The loss of cable and internet creates havoc. I have a hotspot so I can connect and work on the newsletter, but this is not going to do my wife any good when I take off to my next destination. It is frustrating to realize how dependent one is on something that is only dimly understood, and it reminds me that most of my life is composed of reliance on things that are as mysterious to me as ancient hieroglyphs would be. Electricity is magic, cars are put together by elves. Heck, I don't even really understand how my own body works. I just trust that when I flip a switch the TV comes on and when I turn the key the car starts and when I bolt out of bed while air raid sirens sound my legs will support me and my heart will not pound out of my chest. I fully understand that I will never have a clue what is going on in a cat's brain, but this other stuff drives me nuts as I keep thinking I should have some idea as to what my course of action should be. Alas, no such skill set exists.