Strategic Global Intelligence Brief for May 1, 2019

Short Items of Interest—U.S. Economy

Consumers Upbeat Again

Those fickle consumers are at it again. As the year started, there was a sense that consumers were starting to lose their enthusiasm and the various consumer confidence polls reinforced that assumption. All of the major ones were down, although not in the doldrums as compared to where they have been in past years. The pattern reversed this month as the consumer now seems more confident about what is likely to take place this summer. There is a general mood of optimism about the economy right now and expectations are that this improvement will extend into the summer. The one potential fly in the ointment could be gas prices because hikes have tended to depress consumers in the past. If summer driving season coincides with gas prices near $3, the mood could sour in a hurry.

Trump Still Riding Fed

The economy is arguably clipping along at a pretty healthy pace, with the Q1 numbers showing that GDP growth is 3.2%. Unemployment is very low and, arguably, low enough to trigger wage hikes that could end up stimulating inflation. This is not the kind of environment that would suggest the U.S. needed the Federal Reserve to get active, but that seems not to be the opinion President Donald Trump holds. He has called on the Fed to reduce rates by a full point and get engaged in radical purchase of bonds again—in essence to behave as if the U.S. economy was in full recession. There is no indication that anybody on the Open Market Committee is leaning toward anything like this and, in fact, Trump's nominee to be on the Fed's Board of Governors is losing support in the Senate by the day. At this point, few like Stephen Moore's support for Trump's rate strategy.

Heading for Buyer's Market?

It has literally been decades since there was a true buyer's market in housing. The prices of homes have done nothing but escalate for years and there have been countless markets defined by a severe housing shortage. That situation may have started to reverse a little. The price of homes has fallen generally to levels not seen since 2012. The latest Case Shiller index is only up by 0.4%, a very small hike. It has been reported that several markets are already dealing with housing surplus, which has caused prices to fall as homes are staying on the market for much longer than in the past. Of course, there are many hot markets where the buyer still has no leverage at all, but there are even some growth cities that are seeing better conditions for potential buyers.

Short Items of Interest—Global Economy

Coup Attempt Stalls

Later in this issue, there is a report that was written just as the coup attempt in Venezuela started. It was not clear yesterday what kind of support the opposition would be able to muster and as of today, the potential for a successful overthrow looks weak. Only a small number of troops have rallied to Guaido and most of the population has chosen not to risk attack by taking to the streets. The unfortunate reality is that most of those that might have backed this coup have fled the country—two million plus to Colombia already.

Will Fernandez Make a Comeback in Argentina?

It was just a few years ago that Cristina Fernandez was chased out of the leadership of Argentina and held responsible for the miserable state of the nation's economy. Mauricio Macri was popular and seemed to have ample support for his reform plan. Today, Macri is not as popular and frustrated Argentinians are suggesting that Fernandez should return, despite the fact that global investors would bolt the minute this occurred.

British Manufacturing Slows

For a while, it seemed that the worst-case scenario for Britain was not in the cards as manufacturing continued to grow despite the Brexit mess. Now, it seems that most of that expansion was stockpiling in the event that Brexit was as bad as expected and that inventory build is over and manufacturing has slowed drastically.

Labor Costs Rising

Could it be that the Philips Curve is starting to resuscitate? You remember the good old Phillips Curve from your beloved Macroeconomics class, don't you? This was one of the few economic laws that actually made sense to undergrads and on top of that, it also actually worked as a reliable predictor. It was simple enough: It stated that when the rate of unemployment fell, there would likely be more wage driven inflation as employers would be compelled to pay potential hires more money if they expected them to accept jobs. Furthermore, the employer would need to pay existing workers more if they expected them to turn down new jobs from potential employers willing to fork out more cash and benefits.

Analysis: The problem this past year or two is that the Phillips Curve has not been as predictive as it has been in the past. There has been a very low rate of joblessness for nearly three years now and yet, there has been no real suggestion of a wage inflation issue. There are several reasons that have been cited for this—everything from retired people being replaced by people that make far less money to the fact that companies have been hiring people who are not really qualified and need extensive training. They are not being offered top dollar.

The latest data suggests that labor rates are finally starting to trend up a little—the employment cost index rose by 0.7%, an improvement over what it has been. The expectation was that it would trend up by 0.8%, so this still fell a little short. But, the trend over the last few months has been positive and almost enough to assert that the Phillips Curve is back in business. Year-over-year compensation was up by 2.8% (January 2018 to January 2019). That is a bit slower than the pace that had been set in the December 2017 to December 2018 period when the hike was 2.9%. These are still solid numbers but not enough to cause any real concern as far as overall inflation.

Maduro's End?

As this story was being written, there is a long-awaited coup attempt in Venezuela. This story is being written on April 30 and may dramatically alter by the time it is published, so I will do my best to update while on the road. It is likely to be something that will unfold in layers for days. The news thus far is that Juan Guaido has called for the population to take to the streets to overthrow Nicolas Maduro. He made this announcement while flanked by various military officers and troops at a military base not far from the capitol. The Maduro government has dismissed the activity as minor and fanciful and has called for loyalists to rally at the Presidential Palace. It has become a matter of who one chooses to believe as far as Maduro's stability.

Analysis: The desire on the part of the general population is clear enough. After years and years of worsening poverty, declining standards of living, widespread crime and the collapse of the oil economy, the country wants Maduro gone. What is not clear is who they want to replace him with. The popularity of Hugo Chavez has not dimmed and many of those who oppose Maduro do so because they believe he failed and perverted the legacy of Chavez. They do not want a return of the oligarchs that once ran Venezuela. Those who support and follow Guaido want a more wholesale change from Maduro and the vestiges of Chavez. The most important consideration right now is the status of the military. The assertion by Maduro has been that the military is united behind him, but Guaido claims that the majority of soldiers back him and have just been waiting for the opportunity to revolt. These claims appear to be close to a final test. For the senior officers, the issue has been potential retribution. Will they be held accountable for actions carried out under either Chavez or Maduro? Even though Guaido has tried to reassure the military leaders that they will not be made to pay for their actions, the officers are well aware that those in Guaido's camp are not yet comfortable with giving these military leaders a pass. There is also the not-so-small matter of losing power in the event of Maduro's downfall.

The reaction of other nations will be key from this point. The U.S. has made it clear that it wants Maduro gone and the man who has been developing the U.S. response is National Security Advisor John Bolton. He has refused to rule out any kind of direct military assistance for Guaido, but the fact that Russian troops have been placed in Venezuela has complicated these options immensely. The Chinese have been pouring money into the country, but it doesn't have the commitment Russia has. They are interested in preserving access to the region's oil, but they also enjoy the fact that they can irritate the U.S. with this policy. The regional player with the most at stake is Colombia since they are being overwhelmed by the refugees—the latest estimate is that almost two million people have fled to Colombia in just the last couple of years. Every nation in Latin America has been on edge over the collapse of a nation that was once a legitimate economic engine due to its oil production.

At this point, the two most likely scenarios are equally risky and unpleasant. Option one is that Maduro is forced out to some degree but refuses to capitulate. He will take up a position in some regional stronghold and his supporters will continue to fight and, thus, create a civil war environment for the country as a whole. Option two is that Guaido is defeated and his supporters resort to the same kind of civil strike as they operate from their safe locale. Either of these options would likely bring outside forces to the fray. The U.S. may elect to try helping Guaido directly and Russia might elect to assist Maduro directly. They may elect to work through proxy nations as well, with the U.S. turning to Colombia and Russia turning to Cuba. The one thing that is certain is that chaos will prevail if Maduro chooses to try to stay in power.

U.S.—China End Game Gets Complicated

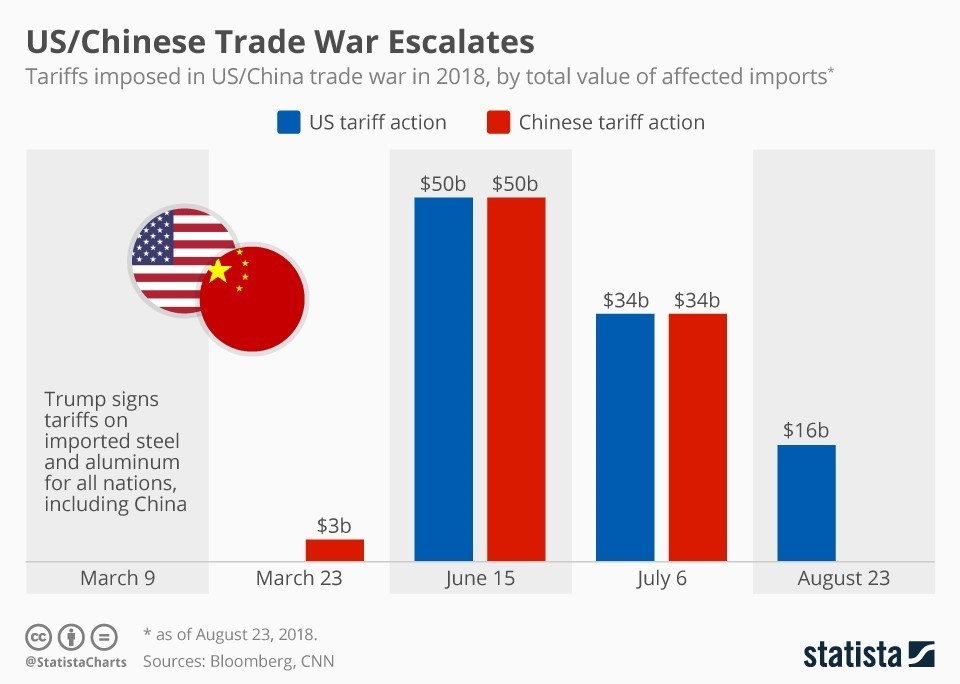

The negotiations between the U.S. and China have been lurching back and forth between potential resolution and bitter failure for months, but for the most part, there seems to have been more steps forward than back. The whole process has been fraught with politics and positioning and it took a while to actually get down to brass tacks. In the beginning, the U.S. attacks on China were almost entirely designed to satisfy the Trump base and had relatively little to do with the U.S. business community or economic growth. The tariffs imposed did as much or more damage to U.S. companies and people than to China. The Chinese simply sold output to others and stopped buying from the U.S., which was a real blow to farmers. The U.S. was making demands that would be impossible to adhere to, demanding that China change its entire economic and political system. Over time, these grand political statements faded and focus shifted to the real concerns for the U.S. and for China.

Analysis: Over the last few weeks and months, the issues that have driven the talks have involved Chinese protection of U.S. intellectual property, an end to the Chinese practice of forcing technology transfer and greater access to the Chinese market with no barriers from regulations or tariffs. In the background, there have been other, more political concessions. China is expected to support North Korea less, provoking Kim Jung-un to make that trip to Russia to meet with Vladimir Putin for the first time. That was supposed to remind China that North Korea has options, but the reality is that Putin offered very little tangible support. China has also cooled its attacks on Taiwan and has even been a bit more conciliatory toward Japan.

China wants things from the U.S. as well, and there have been some major and minor concessions. The most important factor is market access to the U.S. and not just in the consumer sector and agriculture. China has been investing heavily in technology and robotics as their manufacturers try to keep pace with their competition in the U.S., Japan and Europe. They want that engagement to be easier and more varied, but that flies in the face of what the U.S. and the others want to protect. The progress has been slow but real and now the conversation is getting down to the last stages. A big part of the issue now is how both nations back away from the tariff war they started a year ago. It is understood that most of these punitive tariffs will have to be removed and there is tremendous support within both the U.S. and Chinese business communities. There is also opposition from those industries that have been enjoying the protection offered by these restrictions. The Chinese are willing to back away from the tariffs on soybeans but not without concessions on the level of industrial goods that come from China. The farming community is all for the removal of those Chinese tariffs, but many manufacturers have been enjoying the lack of Chinese competition.

The U.S. wants several of the tariffs to remain in place as insurance that China keeps it word, and China sees this as insulting and unacceptable. The U.S. has already backed off on demands that it be allowed to unilaterally impose trade restrictions without consulting with China and odds are the U.S. will back down on this demand as well. Nothing stops the U.S. from re-imposing tariffs whenever it wants to, but the Chinese want an opportunity to react and respond (or stall, as some assert). Most assume there will be some kind of stages process established, allowing both nations an opportunity to climb down slowly.

Oil Prices Not the Trigger they Once Were

For most of the last 50 to 60 years, there was one economic development that could generally be counted upon. Anything that spiked oil prices would inevitably lead to some kind of economic calamity. Higher-priced oil would usher in a recession of one kind or another and often, this downturn was brutal and lasted a long time. The price of oil has jumped by around 45% in the last few weeks and has hit levels not seen in many months, but reactions have been muted. The issues that have affected the oil markets would have turned the sector inside out a few years ago—production cuts from OPEC and Russia; political chaos in oil-producing nations like Venezuela, Libya and Algeria; the imposition of new sanctions on Iran and those that buy oil from them. Any of these would have been expected to have an impact, but this time around, the impact has been minor.

Analysis: The reality is that U.S. oil production has changed the rules. The production can expand more or less at will and oil markets assume the U.S. will kick into high gear when those prices finally hit somewhere in the 80s. Beyond that, there is confidence that global growth is robust enough to sustain demand even if the prices approach $100 a barrel—at least for a while.

Hard to Fathom

Let me hasten to point out that the vast majority of people I run into during my travels seem pretty sane and competent. Perhaps that is why those that aren't become so noticeable. In the last 24 hours, I have witnessed some pretty unexplainable behavior or have heard about it from reliable sources. There was the guy who described his last flight. A passenger, who did not seem intoxicated, was attempting to use the lavatory but could not find the door. He elected to simply relieve himself against the pilot's door. This earned him a welcoming committee from the local constabulary when the plane landed. My grandson related the story of a guy who called him to look at a downed cow—a cow that had been in distress for almost three days. He chose to call on him in the middle of a blinding rainstorm when the whole area was in a tornado watch and report the situation as an emergency.

With my very own eyes, I watched a young man wearing a man bun walk smack into one of those kiosk carts at the airport. The entire cart tipped, scattering the contents and sending the young lady operating the cart sprawling. He was texting some urgent message at the time. Was my mentioning he had a man bun necessary? Not really, it is just that this hair style annoys the dickens out of me. Probably just the resentful reaction of a bald guy.

There are just many times in the course of a day that I want to scream, "Focus!" but that applies to me as well. Just because nobody saw me pour a cup of coffee on the table because I hadn't placed a cup doesn't mean it didn't happen. As engrossing as that email was, I really needed to pull my eyes away long enough to see where the java was going.